SMEs lose credit appetite in economic turbulence

How have local private sector businesses fared in recent years?

To gain a micro-level understanding, ask the question to house yard workshops, rural handicraft units, tiny grocery stores and small leather and footwear ventures.

These businesses have been struggling for over three years, gasping for air amid a challenging economic climate.

This is because high prices have eroded consumer demand, while increased power and utility bills have increased operating costs.

Access to bank loans has also become increasingly difficult for these small ventures, officially categorised as cottage, small, and medium enterprises (CMSMEs).

Instead of easing, the situation for around 78 lakh CMSMEs across the country, which contribute one-fourth of the gross domestic product (GDP) and employ 40 percent of the total workforce, has worsened in late-2024.

On top of the stubbornly high inflation, nationwide protests, violence, curfews, recurrent flooding and punishingly high interest rates on bank loans have brought the CMSMEs to their knees.

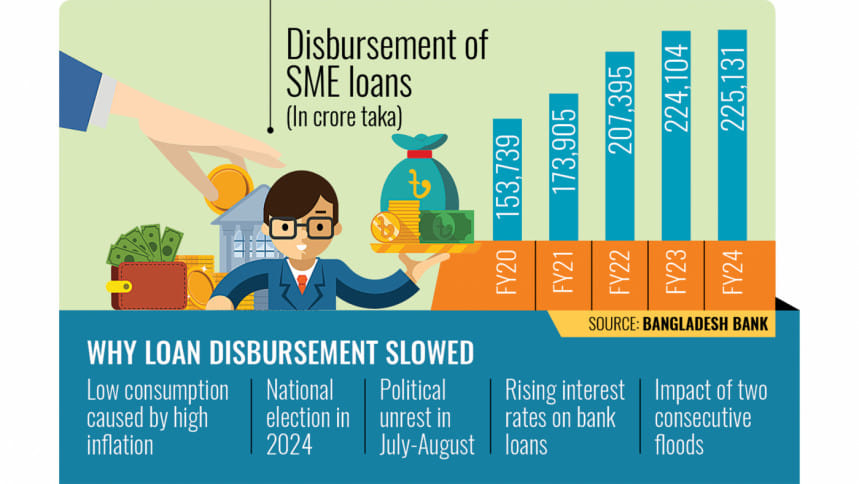

Credit data from the central bank also shows the economic disaster facing the CMSMEs.

During the April-June period of fiscal year 2023-24, small businesses received Tk 54,526 crore in bank loans. This figure plummeted to Tk 42,950 crore in the subsequent quarter, according to Bangladesh Bank (BB) data.

Compared to the same period in FY23, loan disbursement in April-June of FY24 witnessed a 13.10 percent decline.

BB data also shows that CMSMEs borrowed Tk 2.25 lakh crore in FY24, a mere 0.46 percent increase compared to the previous year's Tk 2.24 lakh crore.

Meanwhile, private sector credit growth in November of last year reached a three-year low due to weakened credit demand, a dearth of new investment, and a surge in government T-bills and bonds.

According to Syed Abdul Momen, deputy managing director and head of SME Banking at BRAC Bank, businesses mainly seek loans for two purposes: managing operations and expanding their businesses.

"Given the current economic situation, there is little to no demand for loans aimed at business expansion," said the banker.

"Entrepreneurs are now focused on securing the minimal financial support required to meet their working capital needs," he added.

Similar to Momen, Sanjib Kumar Dey, the head of the SME and Agri-banking division at Mutual Trust Bank, said that high inflation and costly loans have compelled small businesses to shelve their expansion plans over the past three years.

"Business owners have been primarily focused on survival rather than growth," Dey said. "Banks, too, are exercising caution in lending amid the prevailing economic uncertainties."

'SITUATION IMPROVING SLOWLY'

Compared to July or August of last year, when a nationwide protest culminated in a government ouster, the current business climate and credit outlook have improved, according to Mohammad Salekeen Ibrahim, head of asset at Eastern Bank.

"Banking activities were almost shut in July and August of last year. During that period, curfews and general holidays were frequent," recalled the banker.

"Banks were unable to reach customers, and customers were likewise unable to access bank services," he added. "While the overall situation in the country has shown signs of recovery since August, it has not fully stabilised."

Ibrahim said they are looking for potential clients. However, the current business climate and high interest rates remain major obstacles.

"The loan disbursement rate may remain sluggish until the client confidence stabilises," he commented.

The high-interest rate environment is a direct consequence of the central bank's prolonged battle against stubbornly high inflation, which has been dragging on for more than two years.

In the first half of FY25, inflation averaged 10.87 percent, according to the Bangladesh Bureau of Statistics.

To curb spiralling prices, the BB has been steadily increasing the policy rate, the rate at which it lends to banks, since May 2022.

This has resulted in a gradual rise in loan interest rates, particularly after the central bank lifted the lending rate cap in July of last year.

In October of last year, the central bank raised the policy rate by 50 basis points to 10 percent. This marked the eleventh upward adjustment since May 2022, when the policy rate stood at only 5 percent.

'BUSINESSES NEED GOVERNMENT SUPPORT'

Current consumer confidence is at an all-time low, a level unprecedented in the past 30-35 years, according to Rizwan Rahman, former President of the Dhaka Chamber of Commerce and Industry.

He told The Daily Star that businesses are also grappling with rising costs, and inflation remains unmanageable.

In such an uncertain and confidence-deficient environment, businesses are hesitant to assume loan obligations, he added.

The business environment since June 2024 has been far from conducive to investment, and loan disbursement in this sector is expected to decline significantly in fiscal year 2024-25 compared to the previous year, he added.

"Without timely monetary or fiscal support from the government, reviving loan disbursement and encouraging investments in this challenging economic scenario will be almost impossible," he commented.

Melita Mehjabeen, a professor at the Institute of Business Administration at the University of Dhaka, told The Daily Star that the significant SME loan disbursements observed in 2021 and 2022 were due mainly to refinance schemes and Covid stimulus packages.

However, loan disbursements witnessed a decline in 2023 and 2024, attributed to increased prudence exercised by banks and financial institutions, she noted.

A restrictive loan ceiling of 30 percent of working capital further limited borrowers' ability to apply for fresh loans if they exceeded this limit, she added.

Moreover, the central bank's actions against loan misuse (for example, using working capital loans to repay existing debts) and the reduced lending appetite of commercial banks towards smaller borrowers have also contributed to the decline in disbursements, she added.

Khondaker Golam Moazzem, research director at the Centre for Policy Dialogue (CPD), said that while private sector credit growth remains sluggish, SMEs are the most vulnerable in the current economic climate.

He said rising production costs, fueled by increased gas and electricity prices, coupled with high inflation, have largely eroded sales and profit margins for SMEs.

"They are struggling to meet loan instalment obligations on time," he noted, adding that these challenges are not being adequately addressed.

"With the exception of a few specific banks, SMEs are unable to access loans due to varying terms and conditions," said the economist.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments