March was mean for MFS providers

Given the need for social distancing and the push towards digital transactions to prevent the spread of the highly contagious coronavirus, one would have thought the mobile financial service sector would be having a bit of a purple patch.

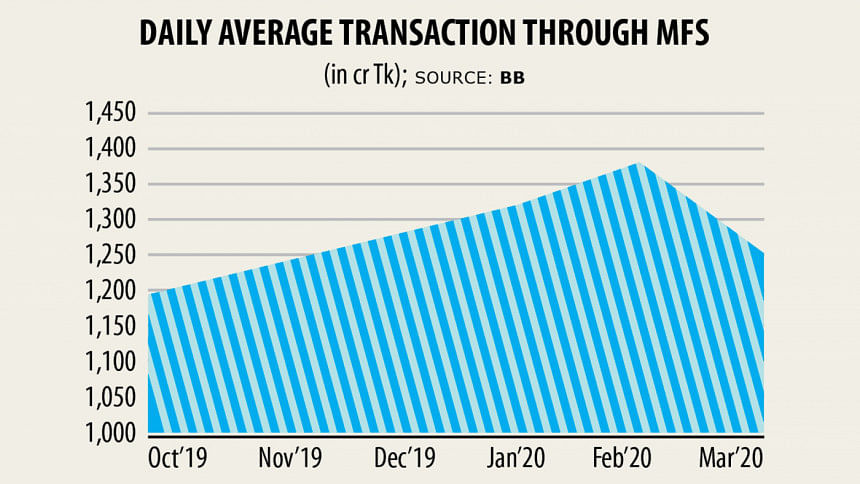

But, March, which marked the first confirmed cases of COVID-19 in Bangladesh, appears to have been a sobering comedown for the high-flying MFS sector. The average daily transactions on mobile money accounts drastically fell that month.

The first confirmed cases of COVID-19 were announced on March 8 and from the second week of the month the industry got a massive hit, which is way before the government had announced a countrywide shutdown to flatten the curve on coronavirus.

Account-holders transacted about Tk 1,283.39 crore in March, down 11.06 per cent from February, according to a Bangladesh Bank report released this week.

Though the use of mobile money has increased among the middle-class or the upper-middle-class during the pandemic, people who are at the bottom of the pyramid did not transact money regularly, industry insiders said.

The people at the bottom of the pyramid account for the majority of the transactions.

"Transaction volume always depends on the country's overall economic situation. As we are passing a tough time, it was reflected on the MFS transaction records," said Shamsuddin Haider Dalim, head of corporate communications of bKash.

Though the government had declared a general holiday from March 26, the situation had already started to become gloomy from the second week of that month, he said.

The outbreak impacted the overall economy and the MFS industry as well.

In March, the market's leading operator's average daily transaction was Tk 985 crore and it came down to Tk 800 crore in April. Daily average transaction volume rose to Tk 1,200 crore in May.

The government would have to be given some credit for the recovery in transaction volume in May as, thanks to its directive, a huge number of garment factory owners started to disburse wages and salaries among employees and workers through the MFS channel.

It also went for disbursements of its own through the digital channel. Remittance channelled through MFS also got a boost, Dalim said.

Withdrawals fell in March and it widened further in April, highlighting the distress the poor had been going through, industry people said.

Initially, Nagad faced some challenges, but the situation had improved over time, said its Managing Director Tanvir Ahmed Mishuk.

With the challenges, some new avenues also opened in the last three months.

"We are very much linked with the overall economy and it was obvious that the transaction volume would be impacted as people were not coming out for their regular activities."

However, people are using digital financial services more for recharging mobile phones and making payments and wallet to wallet transfers.

"We, the MFS providers, are ensuring citizens' physical distance in the coronavirus period. I think this is very important to prevent the pandemic," said the top executive of Nagad, which became the second-largest operator in the market within just one and a half years.

Nagad has designed some products and offers extra facilities to small and medium enterprises. These offers helped a huge number of business entities during the pandemic.

The BB report, however, did not show statistics on Nagad, the Bangladesh Postal Service's mobile financial service arm, as it got the licence from the central bank in April.

According to the BB report, March was the worst month in recent times for the MFS industry in almost all the parameters.

The BB is yet to publish April's report. The indicators are surely going to be worse and might be the most awful in all of the last couple of years, according to industry people.

As of March, there was 8.26 crore registered users in Bangladesh. Of them, 2.68 crore were active.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments