Moody’s downgrades Bangladesh banking rating to ‘very weak’

Moody's has downgraded Bangladesh's banking sector to "very weak" from "weak", citing worsening client confidence, limited transparency and inadequate financial safeguards over the past year.

The global credit rating agency, which provides financial analysis on various entities, revealed its positions on Bangladesh's banking sector on Tuesday -- a day after it downgraded Bangladesh's sovereign rating to B2 from B1, shifting its outlook from stable to negative.

Top bankers translated the banking downgrade as an after-effect of the sovereign rating change and worsening operating conditions within the banking sector.

In plain terms, a weaker banking sector means a more difficult economic environment and more risks to banks.

The risks include increased financial instability, poorer growth prospects and higher default risks, all of which could negatively impact the creditworthiness and profitability of banks.

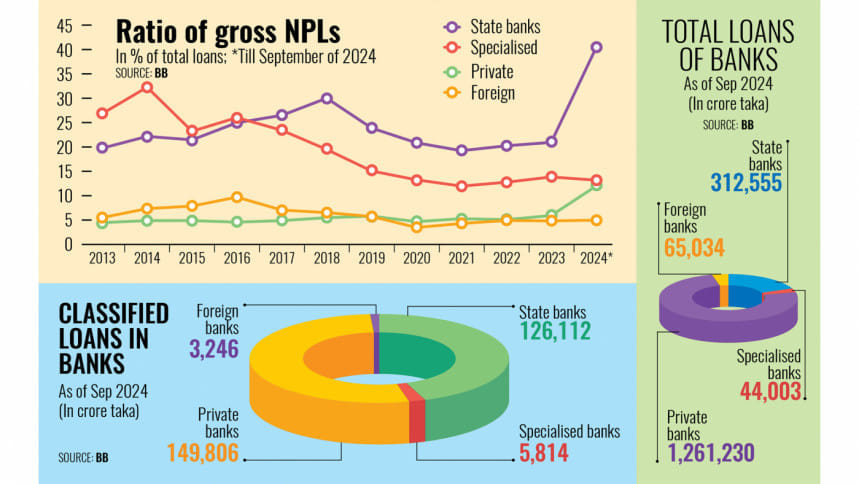

"We anticipate that the central bank's initiative to enhance asset quality recognition will cause a near-term surge in non-performing loans (NPLs) but contribute to greater systemic stability," Moody's said.

The ratings agency, however, said despite the increased risks to asset quality, the funding and liquidity of most rated banks have remained largely stable.

For the past several years, Bangladesh's banking industry has faced myriad crises marked by rising NPLs, liquidity constraints and governance issues.

Bad loans hit a record Tk 284,977 crore as of September this year, mostly due to poor credit risk assessments, political meddling and lax regulatory enforcement under the previous Awami League regime.

Some private Shariah-based banks and a few state-owned banks were at the centre of controversy, becoming embroiled in massive loan irregularities often linked to companies and borrowers with ties to the previous government.

As a result, public confidence in the banking sector has been severely damaged and operational challenges, such as acute liquidity problems, have arisen.

In its sovereign outlook, Moody's said: "We expect a material portion of loans to politically connected borrowers under the Sheikh Hasina regime will default through the year, adding to existing structural weaknesses in the banking system.

"This is likely to increase the fiscal cost of banking sector reforms, which the government is currently reviewing with the IMF."

According to Moody's, banking governance challenges have in part contributed to asset quality issues in the banking sector. Besides, a deteriorating monetary policy framework undermines macroeconomic stability while challenging fiscal prudence.

Long-term ratings of six banks downgraded

Aside from the overall banking sector, Moody's also took a negative view of the six Bangladeshi banks it reviewed.

They are: BRAC Bank, City Bank, Dutch-Bangla Bank, Eastern Bank, Mercantile Bank and Premier Bank.

The agency said it downgraded BRAC Bank's long-term local currency and foreign currency deposit ratings from B1 to B2.

Besides, Mercantile Bank and Premier Bank's long-term local currency and foreign currency deposit ratings were demoted from B2 to B3.

However, the ratings agency affirmed the B2 long-term local currency and foreign currency deposit ratings of City Bank, Eastern Bank and Dutch-Bangla Bank.

"At the same time, we have changed the outlook on the long-term deposit ratings of all six banks from stable to negative," Moody's said.

Md Mahbubur Rahman, additional managing director and chief financial officer of City Bank, said: "We observed that Moody's is concerned about the recent political developments in Bangladesh and subsequent consequences. This concern has been reflected in the rating downgrade for the country."

He said the negative rating action against the six banks is an after-effect of the sovereign rating change.

As for City Bank, Moody's affirmed its B2 rating, the same as last year, Rahman added.

He attributed political instability, slower economic growth, liquidity concerns and deteriorating asset quality and foreign currency reserves as having an impact on the long-term outlook for the six banks.

"Such rating actions may adversely impact overall trust, investor interest and pricing of foreign funds for the banking sector as a whole. But the impact will vary from bank to bank."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments