As inflation slows, Europe Inc must show off its margin might

European companies haven't had such a low bar to clear in terms of earnings expectations in years, not least because of the highly complex geopolitical and macroeconomic backdrop, yet investors may only reward those that can protect their margins.

Bank of America analysis found in the three months to end-December more companies had their earnings estimates downgraded than upgraded than at any time in the last three years, with this ratio firmly in "net downgrade territory".

The pandemic and Ukraine war and the havoc both wreaked on global trade flows and raw material prices drove inflation to levels not seen in decades - forcing interest rates up with it - hitting consumers and industry, but plumping up company margins.

Now, those effects are subsiding, the global economy is slowing and the world is a volatile place. So this earnings season, it will come down to which companies can preserve their profit margins and which can't.

Net profit margins for the STOXX 600 peaked at 16.1 percent in the first quarter of 2023, but are expected to have fallen to 10.1 percent in the fourth quarter, according to LSEG I/B/E/S data.

But there are some sectors where margins are expected to hold up. Consumer cyclicals, consumer non-cyclicals, financials and industrials are forecast to see their net profit margin increase in the fourth quarter compared to the period before, the data showed.

Adding to the uncertainty is the disruption to global trade in the Red Sea, which has doubled freight rates, delayed deliveries and forced some automotive companies to pause output. That has stirred concerns of another bout of inflation.

"We are going to see which companies are able to keep their prices up without experiencing a huge drop in volume at a time when the economic environment is slowing down as well," Barclays Private Bank chief market strategist Julien Lafargue said.

"It will be harder for companies to impress, not necessarily because expectations are especially high, but because it's much more difficult to impress," he said. "You have to show it through your business model."

Fourth-quarter earnings are expected to decrease 7.1 percent from the same period in 2022, while revenue is seen falling 4.8 percent, according to LSEG I/B/E/S data.

This would mark the third straight quarter of negative earnings growth.

Key companies reporting in the coming week include chip-names ASML and STMicro, German technology group SAP and luxury bellwether LVMH.

Following last year's surge - the pan-European STOXX600 index rose over 10 percent in the final two months of the year - and modest expectations, analysts said strong earnings are needed to fuel more gains.

"You're going to want to see that delivery of earnings to support last year's rally," said Richard Saldanha, global equity fund manager at Aviva Investors.

Geopolitics, with war in Ukraine and Gaza and with an election-packed 2024, is one of the challenges companies must navigate.

Attacks by Houthi militia on ships in the Red Sea have snarled up trade between Asia and Europe, prompting shipping companies to divert vessels around the southern tip of Africa.

British retailer Next and French food group Danone are just two companies that have warned about prolonged disruption, while Volvo Car and Michelin have both temporarily halted production at some European plants due to delays.

Attacks by Yemen's Houthi militants on ships in the Red Sea are disrupting maritime trade through the Suez Canal, with some vessels re-routing to a much longer East-West route via the southern tip of Africa.

"With heavy reliance on a still weak manufacturing economy, ongoing disruption to global trade from several different sources, it's hard to be particularly optimistic," said Lindsay James, investment strategist at Quilter Investors.

Companies' ability to raise prices will be crucial for investors, given that growth is weaker, consumers have spent their pandemic-era savings and are dealing with high rates and still-hot inflation.

"What we're looking for this earnings season, as you see pricing moderate, is which companies still have underlying volume growth. I suspect the top line will still be challenging for companies," Aviva's Saldanha said.

Another headwind may come from higher interest rates.

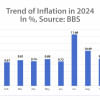

Markets had fully priced a 25-basis point cut from the European Central Bank in March. But hard push-back from various policymakers, plus evidence that the disinflationary process is proving a touch bumpy has prompted traders to cut that to just a 20 percent chance.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments