New fiscal year starts on positive note but fault lines remain

Perhaps for the first time in several years, policymakers are entering the new fiscal year with a greater sense of ease.

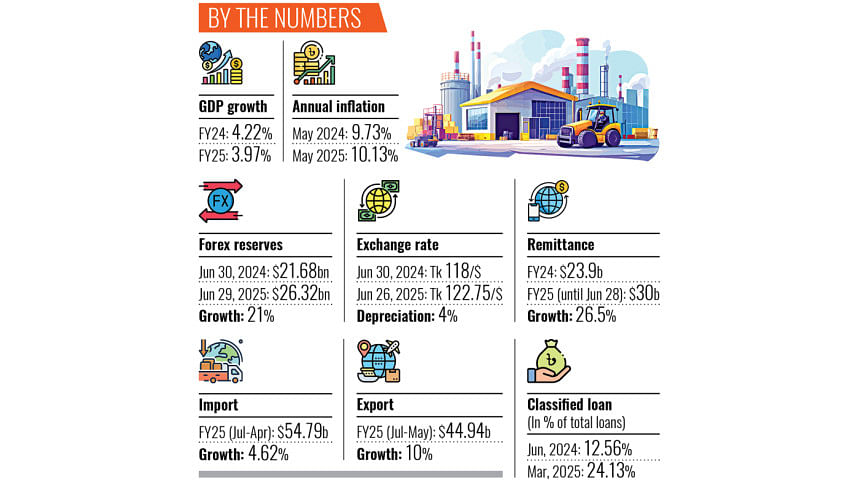

In the past year, remittances from Bangladeshis living abroad surged to a record high of over $30 billion.

This, coupled with the release of funds by the International Monetary Fund (IMF), World Bank, and other multilateral lenders, has helped lift the foreign exchange reserves to over $26 billion — the highest in more than two and a half years.

Exports and imports have bounced back. Inflation shows signs of easing, as consumer price growth slowed for the second consecutive month in May.

However, these numbers tell only a partial story. A number of fault lines remain and continue to weigh on the economy. Tax collection remains sluggish, reducing the fiscal space for the government.

The reduction in the budget size for the new fiscal year 2025–26, for the first time in Bangladesh's history, is a glaring example of this.

Investment by the private sector, the key driver of the country's $461 billion economy, remains dull due to persistent inflation, economic slowdown, and political uncertainty.

A tightening measure by the central bank also exposed the scale of bad loans in the financial sector: one-fourth of total outstanding loans, revealing the fragility of the banking sector.

Despite a slight easing, inflation has remained above 9 percent for more than two years, eroding real incomes and affecting low- and middle-income households.

"Most concerning, perhaps, is that youth unemployment remains very high. While more and more graduates join the labour market, employment generation has failed to keep pace," said Md Deen Islam, associate professor of economics at the University of Dhaka.

The NEET (Not in Education, Employment or Training) rate stood at more than 22 percent, according to the Labour Force Survey 2022.

"Underemployment and informality further cloud the employment picture, undermining the potential demographic dividend that Bangladesh is poised to enjoy," said Islam, also research director of Research and Policy Integration for Development (RAPID), a private non-profit research organisation.

He said the outgoing FY25 has been marked by a converging set of problems which have strained both the government's budget administration and the wider economy.

The Annual Development Programme (ADP) saw poor implementation, with actual expenditures falling well short of the target — a recurring issue that hampers long-term infrastructure and social investment goals.

"The country is entering a new fiscal cycle burdened with the unresolved economic issues of the last fiscal year," he said.

Ashikur Rahman, principal economist at the Policy Research Institute (PRI) of Bangladesh, said the outgoing fiscal year underscored the structural fragilities embedded within Bangladesh's macroeconomic framework.

"The erosion of fiscal space, manifested through stagnant revenue mobilisation, rising debt servicing costs, and elevated subsidy burdens, has constrained the state's developmental capacity."

Rahman said, "This fiscal tightening has occurred alongside mounting stress in the financial sector, where rising non-performing loans and weak governance have impaired credit intermediation and shaken depositor confidence."

Looking ahead to the upcoming fiscal year, he said, three interrelated priorities stand out.

Fiscal consolidation must be anchored in equity-enhancing tax reform and expenditure rationalisation that safeguard critical social investments, he said.

Second, restoring financial sector integrity requires decisive regulatory enforcement, strong political commitment to mergers of weak banks, enhanced supervisory autonomy, and credible governance reforms within state-owned and private banking institutions, he added.

The economist said the Bangladesh Bank has taken some decisive actions to discipline the financial sector, and the reform momentum must be continued.

"Third, and perhaps most importantly, the creation of a more predictable, transparent, and rules-based policy environment is essential to revive private investment and restore macroeconomic confidence.

Absent these reforms, the economy risks remaining trapped in a cycle of low fiscal resilience, weak institutional credibility, and suboptimal growth."

Islam said FY26 appears poised to inherit the difficulties of its predecessor without offering a bold new direction.

"Without meaningful reforms in public financial management, tax policy, and governance, Bangladesh risks slipping into a cycle of low investment, weak service delivery, and constrained growth.

While global uncertainties remain a factor, many of the country's fiscal challenges are self-inflicted and require strong political will to address," he said.

"In short, FY26 appears destined to continue inheriting the problems of its predecessor without a dream of a radical new direction."

He said that as citizens face another challenging year, the need for wiser spending, more prudent implementation, and people-centred economic planning has never been greater.

"Bangladesh stands at a budgeting crossroads; whether it adopts prudence with purpose or just fiscal restraint without reform will determine the course of its development in the years ahead," said the economist.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments