Raising private investment to be tricky: analysts

The government’s target to raise private investment to 24.2 percent of GDP will be challenging given the trend in last several years and the ongoing liquidity crisis in the banking sector.

Private investment has been hovering around the 22-23 percent mark for long. For instance, this fiscal year it reached 23.40 percent of GDP, up from 22.07 percent five years ago, according to the Bangladesh Bureau of Statistic (BBS).

Bangladesh needs additional Tk 23,000 crore to achieve the investment target, said Abul Kasem Khan, former president of Dhaka Chamber of Commerce and Industry.

“As the banking sector is facing liquidity shortage, we don’t know where the money will come from,” he added.

Private sector credit growth sank to a 56-month low of 12.07 percent in April and the government’s target to borrow more from the banks may tighten the situation further.

The government last year set a target to raise private investment to 25.15 percent of GDP for the outgoing fiscal year, but budget documents show it edged up to 23.4 percent from 23.26 percent a year ago.

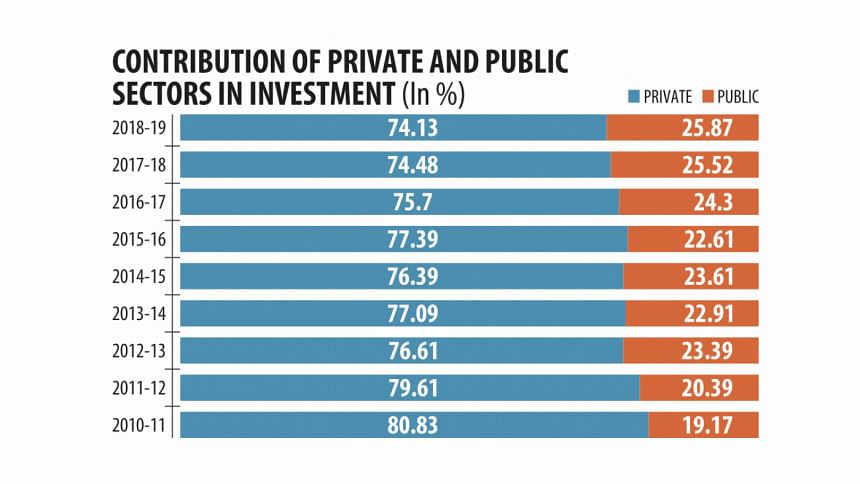

Despite stagnant private invest-ment, Bangladesh’s economic growth has been impressive for the past decade. Provisional estimates show the economy is likely to grow at more than 8 percent in the outgoing fiscal year thanks to a steady rise in public investment.

Public investment jumped to 8.17 percent of GDP in the outgoing fiscal year, up from 6.82 percent five years ago.

Private investments are constrained by a lack of land, reliability of energy supply, poor connectivity, cumbersome regulatory processes as well as regulatory unpredictability, high corporate taxes, limited access to long-term finance and shortage of skills, said Zahid Hussain, lead economist of the World Bank’s Dhaka Office.

Without removing the constraints, it will be difficult to achieve a sustained increase in the private investment rate.

Public investment has increased because of higher expenditure in investment projects, mostly under the annual development programme, he said.

“Many of these projects are yet to be completed. Their crowding-in effects on private investment cannot materialise until the projects are up and running.”

However, there are also quality deficits in public investment expenditures.

“What is spent does not entirely result in the building of useful public assets.”

The government needs to accelerate the pace of regulatory reforms, improve the implementation of high priority projects in infrastructure and energy and invest in education and health, Hussain said.

“It also needs to act decisively to restore discipline in the financial sector.”

Reduction of corporate tax rates and simplification of the tax structure are also needed to make Bangladesh a more attractive location for both domestic and foreign investors, Hussain added.

Kazi M Aminul Islam, executive chairman of the Bangladesh Investment Development Authority, emphasised massive policy reforms to create a business-friendly environment for boosting private investment.

He also stressed the need for improving ease of doing business in cooperation with concerned ministries to continue with the growth momentum and achieve the target of becoming a middle income and high-income country within the stipulated timeframe.

Kazi Akram Uddin Ahmed, former president of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI), blamed the liquidity crisis in the banking sector for the stagnant private investment scenario despite the government’s positive intents.

To scale up private investment Ahmed suggested providing incentives for fresh investment.

“There are some constraints due to which we are not getting the expected result with private investment,” said Abdul Matlub Ahmad, former president of the FBCCI.

The absence of ease of doing business, cost of financing and lack of quality power supply are the major reasons for the slow growth in private investment.

However, he is optimistic about the government removing many bottlenecks next fiscal year.

He too called for bringing discipline to the banking sector as well as cutting down on the mounting default loans for boosting investment.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments