Islamic bank deposits grow despite irregularities

The country's Islamic banking sector registered growth in deposits in June although several Shariah-based lenders are facing widespread scams and irregularities.

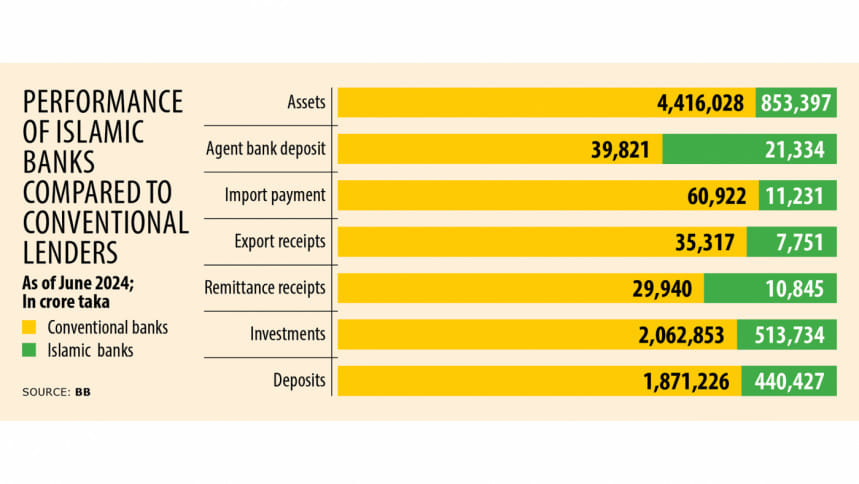

In June, total deposits with Islamic banks increased by Tk 11,625 crore, or 2.71 percent, to Tk 440,427 crore from that in the previous month, according to a Bangladesh Bank report released on Monday.

Meanwhile, other key banking indicators such loans taken in order to be invested and inflow of remittance also showed a positive growth, suggesting that client confidence had remained quite unscathed, according to the report.

Bankers credited the performance to the sector's overall growth.

According to the report, the amount of loans taken in order to be invested reached Tk 513,734 crore, a rise of 1.91 percent from that in the preceding month.

Islamic banking investments account for around one-fourth of the total investment of the banking industry, according to the report.

As of June, the total investments of all scheduled banks stood at Tk 2,062,853 crore, with conventional banks accounting for Tk 1,549,119 crore.

The assets of the Islamic banking sector also grew in June by 5.18 percent to Tk 853,397 crore compared to that in the previous month, showed central bank data.

Mohammad Ali, managing director and chief executive officer of Pubali Bank, said his bank's Islamic banking branches posted growths of over 50 percent in every indicator.

"I think that banks where there are no allegations of scams and irregularities have registered a sharp growth, positively impacting the overall sector's growth," Ali said.

Depositors have already lost confidence in the scam-hit banks, he added.

There are 10 full-fledged Islamic banks in Bangladesh. Besides, Islamic branches and conventional banks with Islamic windows offer Shariah-based banking services.

Islami Bank Bangladesh, the country's biggest Shariah-based bank based on customer deposits, and several other banks have been experiencing a severe liquidity crisis amidst alleged rampant irregularities and scams by shareholder owner S Alam Group.

The Chattogram-based conglomerate and its associates took out Tk 95,331 crore in loans between 2017 and June this year from six banks, with 79 percent of the sum coming from Islami Bank.

Pubali Bank Managing Director Mohammad Ali, however, said many people still prefer Shariah-based banks due to their religious sentiments.

"Especially, retired or elderly people often seek Islamic banking services as they avoid taking interest, which is prohibited in Islam, from conventional banking systems," he added.

Meanwhile, the transfer of export earnings through the Shariah-based banking system decreased by 4.17 percent to Tk 7,751 in June.

Following a similar pattern, import payments also declined 17.55 percent to Tk 11,231 crore.

However, there was positive development with regard to receipts of wage earners' remittances through Islamic banking, as it rose to Tk 10,845 crore in June from Tk 10,634 crore in May.

The total outstanding agent banking deposits in Islamic banking stood at Tk 21,334, up 3.44 percent from that in May.

According to the central bank report, agent banking deposits (outstanding) in this sector have shown a clear upward trend over the past eight months.

This indicates that monthly agent banking deposits in Islamic banking are increasing, suggesting that the mentality to save was growing among banking service recipients, said the report.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments