T-bill yields rise as govt turns to banks for funding

Interest rates on government treasury bills rose again this month, reversing a brief downward trend and signalling a continued liquidity crunch in the banking sector.

The rise also indicates the government's growing dependency on bank borrowing to finance its expenditure.

Separate auctions were held yesterday for treasury bills maturing in 91, 182, and 364 days. The government raised Tk 9,000 crore through the sales.

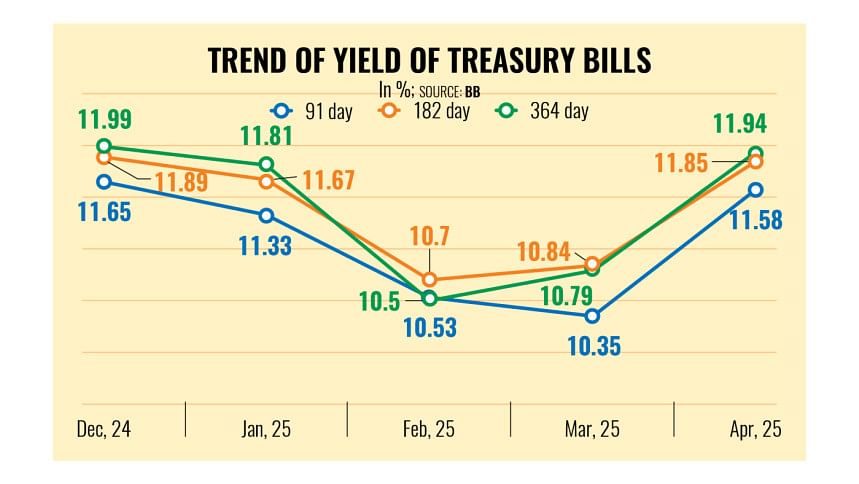

The yield on the 91-day bills stood at 11.58 percent, the 182-day at 11.85 percent, and the 364-day at 11.94 percent, according to Bangladesh Bank data.

In an earlier auction this month, those figures were slightly lower -- 11.44 percent for the 91-day bills, 11.74 percent for the 182-day, and 11.86 percent for the 364-day.

A month ago, yields hovered around the 10 percent mark.

Treasury officials at several commercial banks said there are several factors responsible for the rising rates.

Chief among them is the ongoing liquidity situation across most banks, due mainly to sluggish deposit growth and the central bank's suspension of the 28-day repo facility.

"The government is offering high interest rates on its T-bills to attract banks," said the treasury head of a private commercial bank.

"But most banks are in a tight liquidity situation due to slow deposit growth and the discontinuation of the 28-day repo facility," said the banker, preferring anonymity.

A former treasury official of a state-run bank pointed to another pressure point, which is poor loan recovery.

"A major portion of bank funds is tied up in defaulted loans," he said. "This has largely weakened the financial position of many banks."

Default loans in the banking sector surged to a record Tk 3,45,765 crore at the end of 2024. The sharp increase followed the August political changeover last year, which rattled borrower confidence and enforcement capacity.

With tax revenue failing to keep pace with expectations, the government appears to be leaning more heavily on the banking sector to cover its budget deficit, said the ex-treasury official.

Internal figures from the National Board of Revenue (NBR) show that revenue collection grew by just 2.76 percent during the first nine months of the current fiscal year (FY) 2024–25.

Up to March, the NBR -- which accounts for 86 percent of the state's total revenue -- collected Tk 2,56,486 crore, falling well short of the revised target of Tk 4,63,500 crore.

The revised budget for FY 2024–25 sets the government's net bank borrowing target at Tk 99,000 crore.

Between July last year to mid-April this year, it had borrowed Tk 42,248 crore from the banking sector, according to the central bank.

Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank, said the government now has little choice but to turn to banks for funding.

"The borrowing pushes up yield rates," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments