Loans, deposits rise in Islamic banks despite severe liquidity crisis

Outstanding loans and deposits both increased in full-fledged 10 local Islamic banks in February this year although six of them have been facing severe liquidity crisis for more than a year.

Outstanding loans at the 10 banks stood at Tk 455,525 crore, up by Tk 6,452 crore from a month earlier, according to the latest data of the Bangladesh Bank.

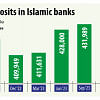

At the same time, deposits in those banks hit Tk 380,066 crore, up by Tk 4,762 crore from January.

Massive loan irregularities have been taking a huge toll on six Islamic banks: Islami Bank Bangladesh, Social Islami Bank, First Security Islami Bank, Union Bank, Global Islami Bank and ICB Islamic Bank.

In 2008, Oriental Bank was renamed as ICB Islamic Bank, with the majority share of the bank held by Swiss ICB Group. Now ICB Islamic Bank claimed that no loan irregularities took place after the ICB group took charge of the bank.

The rest four—Al Arafah Islami Bank, Standard Bank, Exim Bank and Shahjalal Islami Bank—have been doing comparatively well, industry insiders said.

The money being added in the form of interest has also played an important role for the increase in Islamic banks' outstanding loans and deposits in February, experts said.

Despite being in a bad shape, the most of the six banks are disbursing loans, which is fuelling the outstanding loans at Islamic banks, they added.

The six have been facing shortfalls in cash reserve ratio and statutory liquidity ratio for a long time along with being hit by a deficit at their current accounts with the central bank.

Some of them continue to take liquidity support from the banking regulator, said a senior official of the Bangladesh Bank seeking anonymity.

Some Islamic banks are largely involved in loan irregularities, which have deteriorated their corporate governance, Mohammed Nurul Amin, former chairman of the Association of Bankers Bangladesh, told The Daily Star recently.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments