NTT DoCoMo poured $350m in Bangladesh. But it is now leaving empty-handed.

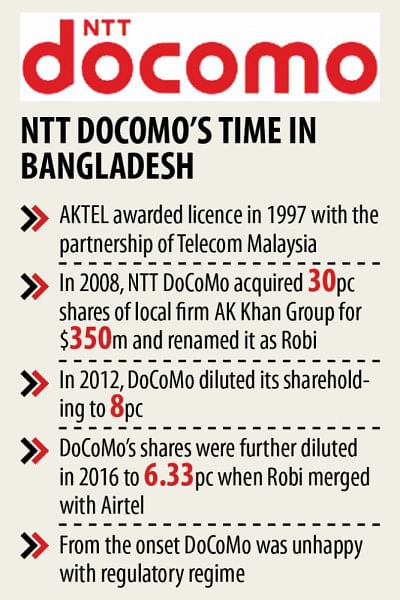

Japan's largest mobile firm NTT DoCoMo is leaving Bangladesh after 12 years completely empty-handed despite injecting $350 million in the country.

The departure, which will bring DoCoMo's 12-year presence in Bangladesh to an end, has raised questions about the regulatory regime in the telecommunication sector.

This may also impact the 5G roadmap of Bangladesh as NTT DoCoMo is ranked the world's leading operator in terms of applications for candidate standard-essential patents and the number one in terms of 5G technical proposals in 2019, experts say.

On Friday Robi, the second-largest carrier of the country where DoCoMo was a part for the last 12 years, got the approval from the Bangladesh Telecommunication Regulatory Commission (BTRC) to hand over its 6.33 per cent share in Robi to Indian multinational company Bharti Airtel.

The Japanese mobile phone operator has not disclosed how much it is getting from the Indian firm for selling the shares.

This compelled the BTRC to reach an amount by fixing the value of the stake at Tk 10 per share in line with the face value of each security in the stock markets in Bangladesh.

The carrier has paid all of the Tk 4 crore it has got from Bharti International to the BTRC in share transfer fees, which would leave the Japanese company with no money or very insignificant amount to take home.

Now, it has to complete some formalities at the Registrar of Joint Stock Companies and Firms before leaving.

In 2008, when DoCoMo came to Bangladesh, the BTRC had charged Tk 139 crore as share transfer fees, which were 5.5 per cent of the total value of the shares.

At the time, AK Khan Group sold its 30 per cent stake in the erstwhile Aktel and a case has still been pending with the High Court on the issue of the huge transfer fees.

Since the foray, the Japanese telecom investors were very unhappy with the telecom policies and regulatory regime of Bangladesh and as a result, they even did not consider any further investment in the country save some requisite technological support.

DoCoMo raised questions about the policies on fibre optical cable, interconnections and telecommunication transmission.

Mobile operators are allowed to lay fibre optic in other countries. But in Bangladesh, they have to take the service from other companies.

Similarly, the carriers have to go through interconnection exchange operators and international gateway operators before connecting subscribers at home and abroad.

High tax is another reason, say industry people. At 54 per cent, Bangladesh's mobile industry has one of the world's highest taxation rates.

In 2013, the predominant mobile operator of Japan decided to squeeze its stake to 8 per cent from 30 per cent.

When Robi and Airtel merged in November 2016, DoCoMo's share was diluted and came down to 6.33 per cent.

When DoCoMo contracted its shareholding to 8 per cent in 2013, the Bangladesh government should have taken it as a wakeup call as the Japanese behemoth had squarely blamed regulatory uncertainty for downsizing its stake, but the situation kept worsening, experts said.

In the last one year, DoCoMo did not sit in the board of Robi Axiata and withdrew all of its employees at Robi more than a year ago.

In February, Robi announced that it wanted to get listed on the stock market and has accordingly applied to the Bangladesh Securities and Exchange Commission -- in a testament of the commitment of the foreign owners of the operator to the market.

Once the issue becomes mature, the stakes of both Axiata and Bharti will be diluted and the shareholding structure will change again.

In a meeting in March, the commission decided to allow DoCoMo to leave the country. There had been no mention of imposing charges on the share transfer in the meeting minutes.

The meeting also decided to recommend the government approve the departure. But in the letter of the telecom ministry where it gave the consent, the issue of charge was mentioned.

On Saturday, Md Jahurul Haque, chairman of the BTRC, said the commission did everything as per the Telecom Act.

"Maybe they (DoCoMo) have other plans and that's why they are leaving Bangladesh," he said.

With the departure, DoCoMo will join a list of telecom players such as Orascom Telecom Holding, SingTel and Dhabi Group (Warid Telecom) that wounded up operations in Bangladesh in the past.

Robi has 4.99 crore active users as of March, trailing behind market leader Grameenphone.

"We are sad to see NTT Docomo exiting from Bangladesh's telecom market," said Shahed Alam, chief corporate and regulatory officer of Robi Axiata.

In 2016, Citycell, the country's first mobile operator, quit the market. Later, Airtel merged with Robi since its operation in Bangladesh as a separate company had become unviable, he said.

"Therefore, there is no doubt about the dire business prospect for telecom business in Bangladesh unless economies of scale are created by an operator," said Alam.

Md Sirazul Islam, executive chairman of the Bangladesh Investment Development Authority (BIDA), does not think that the departure would give a wrong signal to international investors.

If a company invests in any country and does not see the expected return, it can exit the country. This is an international practice. The same has happened in case of NTT DoCoMo, he said yesterday.

"There is nothing to be worried and it would not impact the flow of foreign investment to Bangladesh," he said, adding that the Japanese company did not raise any complaint with the BIDA about any policy.

The BTRC says the departure of DoCoMo would not affect Bangladesh's 5G ambition.

"Bangladesh is a huge market and all the top global players are running their business here. You will never find so many customers in a very small cell like Bangladesh," Haque said.

After securing the DoCoMo's stake, Bharti would hold 31.33 per cent stake in Robi. Kula Lumpur-based Axiata retains the controlling stake of 68.95 per cent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments