Stocks jump as NBR cuts capital gains tax

Stocks soared yesterday as investors cheered the substantial cut in capital gains tax by the National Board of Revenue (NBR) to encourage big local and foreign investors.

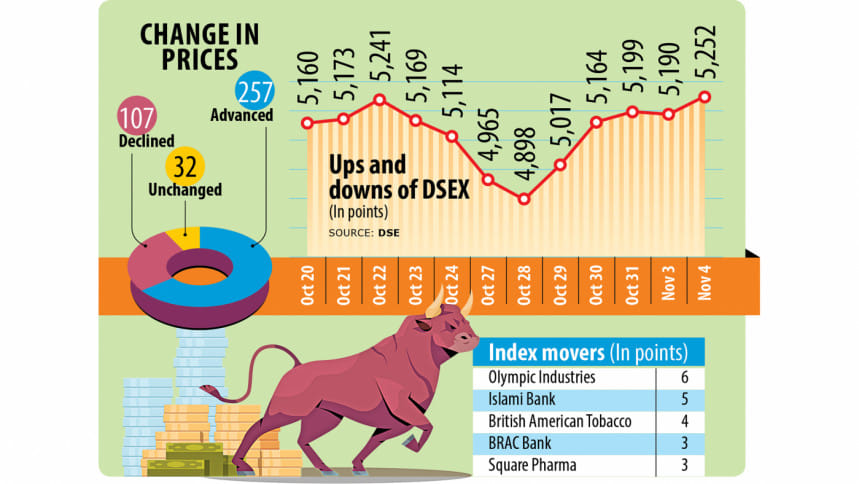

The benchmark index DSEX of the Dhaka Stock Exchange (DSE), which fell in the first three hours of trading to 5,175 points, began to rise after the tax authority announced its decision to cut the capital gains tax rate by half to 15 percent on gains above Tk 50 lakh from selling shares.

The DSEX closed at 5,252.49, a two-week high, adding 61.63 points, or 1.18 percent, from the previous day.

The move by the revenue board comes at a time when the country's stock market has been volatile, with liquidity drying up partly due to a lack of interest among large investors and the central bank's tight monetary policy.

At the DSE, the country's premier bourse, turnover jumped 31 percent yesterday to Tk 566 crore, the highest since September 25 this year.

While investors welcomed the tax cut, an economist criticised the move, saying it would act as a barrier to fighting income inequality.

"This is not a fair and prudent decision," said MA Razzaque, research director of the Policy Research Institute (PRI) of Bangladesh.

He said capital market investors always demand low taxation, blaming market volatility.

"But when they will make a profit of over Tk 50 lakh, why won't they pay more tax despite the taxpayers paying up to 25 percent on their income?" he questioned.

"Now is the time to examine the tax exemption and scrutinise it to raise the tax-GDP ratio. But the tax authority has taken the opposite stand. The government could keep the rate unchanged," he added.

However, Muhammad Abdul Mazid, former chairman of the NBR, said the step might help bring order and attract investors to the stock market.

Saiful Islam, president of the DSE Brokers Association of Bangladesh (DBA), said the market reacted positively due to the reduction in the tax rate on capital gains.

"Everything in the market was negative. And when a positive thing comes in the market, people accept it gladly," he said.

"There was always an apprehension among the large investors of the share market about the corporate tax. After the announcement by the NBR to lower the tax rate, the apprehension has removed mostly."

"Both the market and the investors took the initiative positively. Let's see how long it lasts," he added.

Yesterday, the DSES index, which tracks the Shariah-based companies, made the highest gains. The DS30, which is an index composing blue-chip firms, also advanced.

All the sectors that account for large amounts in market capitalisation, the value of a company's outstanding shares, posted a positive performance, according to BRAC EPL Stock Brokerage Ltd.

At the Chittagong Stock Exchange (CSE), the CSE All-Share Price Index (CASPI), edged up by 122.03 points, or 0.84 percent, to 14,584 yesterday.

Of the issues that changed hands at the DSE, 257 scrips saw a price hike. Some 107 shares fell and 32 remained unchanged.

The Bangladesh Shipping Corporation emerged as the most traded share, with a turnover of Tk 19.7 crore.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments