NRB Islamic Life Insurance: a cautionary tale

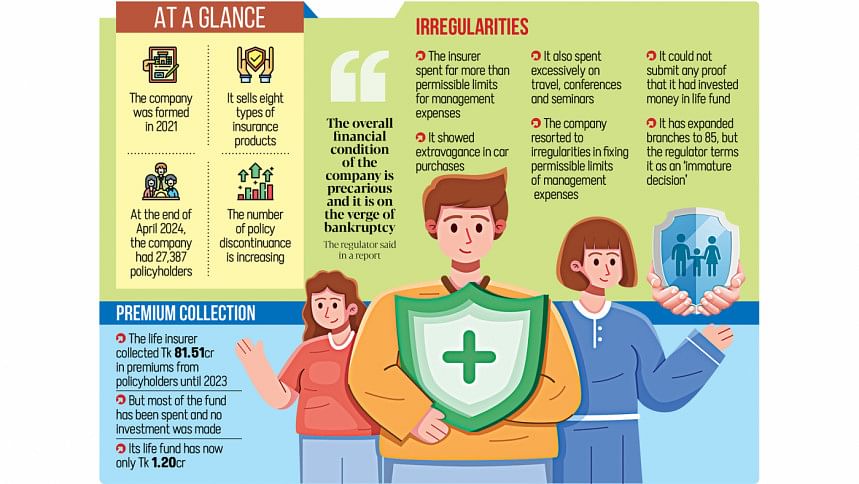

NRB Islamic Life Insurance has been mired in irregularities within just three years of its inception. The insurer has spent far more than the permissible limits for management expenses and showed extravagance in car purchases since being formed in 2021.

The company also spent excessively on travel, conferences and seminars. As a result, the insurer's financial condition is nearing the point of no return.

Besides, the company has resorted to irregularities in fixing the permissible limit of management expenses.

Kibria Golam Mohamad, the chairman of NRB Islamic Life Insurance Limited, is also the founder of the Bangladesh Awami League, Italy and founder organising secretary of the All European Awami League.

As per a probe by the regulator, in 2021 to 2023 the company exceeded the sanctioned limit of management expense of Tk 21.17 crore, which is 1.48 times more than the permissible limit.

The life insurer collected Tk 81.51 crore in premiums from policyholders by the end of 2023, but its life fund showed only Tk 1.20 crore, according to a report by the Insurance Development and Regulatory Authority (IDRA) dated June 3.

"The company could not submit any proof that it had invested money in the life fund," it said.

A life fund is an amount of money that is paid to and invested by insurance companies for life insurance, and from which money is paid when someone dies.

"The overall financial condition of the company is precarious, and it is on the verge of bankruptcy," the regulator said in its report.

To overcome this situation, the company's board of directors will have to inject about Tk 24 crore urgently and compulsorily, the report mentioned.

The company's paid-up capital is Tk 18 crore. However, the company withdrew Tk 7 crore of that with the condition that it would be replenished. Recently, the company managed to inject Tk 3 crore into the paid-up capital, according to the IDRA report.

Mohammad Jainul Bari, chairman of the IDRA, told The Daily Star that the premium collected from the policyholders was illegally spent by the company. The life fund has also not been constituted.

Answers have been sought for the irregularities that have come up in the report. Further action will be taken after receiving the reply, he said.

HOW THE IRREGULARITIES CAME TO LIGHT

A senior official of the IDRA told The Daily Star that the issue came to light while the regulator was conducting a fit and proper test after the company sent a proposal to renew the appointment of its chief executive officer.

The regulator sought various information to review the company's past business success and existing financial condition, including information on its paid-up capital, premium income, assets, investments and policy renewal rates.

"After analysing the information provided by the company, we found several irregularities," the official said, adding that the company spent policyholders' money arbitrarily and in breach of the law.

The IDRA said the company will have to pay Tk 34 crore in 2024-25 and 2028 to settle the claims of a scheme termed single premium policy. NRB Life Insurance will have to have an investment of Tk 23 crore to clear the claims, it added.

In addition, there should be more money invested to settle the claims of policies against its 'Double Payment Single Premium Plan,' for the period of 10 years, 12 and 15 years, said the regulator.

The IDRA said the company does not have any investment other than Tk 15.59 crore. If the money is considered as investment from the paid-up capital, no investment could be found out of Tk 82 crore collected as premium.

And, if the investment is considered as the investment of premium income of life fund, no investment from paid up capital exists, it added.

NRB'S 'UNPRECEDENTED' 85 BRANCHES, INCLUDING IN NAPLES AND ROME

The insurer was registered on May 6, 2021 as a full-fledged Islamic life insurance company.

In three years, it has expanded to 85 branches, according to the regulator report, which termed the expansion as "unprecedented".

Of them, two branches are located in Rome and Naples, making NRB Islamic Life Insurance the only local insurer that has branches outside the country, said a senior official of the IDRA.

"It is unprecedented for a new company to have 85 branches. This will increase the company's operating expenses," the IDRA report mentioned.

The company sells eight types of insurance products.

HOW THE COMPANY WENT INTO THE RED

NRB Islamic Life between 2021 and 2023 purchased 36 Proton cars ignoring the regulator's directive that it could buy a maximum of six vehicles.

In the case of a new company, such an investment creates a serious obstacle to the emergence of the company, it said in the report.

Furthermore, as a result of these decisions, the company's operating expenses increased at an alarming rate, it added.

A new car can be run for 10 years effortlessly, but the company is depreciating the assets at 20 percent per annum. So, the book value of the car will be zero in 5 years, the IDRA stated in the report.

"The result is that if depreciation of cars purchased in 2021 is excluded, the book value of the cars will come to zero value in 2025 or 2026 and they can be sold in the market."

Alongside that, the company incurred unnecessary expenses for travel, conferences and seminars.

The total expenses in these areas amounted to about Tk 5.43 crore, the report said.

"A new company spent Tk 3 crore on seminars and Tk 2.43 crore on travel, which is nothing more than enjoying the money of policyholders. There is a huge scope for embezzlement of funds in this process," the IDRA report stated.

REGULATOR INITIALLY TOOK SOFT STEPS

The IDRA could have suspended or cancelled the company's registration for acting against the interests of the policyholders and the company's business development, according to the insurance law 2010.

Besides, if the regulator suspects that an insurer is acting against the interests of policyholders or failing to fulfil the solvency margin requirements, the IDRA may, after giving an opportunity for the insurer to be heard, suspend the board of directors and appoint an administrator to manage the affairs of the insurer, it said.

However, instead of taking such a concrete action, the regulator recently rejected NRB Islamic Life's proposed re-appointment of Shah Jamal Howlader as its chief executive officer.

"The company's proposed CEO has acted against the interests of the company and policyholders in his last tenure," according to a letter sent from the IDRA to the company.

Howlader is also accused of misleading regulators by providing incorrect information in a report sent to the IDRA, it said.

In the face of these accusations, Howlader opted to stand his ground by getting legal approval to stay on as the insurer's CEO for now.

The Daily Star attempted to contact both Kibria and Howlader through email and phone calls on July 8, but they did not respond until the report was filed.

WHO IS KIBRIA?

Kibria Golam Mohamad is the founding chairman of NRB Islamic Life Insurance Limited.

After earning a law degree from the University of Dhaka, he established nine business institutions in Rome.

He also received an honorary certificate from the government of Italy for being one of the highest taxpayers from 1998 to 2011.

Other than his business interests, he is also the founder of the Bangladesh Association of Italy.

The Daily Star repeatedly tried to contact Kibria and Rahman for comment, but they did not respond to calls or messages. They were also e-mailed. However, no response was received.

Zahangir Alam, spokesperson of the IDRA, told The Daily Star that the regulator was reviewing the company's analytical report on the overall matter.

An explanation for these irregularities has been sought from the company's board, that is why a letter was sent to the company on July 4 highlighting the contexts of irregularities, he said.

An official of the insurer said that the company had sought more time from the regulator to respond to its letter. He hoped a response could be sent by the end of this month.

POLICY DISCONTINUATION INCREASING

The number of policy discontinuances in the company is also increasing.

In 2022, 41 percent of the company's total policies were discontinued and that increased to 43 percent in 2023, according to the IDRA report.

At the end of April 2024, the company had 27,387 policyholders.

NRB Islamic Life Insurance has been able to get away with such huge irregularities because very influential people are part of the ownership structure of the company, said Prof Md Main Uddin, a former chairman of the Department of Banking and Insurance at the University of Dhaka.

An insurance company that is in such dire financial straits should not be allowed to open branches outside the country, he said.

The Bangladesh Financial Intelligence Unit should investigate whether the company is involved in money laundering, he said, adding that the two branches outside the country should be closely monitored.

"If a company finds itself in such a situation after just three years, the kind of role the regulatory body is playing is questionable," he said.

If the regulator finds that a company is unsustainable, the regulator should shut it down. Although that is not common in Bangladesh, he said.

However, if the government cannot do that, they should take strict steps to bring the company out of this situation quickly, he said.

Currently, there are 36 life and 46 non-life insurance companies in the country.

Payments against claims of around 10 lakh policyholders, amounting to Tk 3,050 crore, were hanging in the balance as 29 life insurance companies had not cleared their dues owing to a liquidity crisis, showed official figures published in March this year.

More than 26 lakh insurance policies have lapsed in Bangladesh in the last 14 years owing to a raft of factors, including the worsening financial health of clients, a lack of awareness among them, and agents' tendency not to explain product features properly while selling them. In 2009, the total number of policies was nearly 1.12 crore, but it fell to 85.88 lakh in 2023.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments