Robi posts 5.9% rise in revenue in Q3

Robi has maintained its growth momentum in the third quarter of 2022 when its revenue grew by 5.9 per cent year-on-year to Tk 2,207.4 crore.

The telecom operator's revenue also rose by 4.8 per cent compared to the last quarter when it gained a profit after tax (PAT) of Tk 29.2 crore, Robi said in a statement today.

In the last quarter, the company's voice revenue increased by 6 per cent and data revenue by 2.8 per cent compared to the previous quarter.

In year-on-year comparison, the voice revenue growth stood at 8.7 per cent and data revenue growth 3.8 per cent, according to the statement.

However, the country's second biggest operator has seen a 0.3 per cent fall in its subscriber base in the third quarter compared to the second quarter.

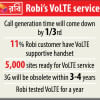

Its subscriber base reached 5 crore 44 lakh at the end of Q3, posting a 2.5 per cent rise year-on-year.

The company had 4 crore 11 lakh data subscribers in the last quarter, which is a 4.8 per cent rise year-on-year.

In the first nine months of 2022, Robi's revenue reached Tk 6,331.7 crore when it made a profit after tax of Tk 56.9 crore.

The telecom operator said in the last quarter around 50.9 per cent of its subscribers were 4G users, around 75.5 per cent were internet subscribers and, of the data subscribers, 67.3 per cent were 4G users.

Robi also claimed that it has brought 98.2 per cent of the population under its 4G network coverage with 15,219 4G sites.

At the end of Q3 of 2022, the company had 2 crore 76 lakh 4G subscribers, which is a 4.9 per cent rise compared to the previous quarter and 23.2 per cent year-on-year.

The company's earnings per share (EPS) in the third quarter of 2022 was Tk 0.06, down from Tk 0.11 in the same period last year.

In the third quarter, the mobile operator handed over Tk 1,012.2 crore to the government exchequer, which was 45.9 per cent of Robi's total revenue for the quarter.

The company made a capex investment of Tk 555.5 crore in the same quarter.

"We are very encouraged with the growth we are having in the market," Robi's Acting Chief Executive Officer and Chief Financial Officer M Riyaaz Rasheed said.

"However, profitability remains subdued due to large scale capex injection in our business. High depreciation and amortization cost induced by sustained capex investment is squeezing the profit margin."

"Unfortunately, there is no alternative to this strategy if we want to increase the scale of our business, which is critical to securing long-term sustainable growth in profit margin," he said.

"We are determined to get to the end of this long-haul journey. We urge our shareholders to company us in this exhilarating journey ahead."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments