Old political issue has evolved from financial to structural problem

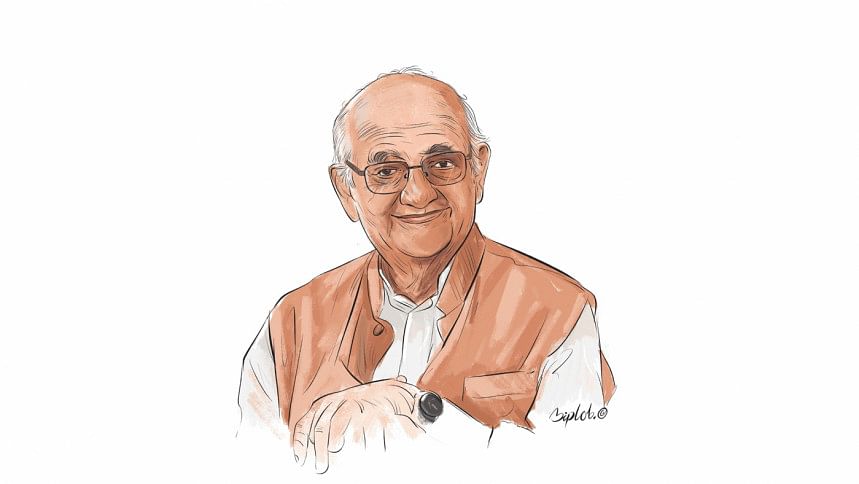

A longstanding political issue has now evolved from a financial concern to a structural problem in Bangladesh, according to noted economist Prof Rehman Sobhan.

Prof Sobhan said they initiated discussions about the impacts of political influence on the economy 40 years ago, adding that it had now graduated from a financial problem to a structural one.

One of the major issues lies in finding a solution to ensure the independence of the Bangladesh Bank, he said while addressing a webinar on 'Political Economy of Banking Sector in Bangladesh' organised by Samaj Gabeshana Kendra on Sunday.

"You [influential people] essentially want to make sure that the management of the central bank and the nature of the malfeasance in the banking system is an instrument of politics rather than an instrument of governance within the system."

Mentioning the names of Mohammed Farashuddin, Fakhruddin Ahmed, Salehuddin Ahmed and Atiur Rahman, Prof Sobhan said professionals were appointed as governors of the Bangladesh Bank over the years, but added that it was no longer the case.

"Eventually, we have ended up appointing bureaucrats as governors because by now the need to make sure that governors are completely subordinate and instrumental to the political dimensions of financial policy-making has become essential."

He suggested that there should be independence in the banking system, but added: "It is a nice dream but you will have to have independence, democracy and accountability before that if this is to be meaningful advice," he said.

He also observed that, over time, political patronage has become the main criteria for lending.

He added that banks are using savings of small people to lend to a class which is not repaying its loans. This has created a massive state-patronised system of maldistribution of income and assets in the economy, he added.

This also created another asymmetry. "You are borrowing from short-term investors and lending to long-term investors. And since the bulk of the short-term investors are people of more modest means, you are taking the money of less privileged people and lending it to overprivileged people."

So, there was both an injustice and inefficiency which became built into the financial system, Prof Sobhan said.

Furthermore, political resources are used to ensure that loans are not effectively collected. Once that happens, that class becomes more empowered, he said.

The default culture has also distorted the setting of interest rates.

"Now, this whole process is linked to fundamental structural inefficiencies in the functioning of the banking system. The nature of defaults is linked to the whole issue of money laundering."

What is essentially happening and what is one of the sources of the default loans is the fact that people use bank borrowing as a means to launder money outside the country, he said.

"You then created a structural problem within the banking, within the business sector itself and you created a model hazard problem."

The other structural problem is that borrowers were borrowing money cheaply from the banks while there was very little attempt to use the capital market as a source of industrial financing, he said.

As a consequence of such decisions, now, not only is the proportion of businessmen in parliament increasing, but a larger percentage of bank borrowers as well as a much larger percentage of defaulters are also businessmen, he said.

"But for all the default crises, no major discussion, meaning a substantive discussion of the default problem, has actually taken place in parliament for probably about 20 or 30 years as far as I can see over successive regimes. Now, this again is an extraordinary state of affairs but hardly surprising."

Now, a class of people have evolved who have not just captured the state but have become the state itself, he said. It is going to be very difficult to do anything about it because this class has now joined hands with the bureaucracy.

"A whole class of bureaucrats have also become part of the financial crisis because they too borrow from the system, they too in fact launder their loans," he said.

He added that he recently came to know that a senior police official had acquired huge assets and set up a holiday resort and so forth.

"Now, obviously this could only have been done by massive borrowing from the banking system. I have no idea what equity investments also went into this. But obviously this class can borrow and this class can reschedule."

"Now, you will see that a lot of the borrowed money which is coming in is now being laundered outside the country."

"Unless you can address the political sources of the problem and create a politically accountable system in which the state and nature of governance can be held accountable, not just in dialogues and discussions like this, but actually on the floor of the house and parliament, this will continue," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments