Stocks bleed as investors aim for profit

Stocks in Bangladesh have entered a downtrend as major market indicators yesterday fell for a second day consecutively, with skittish investors liquidating their holdings to profit amid ongoing price fluctuations.

The DSEX, which reflects the collective value of shares listed at the Dhaka Stock Exchange (DSE), edged down by 0.53 percent from the day prior to close at 5,300 points.

The situation was similar for other indices as the DSES, a representation of how Shariah-compliant companies are performing, receded by 0.97 percent to 1,171 points.

Likewise, the DS30 index, which is comprised of blue-chip stocks, slipped by 0.70 percent to 1,963 points.

Of the 380 stocks traded at the DSE yesterday, 133 saw their share values grow while that of 205 others shrank and the remaining 42 did not see any fluctuation.

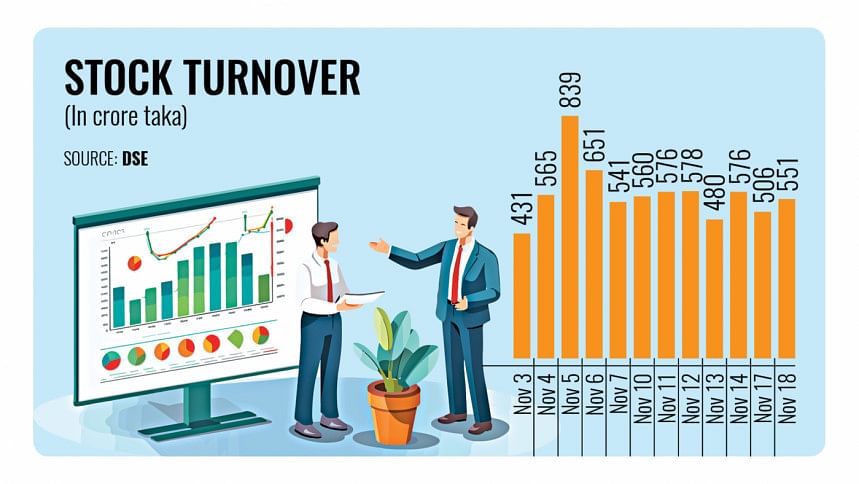

The DSE's daily turnover, which measures the cumulative value of traded shares, increased by 8.96 percent from the previous session to reach Tk 551 crore.

The pharmaceutical sector dominated the turnover chart, accounting for 13.98 percent of the total.

Block trades, which are high-volume securities transactions privately negotiated and executed outside of the open market, also made a significant contribution by adding 3.6 percent.

Agni Systems Ltd emerged as the most traded stock, registering turnover of Tk 35.7 crore.

Life insurance, general insurance and jute were the top three sectors to close in positive territory, UCB Stock Brokerage said in its daily market update. Meanwhile, paper and printing, services and real estate and ceramics were the top three sectors to close in the negative.

In a separate daily market update, BRAC EPL Stock Brokerage said all sectors that account for large amounts of market capitalisation, which refers to the value of a company's outstanding shares, posted negative performances yesterday.

The banking sector notched the highest loss of 1.16 percent, followed by fuel and power (1.05 percent), pharmaceuticals (0.77 percent), telecommunication (0.71 percent), non-bank financial institutions (0.55 percent), food and allied (0.37 percent), and engineering (0.01 percent).

Shares of Beximco Pharmaceuticals, Islami Bank Bangladesh, Square Pharmaceuticals, BRAC Bank, Olympic Industries, MJL Bangladesh, Prime Bank, Khan Brothers PP Woven Bag Industries, Shahjalal Islami Bank and Grameenphone failed to draw investors' interest.

Beximco Pharmaceuticals, Islami Bank and Square Pharmaceuticals suffered combined losses of more than 16 points. Beximco bore the brunt though as it shed 6.20 points.

On the other hand, Delta Life Insurance, Pragati Insurance, Confidence Cement, Green Delta, ADN Telecom, Rupali Life Insurance, ACI Formulations, Beach Hatchery, Meghna Life Insurance Company and GPH Ispat performed well.

The Chittagong Stock Exchange saw a similar trend as the CSE All-Share Price Index declined by 0.28 percent to settle the day at 14,816 points.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments