Power producers may lose zero-duty benefit

Power generation companies, including rental ones, may see an end to a zero-duty benefit on their import of machinery, equipment and spare parts from next fiscal year as the government moves towards generating more revenue curtailing the practice of handing out tax exemptions.

The companies may need to pay a 5 percent customs duty when importing goods from the upcoming fiscal year of 2024-25, according to officials of the National Board of Revenue (NBR).

The rental power plants have been enjoying the duty-free benefit since 2008. Prior to that, there was an import tax of around 10 percent.

The government exempted the rental power companies from paying the duties to enhance private investment in this sector at a time when there was a huge deficit in power production, said the officials concerned.

There were times when Bangladesh Power Development Board (BPDB) had no option but to impose power cuts around the country by rotation for hours on end.

"The government awarded contracts to a good number of small power plants at that time to increase the power generation capacity within a short time," said a BPDB official wishing anonymity.

"But later the validity of contracts with them were extended several times. Besides, they were provided advantages, including different VAT and tax exemptions," said the official.

According to a private sector power generation policy (PSPGP) of Bangladesh 2004, private investors enjoy a corporate income tax waiver, relaxed customs duties, exemptions from stamp duty payments and interest on foreign loans and other benefits.

Such decisions were changed and extended several times.

About the customs duty, a government circular of March 11, 2008 reads that rental power companies have been exempted from paying all kinds of import duties, value added taxes and supplementary duties.

This was applicable whenever equipment or spare parts were being imported for power plants being set up temporarily.

There were some conditions in the circular, including one that stipulated that rental companies would have to export their plants and parts after the end of the contracts.

But later, most of the plants got extensions on the durations of their contracts. The validity of the circular was also extended multiple times, the last being till June 2026.

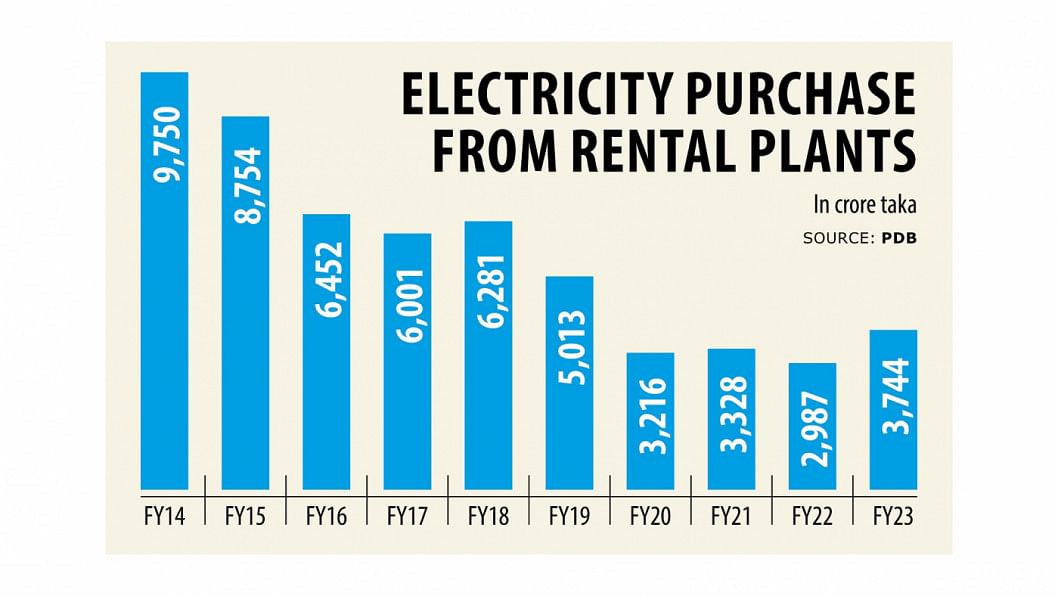

The new proposal for imposing the 5 percent customs duty comes at a time when the government is facing pressure from the civil society to stop availing power from the rental plants for it being more expensive than that from other sources.

The other sources are government-run power plants and independent power producers, which have a much larger power generation capacity than the rental ones.

On the other hand, the NBR is also seeking ways to enhance revenue collection in order to finance public expenditure and reduce government dependence on borrowing.

"We are working to place the proposals as duty measures for the next fiscal year with the objective of coming out of the culture of giving out tax breaks," said a senior official of the NBR, seeking anonymity.

"A 5 percent customs duty will be applicable on all types of equipment required for setting up any power plant," said the source in the NBR.

According to the NBR's data, investors in this sector have received duty exemptions amounting to Tk 1,853 crore in the last two years from July 2022 to March 2024.

There were at least 32 rental power plants operating in fiscal year 2015-16.

Now there are 18 with a combined capacity of 1,170MW. Of it, 797MW is being availed on a "No Electricity No Payment" basis following renewals of associated contracts, said the BPDB officials.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments