Tax-free income limit may rise to Tk 3.75 lakh

The government is planning a series of measures in the upcoming national budget to alleviate the tax pressure on individuals and businesses, including raising the tax-free income threshold and relaxing certain compliance requirements.

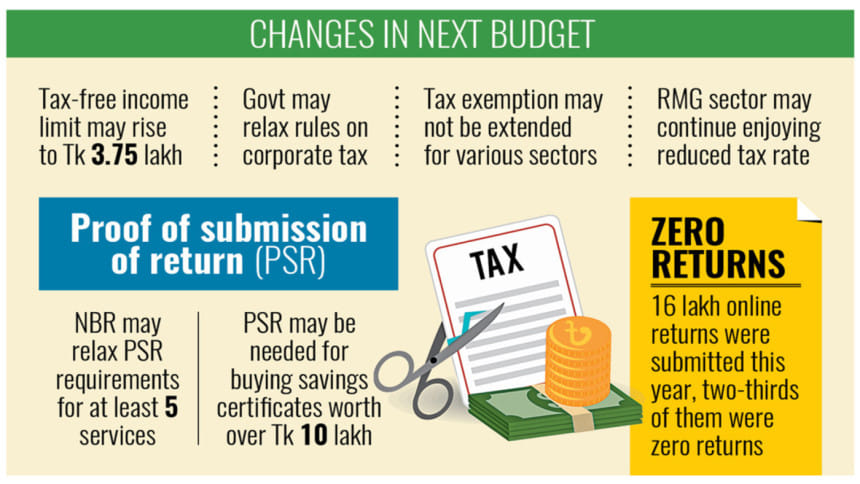

The revenue authority is considering increasing the tax-free income limit for individual taxpayers to Tk 375,000, up from the current Tk 350,000, according to finance ministry officials familiar with the matter.

The proposal is expected to be presented to Finance Adviser Salehuddin Ahmed on May 15. Then it will be forwarded to Chief Adviser Professor Muhammad Yunus on May 19 as part of the national budget preparation for the fiscal year (FY) 2025-26. The finance adviser is likely to announce the budget on June 2.

"We are considering these measures to provide some relief at the individual level amid stubbornly high inflation over the past couple of years," said a senior finance ministry official, requesting anonymity.

Over 9 percent inflation has been weighing on Bangladesh for the past 26 months, significantly eroding real incomes.

In April, the inflation rate stood at 9.17 percent, according to the Bangladesh Bureau of Statistics (BBS).

In the fiscal year 2023-24, the government increased the tax-free income limit by Tk 50,000 from Tk 300,000.

Given the ongoing cost-of-living crisis, economists and business groups have repeatedly called for a revision of the tax-free income threshold.

In March, the Centre for Policy Dialogue (CPD) recommended increasing the cap by Tk 50,000, while the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) urged the government to raise it to Tk 450,000.

Other business associations have echoed these calls, arguing that the current threshold no longer aligns with economic realities.

In addition to raising the tax-free income limit, the government is also considering easing the requirement to submit proof of income tax return filings for purchasing savings certificates.

Currently, individuals investing more than Tk 5 lakh in savings instruments must provide proof of the previous year's tax return.

According to officials, the investment threshold could be doubled to Tk 10 lakh to facilitate investments, particularly for low- and middle-income earners.

Currently, proof of return filings is required to avail of as many as 45 public and private services.

The National Board of Revenue (NBR) introduced the provision of submitting return filing documents for those services to increase tax compliance.

However, under the proposed changes, the NBR may relax the proof of return requirement for businesses obtaining licences for the first time, although it could still be mandatory for renewals.

Meanwhile, the government is unlikely to extend tax exemptions and reduced rates for businesses in the upcoming budget, as part of conditions tied to the ongoing $4.7 billion loan from the International Monetary Fund (IMF) and efforts to boost revenue collection.

Revenue officials suggest the rollback of exemptions will be phased, with some being allowed to expire and others curtailed through statutory orders.

For instance, a tax break granted to textile exporters in 2022 is set to expire this June and is unlikely to be renewed. However, the readymade garment sector is expected to retain its reduced corporate tax rate until 2028 under a sunset clause.

Other sectors currently enjoying lower tax rates, such as jute, small textile mills, poultry and fisheries, could face gradual increases, with rates currently ranging between 5–15 percent.

Fahmida Khatun, executive director at CPD, welcomed the proposal to raise the tax-free income threshold and increase the savings certificate investment limit.

"Although we recommended raising the ceiling to Tk 4 lakh, this is at least a positive step amid the ongoing high inflation," she said.

However, she acknowledged the government's fiscal constraints and emphasised widening the tax net and reducing tax evasion.

According to the NBR, around 16 lakh taxpayers filed their returns online this year.

Yet, nearly two-thirds of them submitted zero returns, while about 65 percent of Taxpayer Identification Number (TIN) holders did not file returns, despite there being around 1.13 crore TIN holders.

"Many people avoid paying taxes, either due to apathy or a tendency to evade taxes," Fahmida said. "Some are concerned about how their money is spent or whether it's being wasted."

"In this context, it is the government's responsibility to address taxpayers' apathy by ensuring the efficient use of public funds and delivering visible, quality services in return," she added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments