Robi beats pandemic blues as its profit takes a leap in second quarter

The second quarter of 2020 will possibly go down in Robi's annals as one of its pluckiest. The global coronavirus pandemic was at its ferocious worst then, so it was a given that businesses in all shapes and sizes would take a battering.

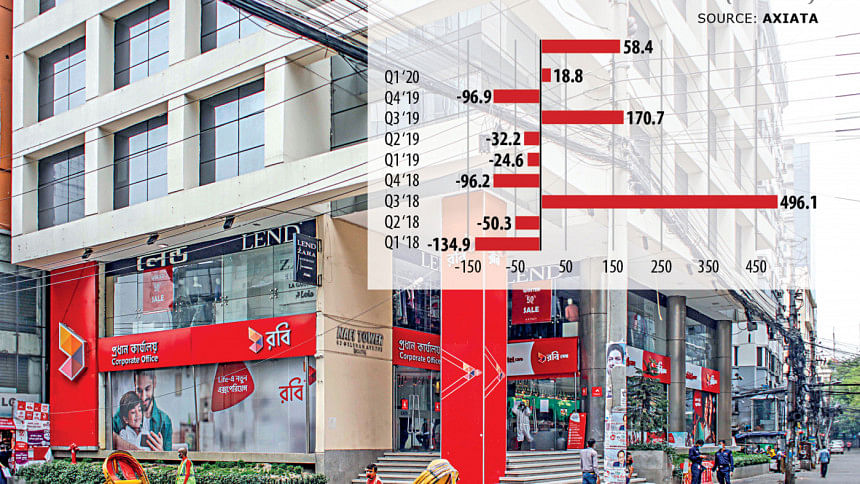

But Robi seems to have logged in solid numbers during the three months. A year earlier, the operator was in the losses. Now, it is not only in the black, but its profits trebled from the previous quarter.

"The quarter was unlike any other we have lived through," said Mahtab Uddin Ahmed, managing director and chief executive officer of Robi, in a press release yesterday.

The country's second-largest mobile phone operator cited the results as a mixture of cost optimisation drives and lower customer acquisition for the pandemic.

"We are reaping the fruits of a cost rationalisation drive that started in January," Shahed Alam, the chief corporate and regulatory officer of Robi, told The Daily Star.

To be a formidable challenger in Bangladesh's mobile landscape, the operator, which is due to get listed, realised it needed to be far more efficient.

"Our razor-sharp focus on cost optimisation and less direct cost due to pandemic helped us to end the quarter with a decent profit," Ahmed said.

Alam expects the third-quarter results will be better given the operator would be leaner and meaner.

Another reason is the higher data consumption, which grew 18.9 per cent from the previous quarter and 23.7 per cent from a year earlier. Of its 4.8 crore active subscribers, 3.2 crore are internet users.

The operator is not happy though, saying that the pandemic-induced drastic data price reductions resulting in data revenue de-growth of 1.5 per cent compared with the previous quarter.

Its voice call business, which is still its bread and butter, was, however, affected in April and May as the countrywide shutdown that began on 26 March meant a portion of its low-income subscribers were out of work, while its retailers could not open shops either.

Voice revenue declined 14.2 per cent compared with the previous quarter and 18.6 per cent year-on-year.

Robi termed it an indication of "the economic hardship endured especially by the lower income customers who tend to use 2G based voice call service".

The operator clocked in Tk 1,763 crore in revenue, down 9.5 per cent from the previous quarter and a 5.2 per cent from a year earlier.

Its total active subscribers stood at 4.8 crore at the end of June, up 0.1 per cent year-on-year and down 3.5 per cent quarter-on-quarter.

"As anticipated, the impact of pandemic was quite telling on our business," Ahmed said.

The Malaysian Axiata-owned operator though felt its financial performance would have looked better were it not for the tax regime.

In a statement, it said its net profit was "heavily impacted by the discriminatory 2 per cent minimum turnover tax".

The harsh impact of the pandemic on the business was further exacerbated due to the increase of supplementary duty by 5 per cent on all SIM services introduced in the budget for fiscal 2020-21 unveiled on 11 June, Ahmed said.

The higher SD of 15 per cent, which took effect on the midnight of 12 June, took the customers' total service tax to 33.25 per cent.

"In fact, the very premise of the budget, which assumes that the telecom sector is awash with cash has been further debunked by the financial data disclosed by other operators. Besides, the lack of support from the government to help the industry cushion the blow from the pandemic made the situation all the more painful."

Ahmed went on to laud the Bangladesh Telecommunication Regulatory Commission's move in June to implement the significant market player regulations on Grameenphone.

"We now eagerly await tangible outcomes in this regard," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments