Provision shortfall at banks widens six times

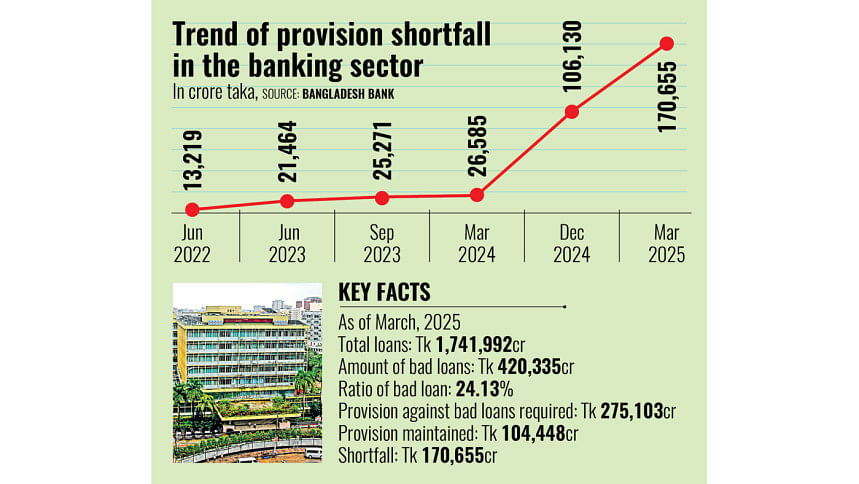

The provision shortfall in the banking sector has increased more than six times to Tk 170,655 crore over the past year, Bangladesh Bank data show, exposing the fragile financial health of commercial lenders due mainly to large-scale scams and irregularities during the previous regime.

Banks and financial institutions are required to set aside sufficient funds, or provisions, to cover potential losses from loans, especially those that turn sour, and safeguard the interest of depositors.

A shortfall occurs when they fail to keep enough aside to meet these obligations.

By March this year, banks were required to set aside Tk 275,103 crore in provisions. But they managed only Tk 104,448 crore, leaving a shortfall of Tk 170,655 crore, according to the Bangladesh Bank (BB) data.

A year earlier, the shortfall stood at Tk 26,585 crore, while it was Tk 106,130 crore at the end of December last year.

BB officials said the spike in non-performing loans (NPLs) has driven the shortfall. High levels of bad loans mean banks need larger provisions, which eat into profits.

They added that a provision shortfall also points to weak financial management.

Bad loans in the banking sector reached a record Tk 420,335 crore at the end of March.

Compared with a year earlier, the amount more than doubled, although total loans rose just 6.2 percent over the same period.

Alone in the first quarter of this year, bad loans jumped by Tk 74,570 crore. As of March, total loans in the banking sector amounted to Tk 1,741,992 crore, of which 24.13 percent were classified as non-performing, as per BB data.

Banks must set aside between 0.5 percent and 5 percent of standard loans as provisions, depending on the type of credit.

For problem loans, the requirements are steeper. Banks need to set aside 20 percent for substandard loans, 50 percent for doubtful loans, and the full amount for bad or loss-category loans.

BB officials said the rising tide of bad loans has fuelled the widening provision gap.

They said that most state-owned banks and many private lenders are struggling with large shortfalls.

By contrast, some private banks have kept surplus provisions thanks to healthier balance sheets.

Central bank data show state-run banks faced a shortfall of Tk 63,996 crore, while private commercial banks were short by Tk 107,340 crore. Foreign and specialised banks, on the other hand, maintained excess provisions.

Speaking on condition of anonymity, the chief executive of a private commercial bank blamed the crisis on widespread scams and irregularities under the previous government.

He pointed to the S Alam Group, alleging the conglomerate siphoned off thousands of crores of taka from banks under its influence.

The poor state of Islami Bank Bangladesh, First Security Islami Bank, Union Bank, Global Islami Bank, and Social Islami Bank shows how the business conglomerate used those banks, said the senior banker.

Due to the scale of the shortfall, many banks were unable to declare dividends for 2024.

In March this year, the central bank issued new rules for dividend payouts.

From 2024, banks that benefited from provisioning deferrals are no longer eligible to issue dividends.

From next year, the dividend payout restriction will apply to any bank with NPLs crossing 10 percent of its loan portfolio.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments