Southeast, Bank Asia most efficient, profitable lenders

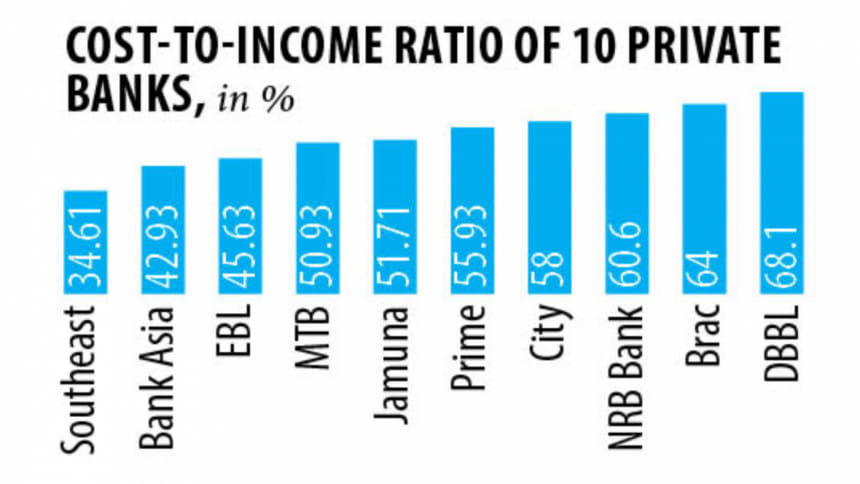

Southeast Bank is the most profitable and efficient lender in Bangladesh followed by Bank Asia while Dutch-Bangla Bank is the least, according to an analysis of different banks’ cost-to-income ratio.

Last year, Southeast’s cost-to-income ratio was less than 35 percent, meaning that it had to spend Tk 35 for Tk 100 operating revenues. Bank Asia had the next best ratio of 43 percent, followed by Eastern Bank at 45.63 percent.

The cost-to-income ratio shows a bank’s operating costs (administrative and fixed costs) in relation to its operating income. The higher ratio generally indicates lower efficiency, but a number of factors can affect the ratio, including a bank’s business model, its size and the overall investment climate of a country, according to bankers.

A general rule of thumb is that any figure above 50 percent refers to inefficiency. But almost all the banks in Bangladesh fall in this category.

Dutch-Bangla Bank’s ratio was the highest at 68 percent, followed by Brac Bank at 64 percent (consolidated).

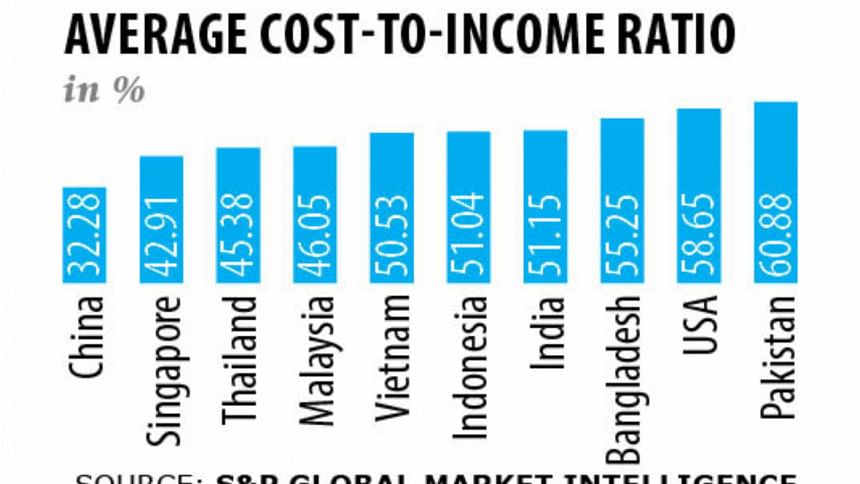

According to the S&P Global Market Intelligence report, Bangladeshi banks’ average cost-to-income ratio was 55.25 percent in 2018, higher than those in China, Thailand, India and Vietnam.

“We have been managing our resources efficiently to get better output,” said Md Arfan Ali, president and managing director of Bank Asia.

Bank Asia has set a target to bring down the ratio to 40 percent.

Anis A Khan, managing director of Mutual Trust Bank, which has lowered its cost-to-income ratio by four percentage points to 50 percent last year, said they have brought every expense under control except salary payments.

“We do what we need to do. We have reduced our rental and administrative costs and limited opening of new branches as well,” Khan said.

Brac Bank and Dutch-Bangla Bank have the higher ratio as they have invested heavily in people and technology.

“We have improved significantly in many indicators including return on assets and return on equity. But our higher cost-to-income ratio indicates that we are continuing to invest in people, technology and processes,” said Selim RF Hussain, managing director of Brac Bank.

“Since the economy is growing fast, we have to continue to invest for the future,” he added.

Some other banks with high ratio said they are trying to limit their expenses by cutting costs for human resources and increasing the use of technologies.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments