Lower revenue collection narrows fiscal space

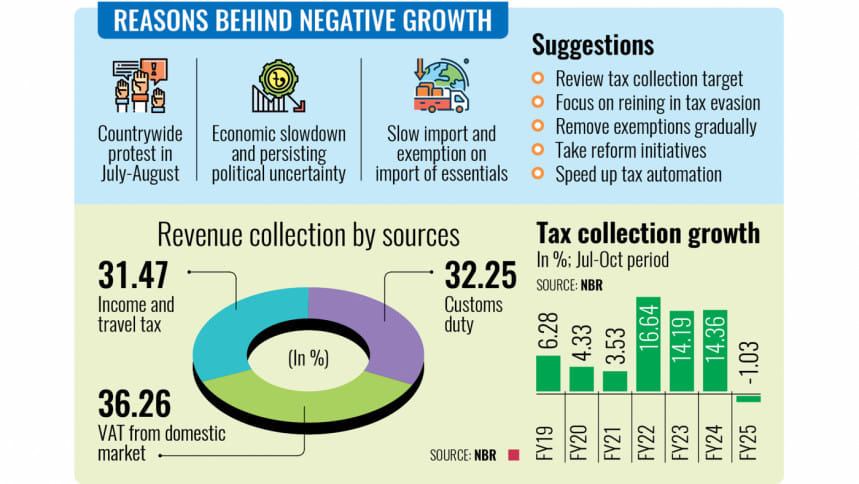

Revenue collection in the first four months of the current fiscal year declined by 1 percent year-on-year, according to official data, which is likely to complicate the government's plan to revive the economy by accelerating development spending.

Lower revenue mobilisation has resulted in a tight fiscal space, which, according to economists, might force the interim government to curtail the development budget instead of increasing public works spending to avert a further economic downturn.

They argue that the ongoing tight liquidity situation makes domestic borrowing difficult for the government, while foreign funding commitments remain lacklustre compared to previous years.

In the July-October period of fiscal year (FY) 2024-25, the National Board of Revenue (NBR) collected Tk 101,281 crore, falling short of its target for the first four months by Tk 30,831 crore.

During the previous Awami League government, the tax administration set a revenue collection target of Tk 480,000 crore for FY25.

Although a mass uprising ousted the government in early August, leading to the formation of the interim government, Finance Adviser Salehuddin Ahmed recently said that the FY25 revenue target would remain unchanged.

Amid economic stagnation, the government's project monitoring and evaluation agency recently reported that development expenditure hit a 14-year low.

This prompted Planning Adviser Dr Wahiduddin Mahmud to announce the government's "policy adjustments" by prioritising the execution of development projects to avert a further economic downturn.

Meanwhile, the ongoing political turmoil and economic uncertainty, which had already hamstrung revenue collection in July and August, have led policy analysts to question the unchanged collection target.

"The existing target is unrealistic," said MA Razzaque, research director at the Policy Research Institute (PRI) of Bangladesh. "It is unlikely to be achievable this year."

Apart from nationwide unrest in the July-August period, Razzaque pointed out that slow imports and tariff exemptions on essential goods amid the double-digit inflation contributed to lower tariff collection.

During the July-October period, the revenue administration saw a 0.84 percent single-month growth in October, and Razzaque expressed optimism about the overall collection.

"Amid the economic slowdown, the year-on-year revenue collection still seems optimistic as we earlier thought that it may dip drastically," he said.

Echoing similar sentiments, Towfiqul Islam Khan, a senior research fellow at the Centre for Policy Dialogue (CPD), said the revenue collection target for FY25 should be revised by December this year.

Besides, he believes the budget should be revised accordingly.

However, the foremost priority for the NBR should be implementing measures to reduce tax evasion to stop immediate losses, Khan said.

Regarding funding the government's expenditure, Razzaque sees limited options available.

"Tight liquidity restricts bank borrowing, while borrowing from the central bank could further fuel inflation," he said as he assessed the options. "Moreover, funding commitments from foreign donors remain lacklustre."

Bangladesh received only $27 million in commitments from its international development partners so far this year, compared to $2.8 billion in loan pledges a year ago, according to the Economic Relations Division (ERD).

Razzaque suggested the NBR speed up customs activities, streamline port operations and expand the tax net. He also advocated for revenue reform measures through automation.

He said the focus should not solely be on achieving revenue growth but rather on ensuring implementation of ongoing reforms.

In the first four months of FY25, value-added tax declined year-on-year, while income tax and customs duties witnessed slight growth.

Duty collection from international trade increased by 0.84 percent to Tk 32,671 crore as political turmoil led to a decrease in imports.

Meanwhile, income tax receipts increased by 1.78 percent to Tk 101,281 crore. The collection of value-added tax, the largest revenue source, fell by 4.87 percent to Tk 36,729 crore.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments