Rebooting the economy

The Bangladesh economy came to a sudden stop in July 2024 as the student movement against quota in civil service took a disruptive turn. The killings, arson and destruction traumatised the nation.

The crackdown on the nonviolent uprise of the students and the subsequent one thing leading to another chain of events locked down the economy, only figuratively reminiscent of the pandemic in 2020.

Historian Yuval Noah Harari says, "We fully appreciate our knees only when they stop working." The knees of the Bangladesh economy incurred more like systemic malfunctions than just glitches.

Getting the knees back up

Curfew sheltered everyone at home as did the violence preceding it. Factories, shops, markets, and roads faced sudden escalation of disruption. Mobile data and broadband switch off corroded the economy's immune system founded on digital connectivity.

All stakeholders remained "virtually" isolated from the rest of the world and from each other with unspeakably adverse human and economic consequences.

The coming together of virtual and real lockdowns dragged the economy down to its barebones. When order collapses, the weak usually suffer most. Bangladesh is no exception to this law of history.

Navigating livelihood systems becomes harder when the ordinary business of life faces extraordinary risks from an unraveling social order. Taking student away from their families for "their own safety" without their consent, block raids and indiscriminate arrests suggest the bottom is still in the front view mirror.

The economy's operating system cannot reboot without hick-ups if the institutional hardware has malfunctions such as overt and covert political unrest, curfew, fear, digital disconnects, and closed educational institutions. These undermine the ecosystem in which economic policies and institutions operate.

The recent reopening of broadband and mobile data helps get the knees back up with deep sprains remaining. Social media and digital connectivity restrictions are limiting the public's right to communicate and stay informed.

Handling the consequences

The ecosystem is badly damaged, putting it mildly. Salient are the families distressed by loss of lives and injuries, damaged public properties and tremors in trade and financial relationships. Red flags tend to go up everywhere when tragedies such as Abu Sayeed, captured in incontrovertible footage, happen.

Those of us observing the loss of lives from afar should not pretend to have any clue about the trauma the families of the victims are enduring. It will forever be toxic in their hearts and minds.

Nothing short of holding the real perpetrators accountable can heal their emotional wounds and provide some solace to the bereaved families yearning for justice.

The losses incurred by the private sector are surely considerable. For instance, according to Internet Society Pulse, communication failures alone during the internet blackout could have inflicted over $3.5 million economic losses per day.

The loss of confidence that usually comes with such sudden stops does not automatically reverse as the net is switched back on.

Pre-existing sore points will be aggravated by the economic fallout from death, destruction, and disruption. Scars in the real and virtual supply chains may exacerbate already entrenched high inflation.

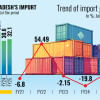

Remittances through formal channels could be hit, maybe temporary but a hit, nevertheless. The trade deficit may widen as exports lose competitiveness on lead time and confidence. Investors, both foreign and local, tend to shy away from concrete commitments in times of deepened uncertainty.

Rating agencies and development observers may downgrade their risk assessments. The Standard and Poor's downgrade of Bangladesh's sovereign credit rating on July 30 suggests the conditions preceding the sudden stop, which drove the downgrade, were not that healthy either.

Revenue based fiscal consolidation, as envisaged in the FY25 budget, will be challenged by resistance from business groups eager to pass on the hit on their profits to the taxpayers.

Yielding to the temptation to seek the path of least resistance by printing money will inflame inflation and fertilise foreign exchange shortage.

Rebalancing fiscal priorities could prove challenging. Crafting economic policy responses to a nationally traumatic political shock, where the weak suffer the most but the strong dominate the voice for policy support, is no piece of cake.

It may serve us well to heed Kenneth Rogoff's (Harvard University) caution "although things usually get better after a catastrophic shock, they can also get much worse".

Rising to the occasion

The connected class will naturally seek financial, fiscal, and regulatory remedies. There already are postures for regulatory favours, moratorium on debt services payments, wage subsidies, tax and fee waivers. Privileged access to public contracts for rehabilitation of damaged structures will come as corollaries.

Rehabilitation of public properties considered "iconic" will rise in priority as the authorities revisit their FY25 public expenditure programme.

Some of the demands from businesses such as waiving port demurrage charges and penalty interests, providing one stop service in customs, ensuring uninterrupted supply of gas and electricity make sense.

Moratorium on loan repayment, cash subsidies, waiving shipping charges, tax concessions are whole different matters.

The diversion of headline public attention from mega corruption is a big casualty of the ongoing situation. Stories on mega corruption had lived a life of its own prior to the current predicaments.

S&P's report couches their concern under the following diplomatic piece of economic writing: "Foreign direct investment has remained persistently low, possibly reflecting the country's evolving institutional settings, infrastructure deficiencies, and bureaucratic inefficiencies." We get the point.

It is easy to repeatedly blame others and divert attention to real or imaginary external threats. Such strategies are popular in authoritarian playbooks globally.

They generally come with greasing endemic corruption, stressing already malfunctioning services, and increasing absenteeism of the rule of law, all leading to staggering inequality and simmering instability awaiting a trigger.

Will good sense dawn?

The analogy between rebooting a digital device and rebooting the economy does not extend beyond the metaphorical biosphere. The economy does not have a unique restart button to click or a switch on the side to turn on. Rebooting requires denting the culture of impunity.

Words carry no credibility unless backed by actions. A highly concentrated as well as polarised political landscape constrains limits, checks and balances on governance and undermines the predictability of policy responses.

The oligarchic model endures despite appealing to none. You don't find too many expressions of pride over market manipulation practices. We pretend to monitor the market, respect the institutional pillars of integrity, allow the media free play and the voters to cast their own votes. We may do exactly the opposite and, at the same time, feel shame in admitting it.

A crisis of this magnitude defines a critical game changing juncture. A head in the sand cannot wish it away counting on draconian tools to enforce order. The instant results run the risk of being misread as presaging durable stability.

The economy is on slippery slopes with policies held hostage by the supposed imperatives of managing protracted stream of crisis. The challenges are unprecedented and the disagreements intense.

Can those in power keep their fears under control, be humbler about their views, and more responsive to public sentiments in their actions? Your guess is as good as mine!

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments