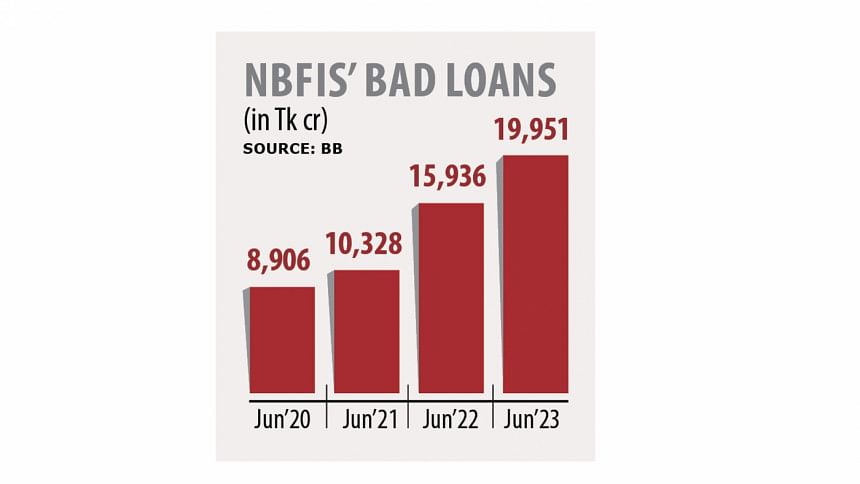

NBFIs’ bad loans at all-time high

After banks, it is now the non-bank financial institutions (NBFI) sector that has logged in a record volume of defaulted loans, in yet another data point that informs of the alarming state of the country's overall financial sector.

At the end of June, the sector's defaulted loans accounted for a staggering 27.65 percent of total outstanding loans, according to the latest published data from the Bangladesh Bank.

The 35 NBFIs' soured loans amounted to Tk 19,951.17 crore at the end of June, up 25.2 percent (Tk 4,015 crore) year-on-year.

"The actual volume of bad loans in the sector is much higher than the documents they send to the Bangladesh Bank," said a senior BB official on the condition of anonymity to speak candidly on the issue.

Some NBFIs' defaulted loans tend to increase after the central bank inspection, he added.

"Not only the NBFIs, the overall economy is now facing multiple challenges and that is why the bad loans in the sector increased," said Md Golam Sarwar Bhuiyan, chairman of the Bangladesh Leasing and Finance Companies Association.

Bad loans also jumped after the central bank last year withdrew the deferral facility extended during the pandemic for paying back loans.

"We are facing difficulty in recovering the disbursed loans because borrowers are not interested in repaying citing the ongoing economic crisis as an excuse," said Bhuiyan, also the managing director of Industrial and Infrastructure Development Finance Company (IIDFC).

Meanwhile, the number of weak NBFIs is on the rise due to huge loan irregularities and scams in this sector, according to the BB official.

Last year, 14 NBFIs out of a total of 35 were in the red zone, up from 12 in 2021, as per the central bank's financial stability report.

"The central bank is largely responsible for this," said Salehuddin Ahmed, a former BB governor.

BB's supervision in NBFIs is not up to the mark like banks, as reflected in the frequent reports of scams and loan irregularities in the sector in the last few years, he said.

Salehuddin went on to call for shutting down five to six of the weak NBFIs and merging another half a dozen.

"There are so many banks and NBFIs in our country that it is difficult for the central bank to monitor all of them," he added.

Echoing Salehuddin's views, Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said that some NBFIs defraud people by luring them in with promises of abnormally high returns.

"This is the right time to shut down some NBFIs to protect the depositors' money. Otherwise, general people will continue to face fraud."

Mansur, also a former chairman of Brac Bank, went on to urge the central bank to bar at least 10 of the NBFIs that are in rude financial health from collecting deposits.

"Those NBFIs should firstly repay the depositors' money for continuing their business," he added.

A central bank inspection team in 2020 unearthed huge irregularities and scams at a dozen NBFIs, including People's Leasing, International Leasing and Financial Services (ILFSL), Premier Leasing, Uttara Finance and First Finance.

Swindler PK Halder was the MD of ILFSL and he has allegedly embezzled about Tk 3,500 crore from the NBFI as well as People's Leasing and Financial Services, Reliance Finance and FAS Finance and Investment.

People's Leasing faced liquidation in June 2019 because it failed to return depositors' money despite the funds' maturity.

But instead of liquidating the NBFI, the government chose to restructure it.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments