Inflation eased slightly in Dec but still above 10%

Bangladesh concluded another year staring at prices of essential items taking a wild ride, the central bank scrambling to further tighten the money supply and penny-pinching among limited income people.

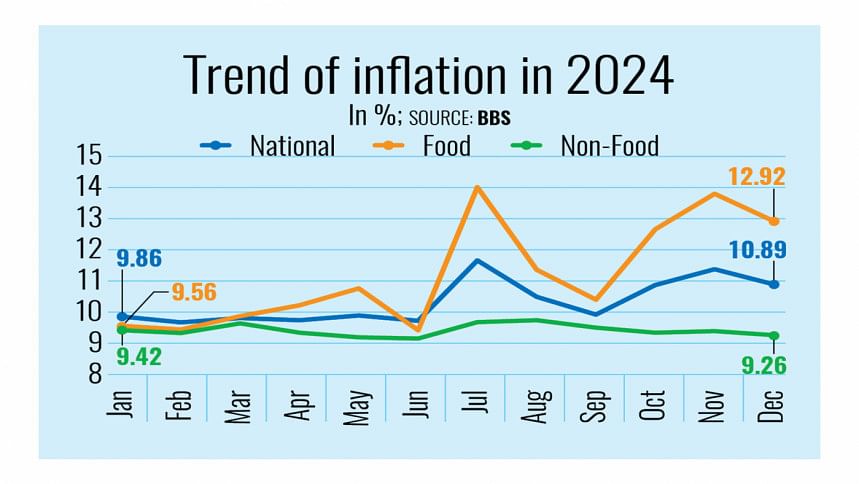

In December 2024, inflation eased slightly to 10.89 percent from 11.38 percent the month prior, but remained above the 10 percent threshold for the second consecutive month, according to the Bangladesh Bureau of Statistics (BBS).

This left the annual average inflation for 2024 at 10.32 percent.

The year began with inflation at 9.86 percent in January, reaching the double-digit mark in July and remaining above 10 percent for almost the remainder of the year.

Last year's inflationary trend resembles the price increases observed in 2023, when inflation exceeded 9 percent in March and continued to strain household budgets throughout the year.

The consumer price index (CPI), which measures price fluctuations in a basket of goods and services, declined to 10.89 percent in December from 11.38 percent the previous month, shows data of the national statistical agency.

Economists and policy analysts credited the arrival of winter vegetables and tariff cuts on essential commodities for the decline.

In December, food inflation decreased to 12.92 percent from 13.80 percent in November.

Non-food inflation also edged down to 9.26 percent in December from 9.39 percent the month prior.

To curb inflationary pressures, the Bangladesh Bank raised the policy rate -- the interest rate at which commercial banks borrow from the central bank -- several times over the past two years.

As such, the policy rate which stood at just 5 percent in May of 2022 gradually increased to 10 percent by the end of 2024.

However, Ashikur Rahman, principal economist at the Policy Research Institute (PRI) of Bangladesh, said the level of inflation in the country is still very high.

This is causing hardships for people with fixed incomes or those living below the poverty line, he added.

However, Mohammad Lutfor Rahman, a professor of economics at Jahangirnagar University, said this elevated inflation impacts all classes.

"People are struggling as their real income and wages have failed to keep pace with rising prices, eroding their purchasing power," he added. "Food prices in Bangladesh are higher than those in neighbouring countries."

According to private think-tank, Research and Policy Integration for Development (RAPID), inflation has pushed as many as 78 lakh people into poverty over the past two years.

Of them, around 38 lakh have fallen into extreme poverty while another 1 crore are at risk of becoming poor.

Regarding the slight decrease in price pressures in December, Lutfor credited seasonal factors, such as the abundant winter vegetables hitting the market.

He said tariff cuts on essential imported commodities may also have contributed to the decline.

In recent months, the revenue board has withdrawn import duties and other taxes on essential products, including onions, potatoes and eggs.

However, Ashikur said improvements in supply-chain dynamics after the political changeover in August last year also contributed to reducing the food inflation.

The monthly point-to-point inflation rate remained high in fiscal 2024-25, especially after the political turmoil in July, changeover in August and repeated flooding in the north-eastern regions that same month.

"These shocks have undermined the contractionary monetary policy," he added.

The PRI principal economist suggested the Bangladesh Bank should remain committed to implementing a contractionary monetary policy while the interim government must ensure that future supply chain disruptions are avoided.

Meanwhile, Lutfor expressed concern over the government's move to increase the value-added tax (VAT) on 43 goods and services as it could reignite overall inflation.

Although food inflation is declining, implementing the interim government's plan to hike VAT would likely fuel non-food inflation, he said.

The interim government's council of advisers approved a plan to impose a uniform 15 percent VAT on various items, including medicine, restaurant services, residential hotels, sweets, biscuits and branded clothing.

The VAT hike is said to be linked to the conditions of the International Monetary Fund for its ongoing $4.7 billion loan programme for Bangladesh.

Besides, the National Board of Revenue needs to immediately increase its collection of taxes by an additional Tk 12,000 crore.

The revenue authority and Finance Adviser Salehuddin Ahmed justified the move arguing that it would not fuel inflation as tariffs on essential goods were already cut at the import stage.

Lutfor criticised this claim, saying that as an indirect tax, higher VAT would affect people from all walks of life.

He argued that the government's focus should be on expanding income tax collection rather than solely imposing a VAT hike.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments