Stocks rise over 2% after 2 years

Shares at Dhaka Stock Exchange (DSE) rose 2.30 percent yesterday with the broad index crossing the 5,400-point mark as skittish investors placed fresh bets on selective large-cap and blue-chip shares over news that public servants may be allowed to trade.

This is the highest rate of gain attained by the DSEX, the benchmark index of the country's premier bourse, in a day in the past two years.

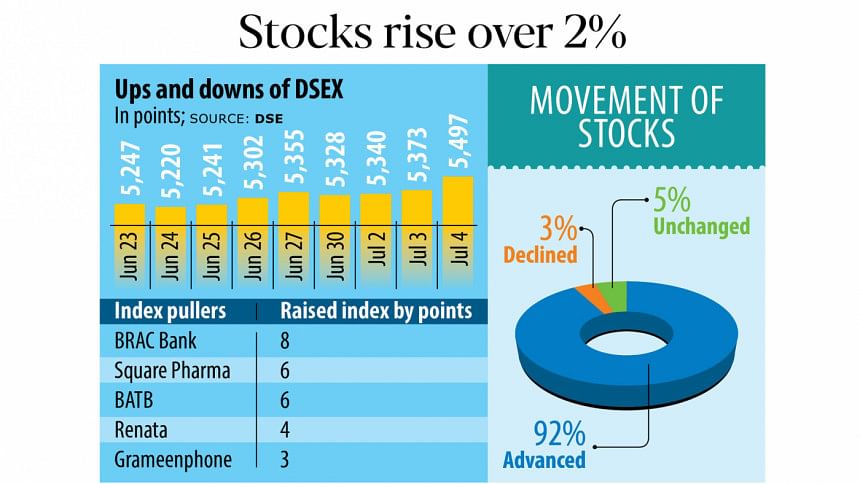

The key index of the Bangladesh stock market, DSEX, rose by 123.72 points from that on the day before, reaching a six-week high of 5,497.56.

Likewise, the DSES, the index that represents Shariah-compliant companies, went up 1.87 percent to 1,208.70.

Meanwhile, the DS30, the index that is composed of the best blue-chip stocks, increased by 2.01 percent to 1,951.34.

The market generally bounces back in its own way after it falls, said Saiful Islam, president of the DSE Brokers Association of Bangladesh.

"It might seem that after this abrupt surge the market is back up and running. But the market cannot get back up so easily. To gain its own progress, the market witnesses ups and downs," he said.

"If we want to make the progress sustainable, we should all jointly work together to ensure transparency in the market and bring back investors' confidence," he said.

A top official of a leading merchant bank said news was going around that government officials may be allowed to invest in the stock market, which has given a boost to investors' confidence.

The ministry sent the draft of amendments to a Government Servants (Conduct) Rules, 1979 to the law ministry seeking approval for allowing government employees to buy or sell primary shares or bonds of any company registered with the share market.

Turnover, meaning the total value of shares traded on a given day, stood at Tk 770 crore, an increase of 42.91 percent compared to that on the previous day of trade.

Of the 369 issues that were traded on the DSE, 365 advanced, 13 declined and the rest of the 18 scrips did not see any price movement.

A high official of an asset management company, seeking anonymity, said he did not see any plausible logic behind this sudden rise.

The market rose in June for a rumour that the imposition of taxes on capital gains may be deferred but that did not happen, he said.

A rise of over 2 percent is never that easy. One explanation could be that the market rose on falling a lot. "It is not a good explanation…We need to find a solid and plausible logic for this," he added.

"We all know that the market can surge in case of a big economic change. But we have no such economic issues right now," he said.

Chittagong Stock Exchange also saw a similar trend as the CASPI, the premier index of the port city, edged up 306.49 points, or 2.02 percent, to 15,463.493.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments