S&P downgrades Bangladesh rating amid deadly protests

S&P Global has downgraded Bangladesh's long-term sovereign rating from BB- to B+ amid deadly protests over the quota-based hiring system for government jobs.

The violence stemming from the protests led to the deaths of at least 163 people alongside massive destruction and arson of government property.

The government imposed a nationwide curfew on July 20 to contain the situation.

Citing local news sources, S&P said Bangladesh is "currently grappling with widespread student-led protests that have reportedly led to more than 200 deaths."

"In response to the protests, the government imposed a telecommunications blackout and nationwide curfew," it added.

However, despite tensions easing to some extent, economic activities are yet to return to normal.

The global rating agency mentioned that Bangladesh is still at risk of failing to rebound from lingering economic pressures due to a lack of competitiveness in political culture and inefficacy in bureaucracy.

"The government faces little opposition in parliament, which limits checks and balances.

"The ruling Awami League won a fourth five-year term following the general elections in January 2024, with the main opposition Bangladesh Nationalist Party (BNP) boycotting the poll. There is deep division between the two historically prominent parties."

It added that Bangladesh's "highly concentrated political environment may undermine the predictability of future policy responses.

"Future policy responses are difficult to predict because of increasingly centralised decision-making. Respect for the rule of law is not assured, owing to high perceived corruption and interference by political institutions."

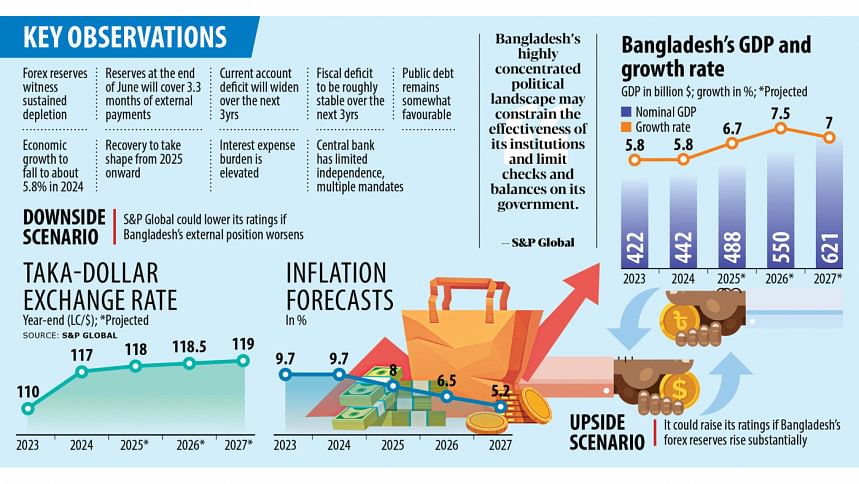

A major reason for the downgrade is the persistent pressure on Bangladesh's external metrics, marked in particular by a continued decline in foreign exchange reserves, the S&P said.

"This has occurred despite import compression measures enacted by Bangladesh Bank and a smaller current account deficit. Gross external financing needs, by our measures, now exceed the sum of current account receipts and usable reserves."

In its outlook, the S&P said Bangladesh's per capita real growth rate would remain very strong compared to peers despite near-term headwinds from tighter financial conditions.

It added that downside and upside risks to its external balance sheet are now broadly balanced.

Mentioning the downside scenario, it said: "Lower generation of current account receipts than we expect, a higher overall current account deficit than we forecast, or a failure to materially boost foreign exchange reserves could all contribute to downward pressure on these metrics."

Explaining the upside, it said foreign exchange reserves have declined sharply due to interventions to prop up the taka through May 2024. However, a transition to the crawling-peg exchange rate regime, combined with tighter monetary policy, may help to attenuate the decline.

However, Bangladesh's external profile remains under pressure. Falling foreign exchange reserves through May 2024 reflect continued net balance of payments outflows, and suggest elevated demand for dollars relative to the taka.

The latest data shows that gross reserves, measured on an IMF formula, stood at $21.8 billion at the end of June 2024. This is 35 percent lower than the figure in June 2022, and enough to cover only about 3.3 months of current account payments.

It said the Bangladesh Bank's policy reforms might help to alleviate this pressure, depending on how well they are executed.

On May 8, the Bangladesh Bank introduced the crawling peg with a mid-rate of taka 117 per US dollar. This represented a 6 percent depreciation from the previous official rate of taka 110 per dollar.

The central bank also raised its policy rate by 50 basis points to 8.5 percent, with the cumulative increase since May 2022 reaching 350 basis points.

"The central bank describes the crawling peg as a transitional measure toward a fully flexible, market-based exchange rate, although it has not yet set a timeframe for this transition.

"We estimate the current account is tracking toward a small deficit of about 1 percent of GDP in the June 2024 fiscal year, a significant improvement from the 4.2 percent deficit two years ago.

"We base this on revised export data published by Bangladesh Bank in July 2024, with the revisions resulting in notable shifts in the compositions of the current and financial accounts."

Remittance inflows grew a healthy 10.7 percent in fiscal 2024. However, exports declined 5.9 percent due to weaker demand from trading partners, it said.

About inflation, the S&P said domestic inflation is elevated and well above the central bank's target as headline inflation stood at 9.7 percent in June 2024.

"We expect inflation to subside only gradually over the next few years, particularly as the effects of taka depreciation still propagate through the economy."

Stating that the country's net general government debt remains moderate, the S&P estimated it would average about 34 percent of GDP through fiscal 2027.

However, the country's public interest burden is elevated, at about 26 percent of revenues.

It added that Bangladesh's narrow revenue base constricts the government's flexibility to provide fiscal support in times of stress. Revenue generation remains critically low as a share of the economy and when benchmarked against other sovereigns, it added.

"Even with recent measures to raise certain value-added tax and personal income tax rates announced in the June 2024 budget, we do not expect general government revenue to exceed 10 percent of GDP."

It added that the composition of public debt remains somewhat favourable.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments