No chance of debt distress

Bangladesh has a low risk of external and overall debt distress despite higher external borrowing in recent terms, said the International Monetary Fund.

"External and overall debt indicators are below their respective thresholds under the baseline," said the IMF's debt sustainability analysis (DSA), conducted to inform its executive board's decision on the $4.7 billion loan application from Bangladesh.

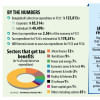

At the end of last fiscal year, the country's total public debt is $166.1 billion, which is 39 percent of GDP and well below the threshold of 55 percent.

Of the sum, $72.3 billion is foreign loan, which is 17 percent of GDP and well below the threshold of 40 percent of GDP.

And of the $72.3 billion, the World Bank accounts for $18.2 billion, followed by the Asian Development Bank ($13.3 billion), Japan ($9.2 billion), Russia ($5.1 billion), China ($4.8 billion) and India ($1.02 billion).

External medium- and long-term debt, which are mostly concessional in nature and helped finance infrastructure projects, is expected to jump in fiscal 2022-23 due to large taka depreciation, before gradually declining to around 14.1 percent of GDP by fiscal 2032-33 and 8.6 percent of GDP by fiscal 2042-43.

This decline is mainly driven by a gradual reduction in concessional financing beyond fiscal 2025-26, while financing from bilateral donors is expected to continue to increase, partially offsetting the lower concessional financing.

The majority of public debt over the last decade is domestic and denominated in local currency.

In fiscal 2021-22, domestic debt was about 56.5 percent of all debt, with the National Saving Certificates (NSCs) accounting for the lion's share.

"NSCs stifle the development of a domestic bond market as they provide a yield of around 10 percent for the majority of the NSC instruments, whereas government bonds of similar maturities provide a yield of around 7 percent," the IMF staff report said.

Subsequently, the lender called for continued reforms to align NSC interest rates to market-determined rates and phasing out the interest rate caps.

This would help debt dynamics by lowering the cost of domestic borrowing, improving monetary policy transmission and deepening domestic debt markets, it said.

Going forward, the debt scenario looks comfortable.

"All but one external debt indicators are below their corresponding thresholds under the most extreme shock, despite an initial increase due to large taka depreciation in fiscal 2021-22 and fiscal 2022-23."

The present value of debt-to-exports breaches the threshold under the most extreme shock to exports.

This temporary two-year breach (starting in 2025) of low magnitude is driven by large export fluctuations during the pandemic and the post-pandemic recovery periods.

"However, a short-lived and small breach, as well as favorable debt dynamics with declining external debt-to-GDP ratio path, supports the use of judgment and deviation from mechanical rating."

Due to large taka depreciation in this fiscal year (around 21 percent), the present value of debt-to-exports and debt service-to-exports ratios are at a higher level compared to the previous DSA.

Both debt service-to-exports and debt service-to-revenue ratios are on a declining trend and remain under the threshold under the most extreme shock of an export shock and a one-time depreciation shock respectively.

"Nevertheless, given the low share of external debt in financing mix, the projected increase in total debt service-to-revenue ratio could raise external debt rollover risks."

Indicators in percent of revenues are on a rising trend, with debt service-to-revenue ratio increasing from 48.2 percent in fiscal 2022-23 to 65.8 percent in fiscal 2032-33, thus further highlighting the importance of mobilising tax revenue.

In fiscal 2021-22, domestic debt service payments amounted to $31.9 billion in fiscal 2021-22 (7.5 percent of GDP) while external debt service payments amounted to $2.1 billion.

"Increasing the revenue-to-GDP ratio beyond the programme period will be critical in providing non-debt financing to growth-enhancing and climate-resilient infrastructure projects."

Overall debt-to-GDP is expected to "increase moderately" to around 42.1 percent by fiscal 2032-33, which is well below the threshold.

Growth is projected to be slower in fiscal 2022-23, compared to the previous DSA projection, but is expected to exceed the previous growth path in the medium to long term, supported by additional external financing and accelerated reform agenda under the IMF programme and programmes by development partners, including the World Bank.

Risks are tilted to the downside and include intensifying spillovers from the Russian invasion of Ukraine, rising commodity prices, a slowdown in major export destinations, elevated defaulted loans and prospective losses from natural disasters.

The authorities remained cautious about contracting external debt, especially commercial debt, the report said.

They underscored that several reforms underway, including domestic revenue mobilisation, public financial management, and public debt management, will help improve the debt dynamic and ensure fiscal and debt sustainability.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments