NBR misses revenue target for 12th year

The National Board of Revenue (NBR) has fallen short of its revenue collection target for the 12th consecutive year, with experts opining that the existing framework for tax collection is inadequate.

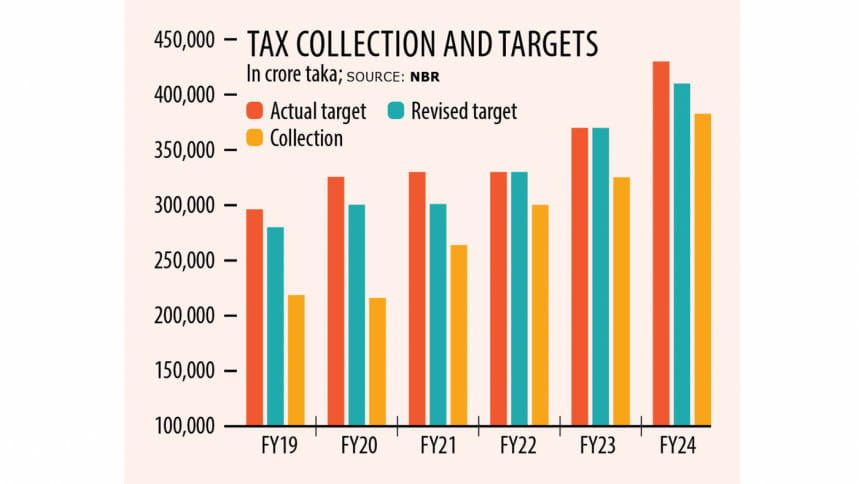

The tax authority logged overall receipts of Tk 382,562 crore in fiscal year 2023-24, falling short of its revised target by Tk 27,438 crore.

The government initially aimed to collect taxes of Tk 430,000 crore in FY24, but ultimately slashed the target by Tk 20,000 crore.

As per provisional data, the NBR failed to achieve its tax collection target despite registering 15 percent growth in collections in FY24 against growth of 10 percent in FY23.

The news comes a month after the government announced the national budget for FY25, which tasked the NBR with collecting Tk 480,000 crore.

The new goal is overly ambitious considering that it is 25 percent higher than what was actually collected last fiscal year.

It is also 17 percent higher than the previous target. The annual growth in tax collection has been hovering at around 11 percent on average for the past five years.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said the revenue collection target for FY25 cannot be achieved within the existing framework.

"If the government does not reform its tax administration, revenue mobilisation will not reach the expected level," he added.

Mansur added that the NBR requires policy and administrative reforms as well as full automation of its services.

The tax to GDP ratio in Bangladesh remains among the lowest in the world, reaching an estimated 7.38 percent in FY23.

"This situation has come about as our tax administration is weak and corrupt," Mansur said.

In this regard, Mansur pointed to Matiur Rahman, president of the NBR's Customs, Excise and VAT Appellate Tribunal, who was transferred to the finance ministry's Internal Resources Division following a recent controversy over his wealth.

Matiur came under the scanner over allegedly amassing crores of taka despite having a basic monthly salary of Tk 78,000.

"Like Matiur, there are many other NBR officials. They are continuing their wrongdoings. But they are not revealed at all," he added.

Echoing Mansur, Towfiqul Islam Khan, a senior research fellow at the Centre for Policy Dialogue, said it was clear from the start of last fiscal year that the revenue collection target would be missed.

"It was more than ambitious," he added.

Khan also said the government has been setting its revenue collection target over the past 10 to 15 years without considering the reality of the country's situation.

Additionally, frequent failures to meet the revenue collection target spoil the credibility of the fiscal framework.

He suggested the tax authority focus on curbing tax evasion and ensuring good governance and accountability to eliminate corruption.

The tax receipts in FY24 also fell short of the Tk 394,530 crore target set by the International Monetary Fund (IMF) as a part of a $4.7 billion loan.

NBR data showed that tax collection from international trade grew 8.72 percent year-on-year to Tk 100,819 crore in FY24 owing to falling imports as the government placed curbs to save US dollars amidst a prolonged forex crisis.

Income tax receipts rose 15.60 percent to Tk 131,025 crore, while the collection of value-added tax, the biggest source of revenue, grew 20.17 percent to Tk 150,717 crore last year.

Of the three segments, the NBR witnessed the highest growth in VAT collection.

"Persistently higher inflation and exchange rate volatility have together contributed to VAT growth last fiscal year," added Mansur, also a former economist of the IMF.

"In the future, we have to focus on direct taxation, which should be 12 percent of the country's GDP."

Also, total VAT collection should be 6 to 8 percent of the country's GDP. Currently, the ratio is just around 3 percent, Mansur added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments