Inflation may moderate but remain elevated: WB

Bangladesh's citizens may experience some relief as inflation is expected to moderate by the end of the fiscal year 2024-25, according to the World Bank (WB).

Overall inflation is projected to decline to 9 percent in FY25 from 9.7 percent in FY24, the multilateral lender said in its October issue of the Bangladesh Development Update, released today.

However, the economy is expected to grow by only 4 percent due to the uncertain impact of political protests and the ongoing transition in government.

The country is still recovering from popular protests and political instability, significantly affecting economic activities in the first quarter of FY25.

"Political uncertainty, inadequate law enforcement, and labour unrest in industrial areas have continued to hinder the complete normalisation of economic activities," the WB noted.

It also highlighted that high food and import prices, worsened by supply disruptions, are expected to keep headline inflation elevated during the forecast period.

The projection comes at a time when skyrocketing food prices, especially of vegetables, have sparked widespread public outcry.

The WB's forecast contrasts with the Asian Development Bank (ADB)'s projection made three weeks ago. The Manila-based ADB predicted that annual average inflation in Bangladesh may rise to 10.1 percent in FY25, driven by supply-side disruptions and higher import costs due to currency depreciation.

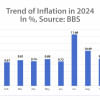

Inflation averaged 9.7 percent in FY24, up from 9 percent in FY23, continuing to erode consumer purchasing power, according to the WB.

Consumer prices also continued to rise in the first quarter of FY25, averaging 10.7 percent.

"The spike was caused by supply chain disruptions linked to social and political unrest in the lead-up to the political regime change on August 5, 2024," the WB said.

Food inflation surged to 14.1 percent in July and averaged 11.9 percent in Q1. However, inflation is now showing signs of easing as food supply chain challenges begin to diminish.

Bangladesh Bank (BB) continued to tighten monetary policy throughout FY24 and into the first quarter of FY25 to combat the persistent inflation.

"Despite the introduction of an interest rate targeting framework in FY23, inflation increased in FY24 due to high food and energy prices, as well as higher import costs from the depreciation of the taka," the WB said.

"The monetary transmission mechanism remained weak due to a cap on lending rates, which was only removed in May 2024. The real policy rate remains negative," it added.

The WB emphasised that the future inflation trajectory will depend on the effectiveness of the central bank's monetary policy transmission and the government's fiscal policy stance.

"The adoption of a crawling peg will help stabilise the exchange rate and foreign exchange reserves. However, as Bangladesh is an oil importer, significant downside risks remain if global energy prices rise more than expected due to geopolitical tensions."

The WB expects Bangladesh Bank to maintain a contractionary monetary policy stance but warned that vulnerabilities in the financial sector, particularly high Non-Performing Loans (NPLs), may hinder effective interbank financial intermediation.

The WB also noted that the banking sector continues to face tight liquidity conditions, and private sector credit growth slowed in FY24.

"The NPL ratio remains elevated, and even this figure understates the true extent of stress in the banking sector due to lax definitions, inadequate reporting standards, forbearance measures, and weak regulatory enforcement," it concluded.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments