SMEs bear the full brunt of financial hardship

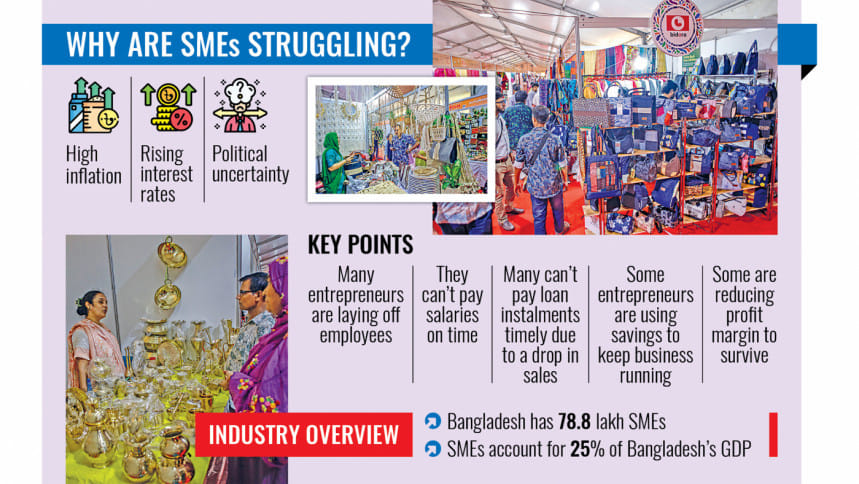

Small and medium enterprises (SMEs) in Bangladesh are struggling due to political uncertainty, high inflation and rising interest rates on bank loans, according to entrepreneurs.

Many entrepreneurs report that they had little choice but to lay off employees and delay salary payments while others said they cannot pay loan instalments timely due to declining business.

Some added that they have even dipped into their savings to keep operations running. Others said they were resorting to loans or reducing profit margins to survive.

Paritosh Kumar Malo, proprietor of RK Metal in Faridpur, said his company reduced its workforce to 15 from 25 over the past few months

On August 5, Sheikh Hasina fled the country after resigning from the post of prime minister amid a mass uprising. Three days later, an interim government headed by Prof Muhammad Yunus took charge amid a weak law-and-order situation and with the financial sector mired in crisis.

Paritosh Kumar Malo, proprietor of RK Metal in Faridpur, which sells agricultural machinery, said business has not been good for the past two-and-a-half years due to high inflation and increasing interest rates.

"The recent political uncertainty only added to many sufferings, causing sales to decline further," he said. He added that his company, which previously employed 25 workers, has reduced its workforce to 15 over the past few months.

"We are still unable to pay salaries on time. We were also forced to let employees go," he said.

Previously, Malo used to clear his employees' salaries within the same month, but now payments are delayed until the 10th or 15th of the following month.

He said his sales totalled around Tk 5 lakh in October 2024, dropping sharply from Tk 50 lakh in October 2023.

Against this backdrop, Malo has taken a loan worth Tk 35 lakh from Rupali Bank to sustain his business. He also invested a part of the loan into a separate venture.

Many of them are now struggling to boost sales, especially as persistent inflation has eroded the purchasing power of consumers.

Bangladesh has been bearing the brunt of high inflation for more than two years, with overall inflation remaining at more than 9 percent since March 2023.

In October this year, inflation hit a three-month high at 10.87 percent, driven by soaring food prices, particularly for rice and vegetables, according to the Bangladesh Bureau of Statistics.

To curb spiralling prices, the Bangladesh Bank (BB) has been hiking the policy rate, the rate at which it lends to banks, since May 2022. This has led to a gradual rise in the interest rate on loans, particularly after the central bank lifted the lending rate cap in July last year.

On October 22, the central bank hiked the policy rate by 50 basis points to 10 percent in an effort to rein in inflation. It was the 11th upward adjustment since May 2022, when the policy rate stood at only 5 percent.

Zakirul Islam Akul, managing partner of Suansh, a Dhaka-based SME that produces jute goods, said they had been losing around Tk 2 lakh in recent months as sales had dipped but rent for showroom, factory costs, and staff salaries still have to be paid.

He reported a drastic fall in sales, which declined from Tk 10 lakh in October 2023 to barely reaching Tk 1 lakh in October this year.

As a result, he said he had dipped into his savings and borrowed whatever else he required from friends to meet operating expenses.

Akul said that the peak season for selling jute products runs from October to April, when different fairs for SMEs are typically held across the country.

Similarly, Sheuli Akter, an entrepreneur from Dinajpur specialising in jute goods, said she is struggling to pay staff salaries and loan instalments on time.

"I have been using my savings to keep the business afloat."

From June to August 2023, Akter sold products worth about Tk 1.17 lakh. But in the same period this year, sales dropped to only Tk 47,000.

In the past, Akter paid staff salaries and loan instalments by the 10th of each month.

However, over the past four to five months, she has had to delay salary payments until the 15th and loan instalments until the end of the month.

"There is constant stress about being unable to meet financial obligations," she said.

Akter employs eight permanent workers and usually hires 35 temporary workers during the peak season. However, she has not been able to offer any work to her temporary staff in recent months.

Shahabia Jahan Siddiqua, an entrepreneur from Jamalpur district who sells women's clothing and Nakshi Katha, said her business is in a precarious situation.

"Previously, monthly sales ranged from Tk 6 lakh to Tk 7 lakh. But they have now plummeted to Tk 1 lakh," she said, adding that salaries, which used to be paid by the 1st or 2nd of each month, were now being delayed until the 14th or 15th.

She added that she had to withdraw funds from a fixed deposit scheme last month to sustain the business.

Siddiqua employs seven permanent workers but recently laid off one employee due to declining business.

Selim Raihan, a professor of economics at the University of Dhaka, told The Daily Star that SMEs are suffering the most due to the current state of the economy.

"Due to inflationary pressures, the raw material costs have increased a lot. One of its impacts is on the production process. As a result, entrepreneurs are unable to pay workers on time. They can't even pay loan instalments on time," he said.

He added that although the interim government is working to address many issues, it has not made any specific efforts to resolve problems plaguing SMEs.

"This needs to be rethought," added Raihan, also an executive director at the South Asian Network on Economic Modeling.

"Related ministries can take initiatives to solve such problems. Then maybe the situation will improve a bit."

SMEs accounted for almost 25 percent of Bangladesh's gross domestic product in 2018, according to a Planning Division report.

According to the Economic Census 2013 conducted by the Bangladesh Bureau of Statistics, there were 78.8 lakh SMEs in the country.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments