IT exports decline in July-March

Bangladesh's IT exports declined in July-March of the current financial year, highlighting the country's struggle to gain a foothold in the global information and communications technology sector.

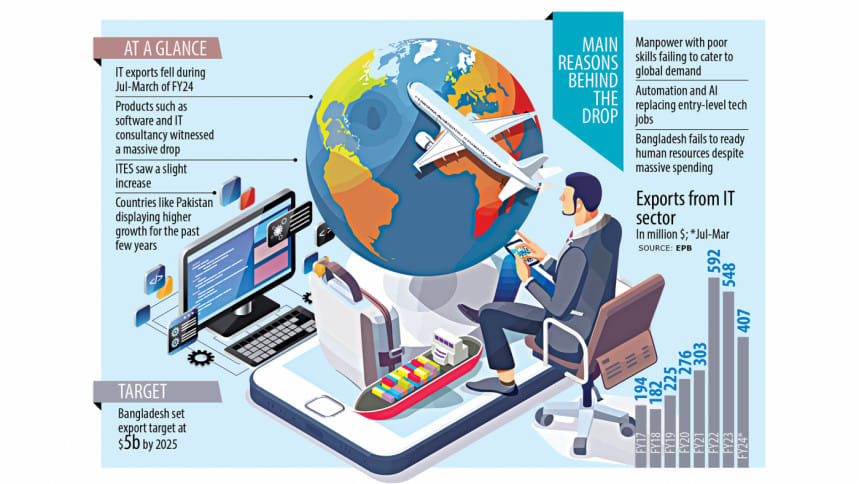

According to data from the Export Promotion Bureau (EPB), earnings of IT firms dropped 2.33 percent to $407.07 million in the first nine months of 2023-24. In the same period a year prior, shipments stood at $416.79 million.

Software exports dropped by 25 percent to $28.6 million and computer consultancy services plummeted 45 percent to $14 million. Earnings from IT-enabled services, however, increased by 4.64 percent to $361.30 million.

If the current IT export trend persists, the sector might see a drop in shipments for the second year in a row. In 2022-23, overseas sales from the industry fell for the first time in five years.

Earnings of IT firms dropped 2.33 percent to $407.07 million in the first nine months of 2023-24

Industry people said the fact that the country has failed to produce big IT firms is an ominous sign for the government's export diversification efforts. Garment accounts for about 85 percent of Bangladesh's earnings from the external sector.

"The negative growth of software services gives a bad signal," said Fahim Mashroor, a former president of the Bangladesh Association of Software and Information Services (BASIS).

The export fall in July-March came although exporters are benefiting from a higher dollar rate, which has gained by 35 percent against the taka in the past two years. One explanation might be that exporters are not bringing in proceeds since the local currency is expected to weaken further amid the persistently lower level of foreign currency reserves.

"Although Bangladesh's software exports are declining, other countries like Pakistan have been displaying higher growth for the past few years," Mashroor added.

Pakistan's IT exports increased 25 percent year-on-year to $2.93 billion in July-May of FY24 although the country is far behind Bangladesh in various economic and social indicators.

Syed Almas Kabir, another former BASIS president, said big changes in global IT outsourcing have contributed to the negative growth in the sector.

He explained the IT services Bangladesh exports require low skills but they are now being replaced by automation and artificial intelligence (AI).

"For example, we used to export large volumes in the 2D graphics and manual data entry segments, both of which can now be handled through robotic automation and AI. These factors have primarily contributed to the downturn in ICT exports," Kabir said.

"Global companies now want to outsource high-level tasks. Therefore, unless we can build a workforce capable of handling such tasks, we will continue to lose contracts. Our workforce needs to learn sophisticated tasks such as 3D animation, blockchain, data analysis, and AI.

"Unless these changes are made, exports will continue to decline."

The IT entrepreneur added if broadband is not extended to remote areas and the curriculum is not updated, the export earnings would not receive a boost.

The grim scenario of Bangladesh's IT exports comes despite the government spending thousands of crores of taka on IT infrastructure and skill development projects over the past decade and a half.

Asked if these initiatives have created skilled manpower capable of competing globally, Kabir said: "Unfortunately, not."

He said there are good intentions at the top level of the government to make Bangladesh an ICT powerhouse, but failures have occurred in implementation.

"Suppose 100 youngsters have taken part in a three-month training course in any area of ICT. There should be a third-party audit to assess how much they have learned. But we see no such things."

"Since the government is spending heavily for the ICT sector's development, it is crucial to evaluate if the expenditure is fruitful and being done the right way."

Rashad Kabir, managing director of Dream71 Bangladesh Ltd, a software firm, does not think the export slowdown is unusual.

"It was anticipated about a year ago. The primary cause is the worldwide economic slowdown and an unprecedented level of inflation for a longer period."

Following significant workforce reductions in 2022 and 2023, the tech layoff wave is still going strong in 2024 globally, which indicates that the business growth of technology companies is weak.

Since the main export area for the IT companies of Bangladesh is resource outsourcing, their revenue stream has been impacted.

Local IT companies mainly work with startups because they tend to outsource for cheaper prices. Due to the global economic slowdown, startups are also facing difficulties in raising funds. Consequently, they have stopped upgrading or developing new tech products.

A lack of skilled human resources in the areas of advanced technologies like AI, data science and blockchain is another reason for the decrease in exports.

"The worldwide demand for IT resources has shifted from traditional technologies to advanced technologies," Rashad added.

"But due to various reasons, Bangladesh has not been able to produce enough skilled human resources for modern technologies. As a result, we are losing potential markets and business opportunities."

Industry people said Bangladesh is poised to miss its target to export IT products worth $5 billion by 2025.

"Our revenue hasn't decreased, but revenue growth has slowed," said Raisul Kabir, CEO of Brain Station 23, one of the largest software companies in Bangladesh.

Securing contracts has become more challenging and competitive due to a recession-like situation in the global software market, he said.

"However, this is the second consecutive year that growth has slowed, but I believe this slowdown will end soon," he added.

Mashroor said another reason for the low exports is that most export-oriented IT firms in Bangladesh are small.

There are fewer than 50 export-oriented IT companies that have at least 100 employees, while there is no firm with more than 1,000 staff members, he said.

"In India, there are over a hundred export-oriented companies that are employing more than 50,000 engineers. Since Bangladeshi companies are small in size, they don't win big orders that can give them large revenue."

"If we want to hit the $5 billion target, we need to have a minimum of 100 companies employing more than 1,000 engineers."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments