Insurance claim settlements nosedive in Jan-Mar

Insurance claim settlements in the country took a nosedive in the first quarter of 2025, exposing the fragile state of insurers marred by cash shortages, irregularities and corruption.

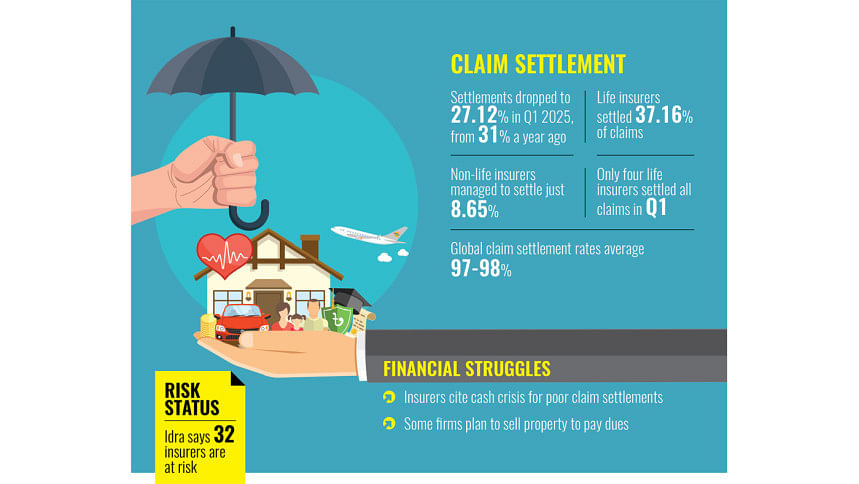

Only 27.12 percent of insurance claims were settled by the end of the first quarter (Q1) on March 31, according to data released by the Insurance Development and Regulatory Authority (Idra).

The rate was 31 percent during the same period last year, data shows.

In monetary terms, insurers paid out Tk 2,663 crore in the first quarter of this year against total claims amounting to Tk 9,820 crore.

According to Idra data, in the first quarter of 2025, life insurance fared slightly better than its non-life counterpart.

During the period, the claim settlement rate in life insurance stood at 37.16 percent, down from 40.56 percent at the same time in 2024, Idra data show.

The settlement rate was 8.65 percent in the non-life insurance sector, compared to 11.10 percent in the corresponding period of 2024.

These figures mark a stark gap with global settlement rates, which usually hover around 97-98 percent. For instance, in neighbouring India, it stood at around 98 percent in the fiscal year 2022-23, according to media reports.

At present, Bangladesh has 36 life insurance companies and 46 non-life insurers. One firm, Golden Life Insurance, has yet to submit its data to the regulator.

Under the Insurance Act 2010, insurers must settle claims within 90 days of receiving all necessary documents after a policy has matured.

Insurers paid out Tk 2,663 crore in the first quarter of this year against total claims amounting to Tk 9,820 crore. Life insurance companies fared slightly better than its non-life counterparts

Only four insurers settled all claims

Idra data show that only four life insurers -- Alpha Islami Life Insurance Ltd, the Life Insurance Corporation of Bangladesh Ltd, Mercantile Islami Life Insurance Ltd, and Shanta Life Insurance PLC -- settled 100 percent of insurance claims up to March 31 of this year.

Among other insurers, Rupali Life, Trust Life, Sonali Life, Meghna Life, Popular Life, Pragati Life, Guardian Life, Sandhani Life, and MetLife Bangladesh showed settlement ratios above 90 percent.

However, several large insurers performed poorly.

Fareast Islami Life Insurance, which had the highest total claims of Tk 2,976 crore, settled only Tk 58.35 crore, reflecting a settlement ratio of just 1.96 percent.

Similarly, Sunflower Life Insurance and Baira Life Insurance settled less than 1 percent of their claim obligations.

Among the 46 non-life insurers listed, Janata Insurance led the sector with a settlement rate of 85.81 percent, followed by Prime Insurance Company (68.28 percent), Eastland Insurance (67.17 percent), Meghna Insurance (66.28 percent), and Takaful Insurance Company (61.05 percent).

At the other end, Sikder Insurance posted the lowest settlement rate at just 0.12 percent, while Sena Kalyan settled only 0.16 percent, Northern Islami Insurance 1.06 percent, Standard Insurance 1.44 percent, and Dhaka Insurance 1.59 percent.

Adeeba Rahman, first vice-president of the Bangladesh Insurance Association and sponsor director of Delta Life Insurance Company Limited, said many life insurance policies mature in December, which leads to their settlement in the first quarter.

"However, there are many companies that do not provide accurate information to the regulator, which is a problem. This prevents a complete picture from emerging," she added.

What insurers say

Md Shahidul Islam, acting chief executive officer of Fareast Islami Life Insurance Company Limited, said, "Our claim settlement situation is in dire straits due to a cash crisis in the company."

Although steps have been taken to sell assets to settle customer claims, no buyers have been found yet, he said.

An initiative has been taken to hand over three spaces to three developer companies, and this will be presented at the upcoming board meeting slated for July 12, he added.

"If we give it to a developer company, we'll receive a good amount as signing money. Then we'll sell our allocated flats to the developer company, and the proceeds will be used to settle customer claims," he added.

Md Mamun Khan, acting chief executive officer of Baira Life Insurance Company Limited, said they have taken the initiative to sell one of their properties for Tk 50 crore.

"We hope to receive the money by October. Once the payment is received, it will be used to settle customer claims," he said.

Amzad Hossain Khan Chowdhury, acting chief executive officer of Golden Life Insurance, admitted the severity of the situation.

He said that irregularities between 2011 and 2014, including unreported policies and unsubmitted money receipts by field-level employees, have created a backlog of liabilities.

The reporter also tried to contact officials of Progressive Life and Homeland Life Insurance, but no one responded.

Brig Gen (retd) Shafique Shamim, managing director of Sena Kalyan Insurance Company Limited, said the Idra report doesn't reflect the whole picture properly.

Explaining the matter, he said Sena Kalyan Insurance's number of primary claims is often very high. But after receiving the final report, it turns out to be less than one percent.

"Idra included the primary claims data, but not the final report. That's why the claim settlement rate appears so low," he stated.

"The real picture is not reflected in Idra's data. We have discussed the matter and urged them to publish only the final settlement figures in the future," he added.

The Daily Star reporter also tried to contact officials of Sikder Insurance but received no response.

Irregularities abound

According to industry insiders, corruption and irregularity are two of the key reasons behind the glaringly low settlement rate.

On July 2, Idra, the regulatory body for the insurance sector, revealed that it has placed 32 companies in the "risk" category, and 15 in "medium risk".

Speaking at a press conference that day, Idra Chairman M Aslam Alam admitted that the insurance industry is facing a crisis.

"The failure to settle claims on time has eroded public trust in the industry. Without transparency and accountability, confidence will not return," he said.

He also acknowledged that Idra itself shares some of the blame and said proposals are underway to amend laws and regulations to help restore trust.

A draft ordinance has been finalised allowing for the restructuring, merger, change in ownership, or even liquidation of troubled insurers.

In June, Idra also launched special audits against 15 life insurance companies for the 2022-2024 period to uncover possible irregularities as claim settlements continued to mount.

Speaking to The Daily Star yesterday, Saifunnahar Sumi, Idra spokesperson, said that to address the issue of claim settlements, each insurance company has been instructed to provide accurate information on their assets and investments.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments