Local, global crises prolong DSE slump in first half

The Dhaka Stock Exchange (DSE), the country's premier bourse, failed to regain its footing in the first half of 2025 amid several geopolitical crises across South Asia, looming tariffs announced by the United States, and domestic political uncertainty, according to the latest performance review by BRAC EPL Stock Brokerage.

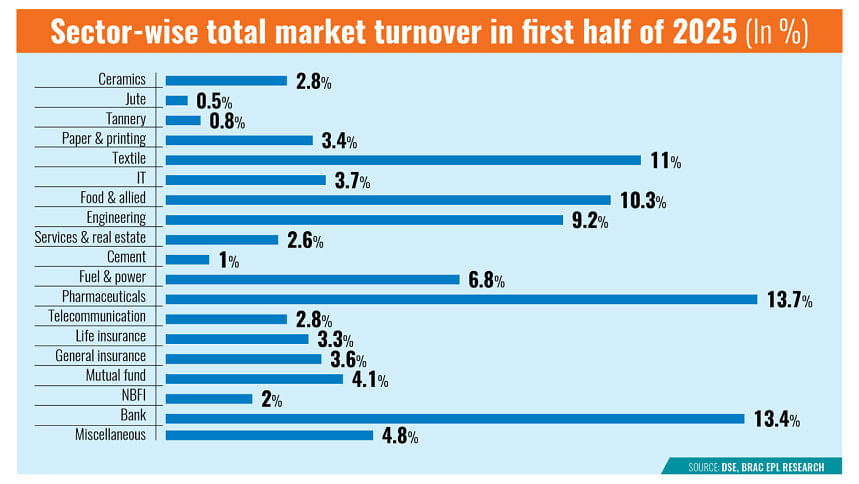

Market turnover at the premier bourse plunged to an average of Tk 383.9 crore per day during the January-June period, down from Tk 632 crore in the same period of 2024, underscoring a prolonged slump since the last quarter of 2024, the report states.

BRAC EPL, in its half-yearly performance review, primarily attributes the downturn to US tariffs on Bangladeshi products, regional geopolitical unrest involving India-Pakistan and Iran-Israel, and political jitters over the timeline of the upcoming national election.

Weighed down by high interest rates and a rise in non-performing loans (NPLs), investor confidence remained weak despite some macroeconomic stabilisation, with easing inflation, relaxed rules, and a more stable foreign exchange regime, the stockbroker states in the report.

As per the BRAC EPL report, the Dhaka bourse's benchmark DSEX index declined 7.2 percent year-on-year in H1 of 2025, while market capitalisation contracted by 8.1 percent. Corporate earnings also fell short of expectations in the January-March quarter.

The banking sector underperformed as well, with an 8.4 percent drop in year-to-date (YTD) returns.

Among major banks, BRAC Bank posted the highest YTD price return of 17.3 percent, buoyed by a 46.9 percent year-on-year jump in Q1 earnings.

In contrast, City Bank fell 0.7 percent in price and saw earnings dip 9 percent. Prime Bank and EBL returned 0.3 percent and 8.5 percent, respectively, supported by earnings growth of 63.5 percent and 11.6 percent.

Non-bank financial institutions (NBFIs) continued to lag, with a sector-wide YTD return of 21.7 percent in the negative.

The telecommunication sector also struggled, posting a YTD return of -7.9 percent.

Grameenphone and Robi saw price declines of 6.3 percent and 13.1 percent, respectively. Their Q1 earnings diverged, with GP's profit down 52.7 percent year-on-year, while Robi's rose 20 percent.

The state-owned Bangladesh Submarine Cable Company experienced a 5.5 percent fall in price, though its earnings grew 7.9 percent.

The food and allied sector was among the worst performers, slumping 17.1 percent YTD.

BATBC and Olympic Industries reported price returns of 23.7 percent and 5.3 percent in the negative, respectively. Their Q1 earnings showed a mixed picture: BATBC declined 23 percent, while Olympic grew 1.4 percent.

Pharmaceuticals, however, performed relatively better, with a modest 5.6 percent YTD decline.

Square Pharmaceuticals PLC posted a price return of 3.5 percent in the negative and earnings growth of 23.1 percent, while Renata PLC logged a 22.9 percent drop with earnings down 19.7 percent.

Beacon Pharma rose 7.2 percent, and Marico posted a 5.3 percent price gain, supported by a 30.7 percent rise in profits.

The engineering sector posted a 9.5 percent YTD decline. Among key players, Walton fell 15.7 percent, Bangladesh Steel Re-Rolling Mills Limited (BSRM LTD) edged down 0.7 percent, BSRM Steels Ltd rose 4.3 percent, and GPH Ispat declined 20.4 percent.

Their earnings varied, with GPH suffering a 102 percent drop and BSRMLTD recording a 53.9 percent surge.

Other lagging sectors included general insurance (-12.4 percent YTD), cement (-8 percent), textiles (-7.8 percent), and fuel and power (-4 percent), largely due to low earnings expectations.

No new initial public offerings (IPOs) or corporate bonds were listed on the main or SME boards in H1 2025, as the Bangladesh Securities and Exchange Commission focused on restoring market discipline, the BRAC EPL report said.

The SME index, DSMEX, fell 18.1 percent during the period, with average daily turnover on the SME platform at Tk 58.8 crore.

Meanwhile, foreign investor sentiment stayed cautious.

Morgan Stanley Capital International maintained Bangladesh under "special treatment" in its May 2025 review, while the FTSE Frontier Index continued to include 24 DSE-listed firms.

Bangladesh's stock market witnessed a lacklustre performance in 2024 as the benchmark index faced erosion, average daily turnover showed no significant rise, and no notable company entered the market.

The DSEX dropped 16 percent in the last one year. It had almost flatlined in 2023 due to the imposition of floor prices.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments