NBR targets 10.5% tax-GDP ratio by FY35 amid IMF push

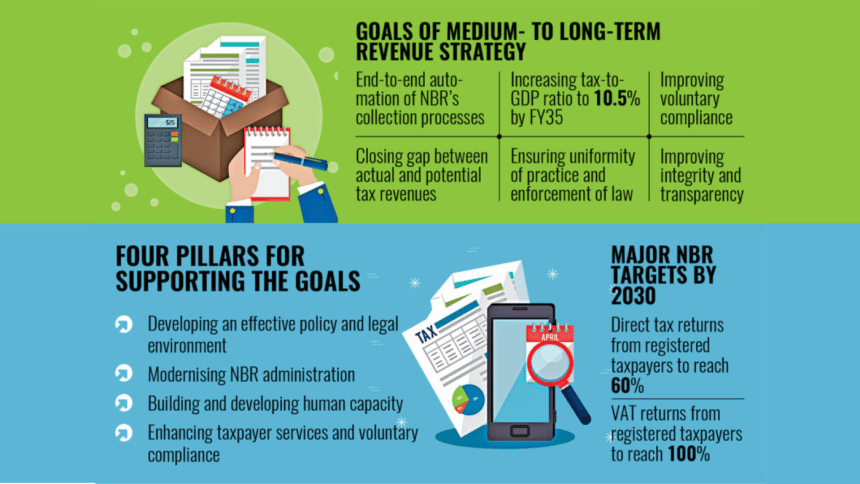

The National Board of Revenue (NBR) has set a target to raise Bangladesh's tax-to-GDP ratio to 10.5 percent by the fiscal year 2034-35, as part of its newly formulated 10-year revenue strategy, according to official documents.

Unveiled on Sunday, the Medium and Long-Term Revenue Strategy (MLTRS) is meant for boosting domestic resource mobilisation, strengthening the country's fiscal foundations, and supporting sustainable growth.

Besides, the plan is intended to prepare Bangladesh for its graduation from the least developed country (LDC) club, as well as to help meet its sustainable development goals (SDGs) by 2030, the revenue board said.

The strategy comes amid pressure from the International Monetary Fund (IMF) and reflects conditions attached to the lender's ongoing $4.7 billion loan programme.

While acknowledging Bangladesh's low tax-to-GDP ratio — which is one of the lowest in the world — the NBR described its target as "ambitious". However, economists criticised the goal as "inadequate" for the demands of the post-LDC period.

In the MLTRS report, the NBR said an ambitious target could serve as a "powerful motivator" to drive all wings towards maximising domestic revenue collection.

It noted that as the economy grows, achieving a higher ratio becomes more challenging, with the current figure standing at about 7.3 percent of GDP.

The NBR proposes aiming for a tax-to-GDP ratio of no less than 10 percent by 2032, with significant efforts required to reach the 10.5 percent target by FY35.

However, Mohammad Abdur Razzaque, chairman of local think tank Research and Policy Integration for Development (RAPID), said, "The ambition to raise the tax-to-GDP ratio to 10.5 percent over a decade is too little, too late for a country with growing development needs."

He said that the target should be much higher, at least 15 percent over the next 10 years, to meet the country's infrastructure, social protection, and investment needs after LDC graduation.

While Razzaque welcomed the MLTRS as a home-grown effort to boost domestic revenue mobilisation and praised its focus on improving taxpayer services, he said that the strategy "must go further to ensure that taxpayers are not subjected to harassment".

He said the revenue board should prioritise building a transparent, automated audit system that removes personal interactions between taxpayers and officials.

Covering the medium term from FY2025-26 and the long term through to FY2034-35, the strategy seeks to tackle the chronically low tax-to-GDP ratio, which has hovered around 7–8 percent for years.

Bangladesh continues to lag behind its peers in direct tax collection. In 2018, its direct tax-to-GDP ratio stood at just 2.62 percent, compared with a South Asian average of 4.6 percent and a global average of 8.5 percent, the report mentioned.

Razzaque said that while the strategy recognises the need to expand the direct tax base, it falls short of presenting a clear agenda for taxing property, wealth, and inheritance.

"Bangladesh cannot afford to delay reforms in these areas if it is to build a fair and sustainable revenue system," he said. "A clear and time-bound plan for modernising property, wealth, and inheritance taxation should have been a central feature of the MLTRS."

With inequality rising rapidly, reforms in these areas are more urgent than ever, he added.

He also welcomed the strong focus on automation and end-to-end digitalisation across income tax, VAT, and customs processes, calling it a "step in the right direction".

However, he said that automation alone could not replace the need for broader institutional reforms.

"Fragmented structures across tax wings, limited interoperability, and weak capacity for risk-based compliance management must be addressed in parallel to realise the full benefits of automation," he said.

While expanding manpower at the NBR is the right move, Razzaque said that building a skilled and capable workforce will be a much bigger challenge.

Meanwhile, commenting on the target, an NBR official involved in drafting the strategy said, "Although it is admittedly ambitious, it is a practical target."

"We have not set any absurd or unachievable goals," the official added, speaking on condition of anonymity.

He said the NBR has taken into account the current economic realities and consulted the IMF before finalising the plan.

Khondaker Golam Moazzem, research director at local think tank Centre for Policy Dialogue (CPD), said, "Although 10.5 percent appears large in terms of proportion, it is also important to consider what kind of economic growth they have forecasted over the next 10 years."

For instance, the World Bank projects Bangladesh's economy to grow by 3.3 percent in the upcoming fiscal year, while the government forecasts a slightly higher rate of 3.5 percent. Both figures are considerably lower than usual growth expectations.

"If low growth persists in the coming years and if economic recovery is delayed, then even with a 10.5 percent target, the absolute amount of revenue generated may not be as large as it appears," he said.

However, Moazzem commented that since these targets are adjustable and subject to regular review, it is not necessary at this stage to express serious concern or anxiety about whether the 2035 target will be sufficient.

"What is crucial for us is the next three years — the immediate years following graduation from LDC status. Because that is when challenges will arise, and the need for domestic resources will be acute."

The CPD research director said, "It appears that the 10.5 percent projection has been made without fully factoring in the possibility of large-scale reforms that could significantly boost revenue."

"We hope that in the coming days, the government will strengthen efforts to digitalise tax collection, formalise businesses, and bring more people under the tax net. If that happens, I believe we will be able to exceed the current targets even within the medium term," Moazzem added.

In the report, the NBR also mentioned increasing the return filing rate to 60 percent by 2030 from the existing 35 percent. Besides, the revenue board has planned to raise the VAT returns from registered taxpayers to 100 percent by 2030.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments