Payout of safety net funds through MFS to enhance transparency

It was unimaginable for Robichandra Shil, a barber in Pingree bazar in Rajapur upazila under Jhalakathi, that he would receive Tk 2,500 on his mobile wallet from the prime minister as Eid gift.

"It was unbelievable to me!" an amazed Robichandra told The Daily Star over the phone. He received the sum on the evening of May 14.

Until he cashed out the sum the following morning, he was not fully confident on whether he would get the full amount or someone would not stake a claim on a portion of it.

"Our local councillor at the union parishad took my mobile and NID [national identification] numbers a few days ago, saying the government would send some money to the people who have become unemployed for the pandemic," he added.

Hundreds of thousands of people like Robichandra have lost jobs soon after the rogue virus hit the country in March, leaving the government on the brink of losing all the gains in poverty reduction over the past decade.

This has prompted the government to provide cash support to those who lost their livelihoods through the mobile financial service platform, which allowed them to avoid to visit banks or union parishad office or lobby with anyone to get the relief.

The government is disbursing cash assistance to support 50 lakh poor households with the help of the four top MFS operators under a programme of the disaster management and relief ministry.

Under the project, designed by the finance ministry, the government has targeted to pay out Tk 1,250 crore to the ultra-poor.

No doubt, MFS is the most efficient way that can push the country to a robust digital financial inclusion, said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

"I think the time has come to accept technology for the financial sector to enhance inclusion and bring transparency."

There is no other effective way like MFS that can disburse cash assistance to the poor while they maintain social distancing to stop the spread of the deadly virus, stakeholders say.

Moreover, a level of transparency can be ensured with this kind of payment, where at least a person who has a mobile and NID card gets the sum and not a ghost.

Allegations are rife under traditional channel that people who do not exist also get government assistance.

For every case of government payout, errors are found both in beneficiary inclusion and exclusion level.

In the listing phase, the government can consider taking support from the MFS operators, which can help prepare an authentic eligibility list, Hussain said.

With some criteria and previous transactions, the MFS operators can determine users' authentication. This authentication can also be done after field offices prepare a list.

"Using this technology, the government can also think about disbursing other cash assistances and even small agricultural loans and also repayment can be done," Hussain added.

The use of MFS for disbursement would be only effective if the beneficiary selection process is done effectively, said Kamal Quadir, chief executive officer of bKash, the country's leading MFS provider.

"Our NID system is one of the best among the emerging countries, so we should take advantage of this national asset for the validation."

Already, there are examples of education stipends such as the Prime Minister Education Trust Scholarship and a few stipends of the government that bKash and Agrani Bank jointly have executed.

Without any flaws, these stipends have gone to the right people, Quadir added.

If this can be done successfully, the other areas can also adopt digital financial service for allowance distribution effectively.

"However, the most critical thing is to select the person with the right mechanism and verify them with the NID system. Otherwise, such great initiatives can be abused," he said.

Industry sources say the government also understands the need for digital payments for social safety net programmes and is increasingly opting for digital platforms in a bid to steer clear of the plundering risks.

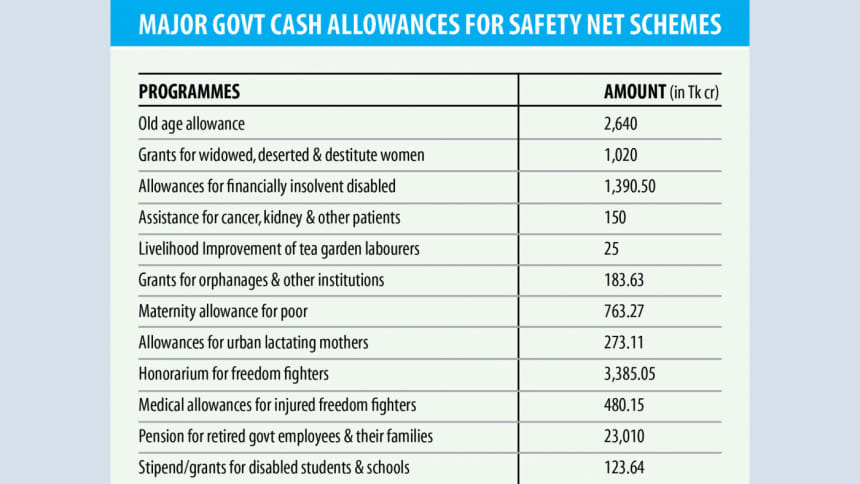

For this fiscal year, the government has allocated about Tk 127,000 crore for safety net programmes, of which Tk 35,000 crore will be disbursed in cash.

If the government considers disbursing this amount through MFS, it will ensure at least a level of transparency and it would be hassle-free for them, economists and industry leaders said.

The government is very positive about this kind of payout, said Abul Kashem Md Shirin, managing director of Dutch-Bangla Bank, which runs Rocket, an MFS service.

"Though there are some resistances within government offices and local level politicians, we have found the top level of the government to be very committed to this digital platform," he said.

Both bKash and Rocket started MFS disbursement of the stipends for students in 2015 and listed about 10 lakh individuals at the time. The number rose manifold and only bKash is dealing with 35 lakh individuals.

The education ministry has embraced large-scale digital disbursement. The women and children affairs ministry is following suit.

But the social welfare ministry, which handles the biggest amount of the safety net amount, is not interested, sources say.

A couple of months ago, the government engaged an MFS operator to run a pilot in Sylhet but the team could not carry it out despite repeated attempts because of opposition from the local level.

"The government even can run technical audit after a fund is disbursed through MFS and can use our technology to find out the eligible persons," said Tanvir A Mishuk, managing director of Nagad, an MFS provider of the Bangladesh Post Office and a private entity.

After the full automation of fund payment, the government can get the exact numbers of how many people are being repeated in all cash support and this will save public money as well.

With 17 lakh families, Nagad, the fastest-growing MFS in Bangladesh, is disbursing the biggest chunk of the prime minister's gift allocation. It is distributing other funds from the government and the non-governmental organisations.

Top player bkash is also disbursing funds to the poor on behalf of the NGOs. Recently, it paid Tk 1,500 to each of two lakh people under an initiative of Brac and Grameenphone.

It has engaged with microfinance institutions and is receiving instalments, which the government halted because of the ongoing pandemic.

MFS operators collect donation on behalf of voluntary organisations such as Bidyanondo, too.

This write-up is produced under the Bangladesh Policy Advocacy Initiative, conducted by the Policy Research Institute of Bangladesh

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments