Luxury car sales plunge amid political, economic uncertainty

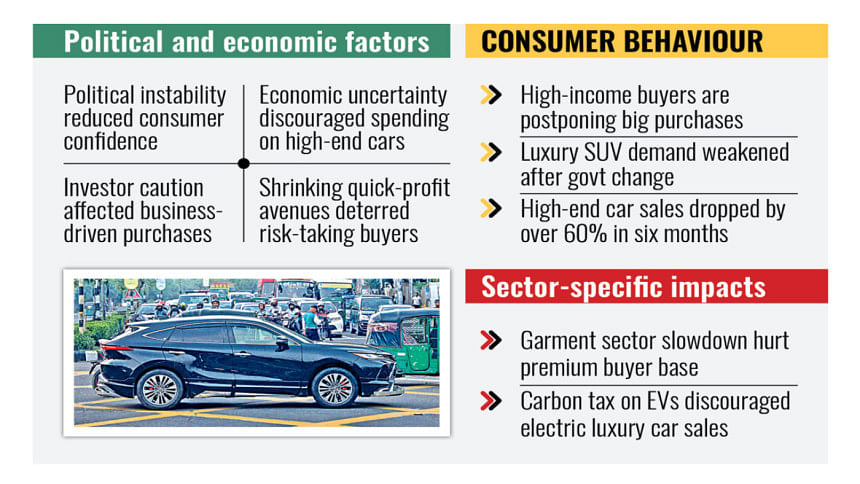

Sales of luxury sedans and sport utility vehicles (SUVs) have dropped significantly over the past six months, as economic and political uncertainties continue to reshape consumer behaviour, according to industry insiders.

Sales have been nearly stagnant since the political unrest and mass protests of July last year, with customers reining in spending amid the sudden change in government.

Although there is no official data specific to premium vehicles, figures from the Bangladesh Road Transport Authority (BRTA) show that around 871 SUVs were registered on average each month between January and June of this year.

Of those, roughly 10 percent fall under the luxury category, as per industry insiders.

Almost all models of Audi, BMW, and Mercedes-Benz are generally considered luxury vehicles, while Toyota's Land Cruiser, Harrier, and Prado, along with Mitsubishi's Pajero, are regarded as premium vehicles.

"From January to April last year, we sold on average 10 vehicles per month," said Asique Un Nabi, director of operations at Executive Motors Ltd, the authorised distributor of BMW vehicles in Bangladesh.

"This year, there were months when we sold at best four or none at all," he said.

According to him, the sales of luxury vehicles dropped by over 60 percent in the first six months of this year.

He attributed the downturn to the political transition, weakened investor confidence, and a reduction in discretionary spending by high-income individuals.

"Corporate executives, doctors, lawyers, and businesspeople who once regularly bought luxury cars are now holding back," he added.

Executive Motors Ltd currently offers nine models of BMW vehicles in Bangladesh, including petrol, plug-in hybrid, and electric vehicles. Prices range from Tk 1.03 crore to over Tk 3.5 crore, depending on specifications.

Citing the BRTA data, Nabi said that in the first half of 2025, a total of 5,119 passenger cars—meaning those that carry fewer than 10 persons—were registered.

In 2024, it was 10,499, he said.

While the number of SUVs registered appears to have increased, most are of 1,500cc or below—far from the high-end segment, he said.

Models such as the BMW i7 and X5 continue to attract interest, but actual purchases remain sluggish. "Customers are now waiting. Confidence needs to return for the luxury market to recover," Nabi said.

Audi Bangladesh, the sole distributor of German luxury automaker Audi, reported two to three unit sales per month since July last year, despite securing a usual monthly average of seven to eight vehicles earlier.

Safayet Bin Taiyab, its country lead for sales, said the company has suffered a significant loss in revenue due to a decline in sales.

Their Tejgaon showroom in Dhaka has seen very insignificant customer footfall in recent months.

Taiyab attributed the crisis to the ongoing political instability, declining purchasing power, and economic uncertainties, which have deterred affluent buyers from investing in their luxury vehicles priced between Tk 1.69 crore and Tk 3.99 crore.

Uncertainties over garment exports—which are the country's key foreign currency-earning sector and account for their largest customer base—have further dented demand.

The sector is grappling with declining orders, reduced income, and shrinking export volumes—factors that naturally dampen interest among entrepreneurs in car purchases, he said.

Adding to the woes, the BRTA recently imposed a carbon tax on electric vehicles (EVs), despite their zero emissions.

"We were hopeful EVs would provide a growth path amid rising fuel costs, but this policy decision has been discouraging," Taiyab said.

He also said that without policy support, especially around EV import duties and taxes, the premium automobile segment may face long-term stagnation.

Arif Khan Bipu, managing director of Motors Bay, said the slowdown in car sales was not limited to the luxury segment.

He added that the change in the political scenario has further dampened consumer sentiment.

Additionally, cash flow has significantly declined due to an economic contraction, leading to an overall sales drop of around 40 percent, he said.

"The overall market environment is simply not favourable for luxury car sales at this moment," said Shafiqul Islam, head of operations at HNS Automobiles.

"Sales of all types of cars—from entry-level to high-end—have remained sluggish for almost a year as customers have lost confidence in spending on luxury products," he said.

He noted that until recently, high-income customers showed a clear preference for SUVs over sedans. "But the recent political transition has disrupted that trend, and even the demand for high-end SUVs has weakened," he said.

Islam added that a series of ongoing events and economic uncertainties have taken a toll on consumer sentiment.

"People are no longer on a buying spree. The uncertainty in the market has made them cautious, especially when it comes to making large, discretionary purchases like luxury vehicles," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments