Steelmakers face capital shortage as sales nosedive

Steelmakers in Bangladesh are facing a severe working capital shortage due to the sharp rise in the US dollar exchange rate and a slowdown in sales, according to industry insiders.

"The ongoing economic downturn, inflationary pressure, high interest on bank loans, and increased gas and electricity costs have put steelmakers at financial risk," said Sumon Chowdhury, secretary general of the Bangladesh Steel Manufacturing Association (BSMA).

Now, most steelmakers are facing difficulty in paying their staff salaries and bank loan instalments, said the secretary general of the association that represents more than 40 major steel producers in Bangladesh.

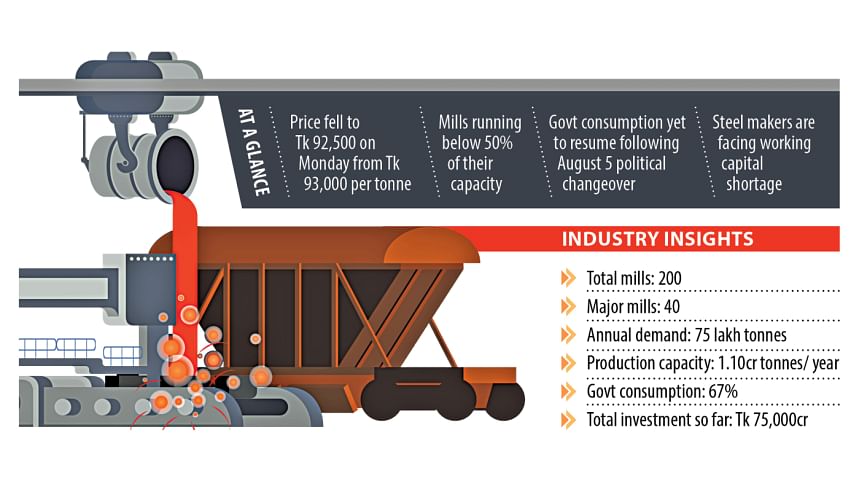

BSMA data shows that about Tk 75,000 crore has been invested in the local steel industry, which employs roughly 10 lakh people both directly and indirectly.

Chowdhury said that of the total investment, around 65 percent came from bank finance. But now, the investors are struggling to pay their loan instalments due to poor revenue generation.

As such, the steel industry may not survive if the situation prolongs, he added.

Chowdhury explained that steelmakers are now facing a significant working capital shortage as the US dollar price has increased to between Tk 122 and Tk 125 from Tk 85 over the past two years.

He said this unexpected surge raised concerns about the stability and future of the steel industry.

Earlier, on October 16, the BSMA wrote a letter to the Bangladesh Bank, requesting necessary measures to support the steel industry.

In the letter, BSMA President Mohammad Jahangir Alam urged for forming a special fund for providing cheap loans with a 2-year grace period to steelmakers that incurred losses for the appreciation of the US dollar.

He urged the central bank to increase the customer credit limit for commercial lenders to 30 percent from the existing 15 percent and provide additional working capital loans at low interest.

Alam, also chairman of GPH Group, said while import prices are rising in the global market, local prices are not being adjusted accordingly. As a result, many businesses are unintentionally becoming loan defaulters.

Furthermore, the BSMA asked the central bank to grant a repayment period of 16 years for rescheduled and overdue loans.

"In these cases, down payments should be set at 1 percent regardless of the loan amount considering the industry's present condition," the BSMA said.

According to the Trading Corporation of Bangladesh (TCB), the price of 60-grade mild steel came down to Tk 92,500 per tonne from Tk 93,000 on Monday.

Amid nationwide protests, curfews, a political changeover and ensuing uncertainty, the past three months have been brutal for the steel sector, with top suppliers like Bangladesh Steel Re-Rolling Mills (BSRM) and Anwar Ispat warning of increasingly bleak conditions.

As mills faced losses on every tonne of steel they made, many are lately opting to shut down their furnaces, according to the industry people.

And in view of the current economic crisis and challenging conditions, industry people are calling for the suspension of Group CIB report requirements for at least two years to protect business interests.

The BSMA believes that such a suspension would bring positive changes to the country's economic growth and investment environment.

"If one unit within an industry faces difficulties, it should not result in negative classification for all units in that group," the BSMA said.

On condition of anonymity, an official of a steelmaker said two letters of credit were blocked back-to-back as a director of his company defaulted on a personal loan, putting nearly 2,000 employees' jobs at risk.

As per BSMA data, there are 190 steel plants in the country, with around 40 being advanced facilities.

Tapan Sengupta, deputy managing director of Bangladesh Steel Re-Rolling Mills, said steel mills are currently incurring losses for producing each tonne of rod. In this situation, some small manufacturers are completely shutting down their furnaces.

This is because mill owners are selling their products for less than their production cost just to cover workers' salaries and utility bills, he added.

Sengupta also said new construction projects in semi-urban and rural areas have stalled as representatives of local government offices left during the political changeover, leaving official approvals in limbo.

"We do not know if the situation will improve," he added.

Public construction and government mega projects, which account for about 67 percent of the local steel demand, have been declining since July and came to a complete halt following the political changeover on August 5.

Additionally, high inflation has weakened the real estate sector, further impacting the demand for steel, the BSMA said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments