Japanese firms most optimistic of their prospects in Bangladesh out of Asia

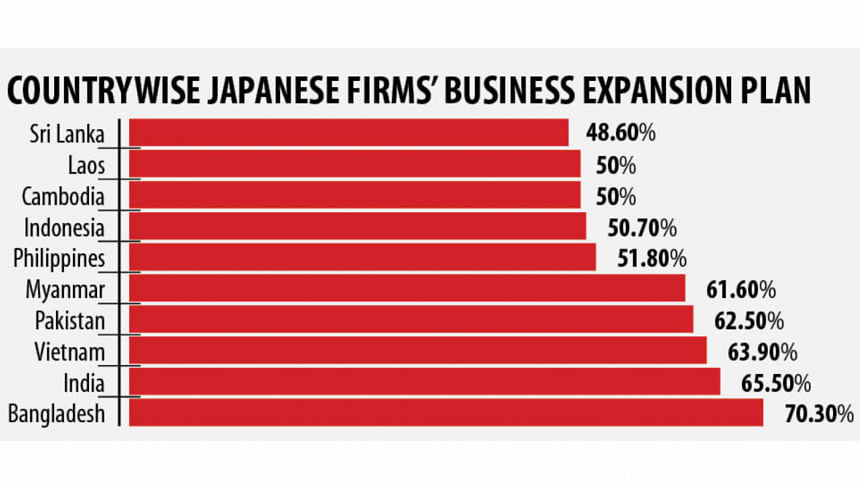

Bangladesh is the top choice for Japanese companies seeking to expand business in Asia and Oceania in the next two years due to its high potential and profitability, according to a survey by the Japan External Trade Organisation (JETRO).

Some 70.3 per cent of the Japanese companies in Bangladesh are mulling expanding business in the next one to two years, 23.4 per cent believe their operations would remain the same and 1.6 per cent are pondering over going for a reduction.

The statistics are from the '2019 JETRO Survey on Business Condition of Japanese Companies in Asia and Oceania', which is yet to be released officially.

The survey took comments of 13,458 Japanese firms engaged in manufacturing and non-manufacturing sectors in 20 Asia and Oceania countries between the months of August and September last year.

The Japanese firms in India are the next most sanguine ones: 65.5 per cent are planning expansion.

Vietnam comes in third, with 63.9 per cent of the Japanese firms there are planning expansion. It is followed by Pakistan at 62.5 per cent.

Bangladesh came in 5th in terms of profitability for Japanese companies.

Some 36.7 per cent of the Japanese companies operating in Bangladesh expect an increase in profit in 2019 from a year earlier, while 44.9 per cent expect it to remain the same. Some 18.4 per cent are bracing for a contraction in their profits.

The survey also found some 68.3 per cent of the Japanese companies are planning to increase the number of local employees they have in the next one year, 29.3 per cent to keep it the same and 2.4 per cent to go for a reduction.

The recruitment plan is the second largest among the countries surveyed, while it was the 5th in the previous year.

"Local production cost is 30.4 per cent cheaper in Bangladesh compared with that in Japan," said the survey report.

JETRO found the Japanese firms were concerned about the time taken up at ports, saying it took 14.3 days on an average for freight to get import clearance upon arrival at a sea port. For airports it was 8.1 days. Bangladesh ranked the worst in this case.

In case of making recruitments or developing human resources in Bangladesh, 81.3 per cent of the companies were facing difficulties due to a lack of skilled workforce or technically sound workers.

Some 61.9 per cent of the employers raised concerns about the quality of employees. Last year it was 62.5 per cent.

JETRO suggested Bangladesh focus on skills development education or vocational training centres and initiatives for improving the quality of education.

Besides, it found 70.8 per cent of the companies facing difficulties in local procurement of raw materials due to a lack of backward linkage industries.

As of December 2019, some 300 Japanese companies were doing business in Bangladesh. There were only 82 of them a decade ago.

As of December last year, Japanese private companies invested $386 million in Bangladesh.

"The next five years would be very important for Japanese firms as the basic infrastructure would be set up in Bangladesh," said Yuji Ando, country representative of JETRO.

The country has been achieving a steady growth over the years, which was encouraging Japanese investors to come over.

"But now, improvements were being made towards a business-friendly environment," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments