Stocks see highest rise in 3.5 years

Stocks in Bangladesh witnessed a massive jump yesterday amid hopes of a revival of the market following the exit of Sheikh Hasina from Bangladesh after her resignation from the post of prime minister on Monday.

The Awami League-led government fell amidst protests over the killing of more than 300 people and arrest of thousands centring a quota reform movement of students.

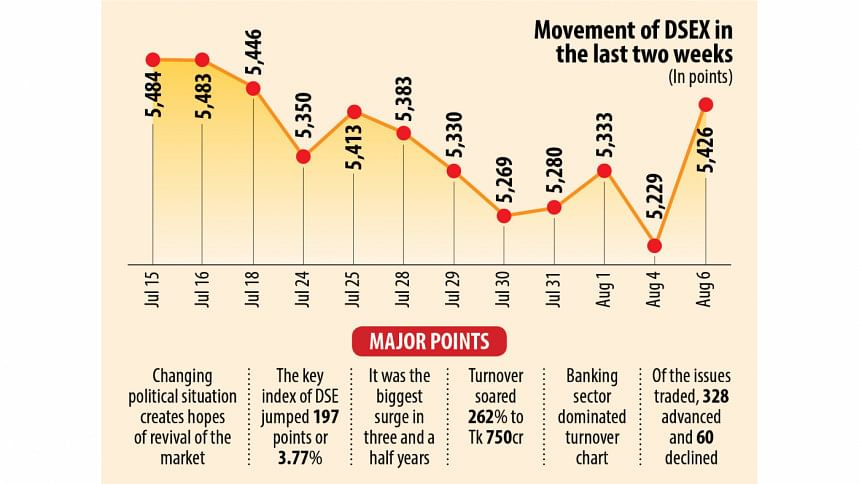

The DSEX, the key index of the Dhaka Stock Exchange (DSE), surged 197 points, or 3.77 percent, from that on Sunday to reach 5,426, the biggest surge in the past three and a half years.

At the same time, the DS30, the index for blue-chip stocks, increased 75 points, or 4 percent, to 1,934.

The DSES, the index for Shariah-based firms, advanced 32 points, or 2.86 percent, to 1,176.

This rare change in the political situation gave hope to investors because they knew that only a change in the regulatory body cannot ensure good governance in the market, said Saiful Islam, president of DSE Brokers' Association (DBA).

Bangladesh's stock market has been languishing in the face of violence centring the quota reform movement since the second half of July. Trading was closed for four days because of general holidays following a curfew.

Between July 15 and August 5, the DSEX lost 4.64 percent.

DBA President Islam said if the banking sector does not suffer that much of a damage, the stock market will run smoothly.

On the other hand, the index and turnover had plunged to a massive extent over the last couple of days and now those had come back to that of an average day, he said.

Turnover, an important indicator of the market, soared 262 percent to Tk 750 crore.

This type of turnover is common in the market but recently it dropped below Tk 500 crore due to the instability, Islam said.

"The market is full of junk shares, and low-performing companies and the market are behaving like a casino," he said.

Most of the owners of listed companies are into the share business instead of focusing on their own business. The regulator has not taken strong steps against these activities, Islam said.

Now, people are hopeful of proper regulatory activities and good governance in the stock market under a new government, he added.

A similar trend was witnessed at Chittagong Stock Exchange. The Caspi, the broad index of the port city bourse, surged 467 points, or 3 percent, to 15,393.

Mir Ariful Islam, managing director and chief executive officer of Sandhani Asset Management, said people now have hope which was the main reason behind the rise.

During another change in government on November 1, 2007, the then broad index of the DSE had gone up around 17 percent in one month. So, a rise in the stock market during any historical regime change is expected, he added.

A mid-level official of a leading stock brokerage firm said after the resignation of Sheikh Hasina, investors were optimistic about the return of good governance in the market.

So, they were buying stocks which had remained at a low price for many years. The participation of people also rose based on that optimism, he added.

Meanwhile, Bangladesh Securities and Exchange Commission Chairman Prof Shibli Rubayat-Ul Islam did not come to office yesterday. A commission meeting scheduled for tomorrow was also postponed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments