Squeezed by inflation, people seek refuge in mini-packs

People are switching to shampoo mini-packs from regular bottles, women are sacrificing their tiny luxuries of cosmetic puffs while households are embracing cheap but substandard detergents for laundry: this is exactly what happens when brutal price pressures push around 78 lakh people below the poverty line in just two years and stalk another 1 crore to do so.

This shift by consumers to smaller quantities of non-essential items began in 2022, continued throughout 2023, and intensified by the end of 2024, according to manufacturers.

But all available options -- smaller bottles, mini-packs and cheaper alternatives -- seem no longer effective against stubbornly high inflation.

Now with no respite from crushing price pressures in sight and the government rushing to raise value-added tax (VAT) on 43 items and services, including some branded products, middle-income consumers continue to dive deeper into junk and substandard products.

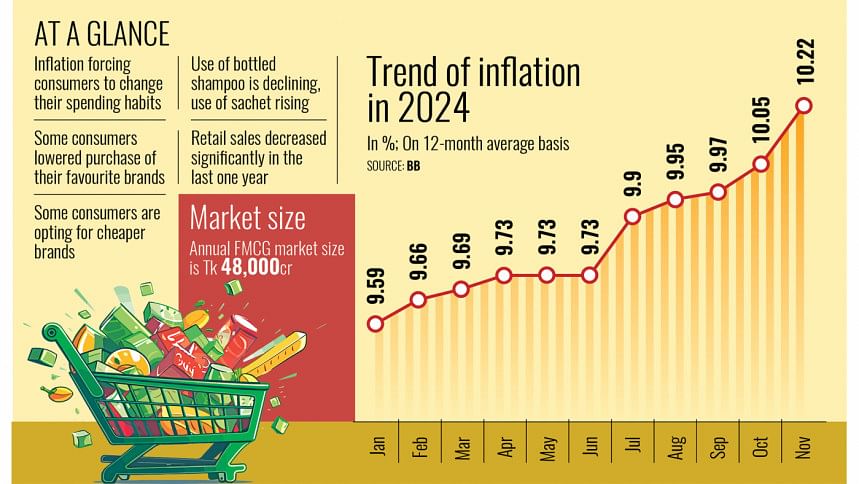

Since March 2023, the country has been facing stubbornly high inflation, with price pressures hovering above 9 percent. In November, inflation soared to 11.38 percent, according to the Bangladesh Bureau of Statistics.

A recent analysis by industrial conglomerate Unilever Bangladesh Limited shows that inflation is prompting consumers to reconsider their spending habits, particularly on non-essential items such as conditioners, meal replacement shakes and face moisturisers.

Major fast-moving consumer goods (FMCG) companies said that their sales declined around 5 percent in the third quarter of 2024 compared to the same period last year.

Hossain Mohammad Sarram, category head for fabric cleaning at Unilever Bangladesh, told The Daily Star that the increase in the cost of essentials and other goods for consumers has had a massive impact on their lifestyle, which has, in turn, hit the FMCG market.

"In this situation, customers will first meet their essential requirements, then they will think about FMCG," he said.

"The buyer who is trying to stay with the higher-quality brand and not shifting to the lower-quality brand is buying a small pack," he added.

Due to high inflation, many people are switching from standard washing powder brands to cheaper brands. This is happening across all FMCG categories.

Sarram said this trend began around 2022.

It continued in 2023 and intensified in 2024. "Those who cannot even afford the small pack have moved to the lower brand," he said.

"We expected people to switch from 500-gramme packs to 1 kg or 2 kg washing powder packs because it would save on cost. But the opposite is happening," he added.

He said they launched 150-gram toothpaste tubes as bachelor and travel packs. "Now we see that many families are using them."

SACHETS BECOMING MORE POPULAR

In 2012-13, 60 percent of daily shampoo sales were in sachets. But now, 75 percent of daily shampoo sales are in sachets, Sarram said.

He said the amount of profit they made in 2023 decreased by 10 percent compared to the previous year. It also decreased slightly in 2024.

Meanwhile, due to price hikes, 15 percent to 16 percent of their customers are switching to other brands, he said.

Jesmin Zaman, head of marketing at Square Toiletries Limited, echoed similar sales concerns.

She said that due to high inflation, many buyers have been forced to move towards smaller packs, while many have changed brands and gone to lower-quality ones.

Eleash Mridha, managing director of PRAN Group, told The Daily Star that due to high inflation in FMCG products, people are now opting for smaller sizes instead of larger ones.

"They were forced to make this decision against their will. It has increased further in recent months," he said.

"They now must balance when it comes to issues of non-essential products for the sake of their lifestyle, so they are leaning towards smaller packs," he said.

"Now people's budgets are limited, and their actual income hasn't increased in recent years. That's why they are trying to keep their expenses within that budget. This situation has arisen," Mridha added.

He also said that prices of their FMCG items have not increased, but consumption has declined remarkably.

RETAIL SALES TAKE A HIT

Zakir Hossain Arif, a retailer in Dhaka's Mirpur, said that due to rising prices, customers who earlier would buy a 400-gramme bottle of Sunsilk shampoo are now opting for the 200-gramme bottle.

Similarly, those who used to buy a 400-gram container of Nivea cream are now purchasing the 200-gram size.

"There were fewer such small buyers even a year ago. But their numbers are increasing daily," he said.

"Due to high inflation, sales decreased by about 50 percent at the start of the winter season compared to the same period last year," Arif added. "Last year, we struggled to meet customer demand, but this year, despite having plenty of stock, there are far fewer buyers."

He informed that sales of imported conditioners, moisturisers, creams and similar products have also dropped.

GOODBYE LITTLE LUXURIES

Sahana Parvin, a housewife who lives in the Dhanmondi area of Dhaka, said the rising prices of branded cosmetics make it difficult to always go for well-known names, so she opts for more affordable alternatives nowadays.

"The options are few as prices of branded cosmetics have risen sharply recently while the cost of living has been climbing for years," she said.

Another customer, Momtaz Begum, who lives in the capital's Tejgaon area, also said that spiked monthly spending for essentials has slashed her budget for cosmetic products.

"There's no way I can afford to spend much on expensive cosmetics anymore. I need to satisfy my passion for cosmetics while sticking to a budget. So, I opt for more affordable options, with smaller packs being my go-to choice," she added.

EVEN CHEAPER ALTERNATIVES LOSING THE GAME

SM Najer Hossain, vice-president of the Consumers Association of Bangladesh (CAB), said high inflation has increased the cost of living, leaving people with limited choices.

"The government's recent move to raise VAT on 43 products and services will make the situation more difficult for them," he added, saying this might compel people to opt for diving further into cheap and substandard alternatives.

Mohammad Abdur Razzaque, chairman of Research and Policy Integration for Development, said people engage in searching for cheap alternatives when inflation continues for a long period.

"At that time, they mainly focus on basic foods," he added.

According to the economist, to minimise costs, the first thing people do is to cut spending on FMCGs, clothes and shoes. This is because people do not want to face any food insecurity.

"They know if they face a situation like food shortage, they will have to face different types of acute problems. That's why they cut costs on FMCGs in the first place," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments