Tax on provident funds' income: One country, dual policy

The authorities are showing discriminatory attitude in taxing the income from provident funds of government and private officials.

At present, private companies operating provident funds for their employees are required to pay 15 percent tax on the income from the fund.

However, income from provident funds for government employees is tax-free, a disparity which has been created in the Income Tax Act 2023.

The constitution prohibits the state from discriminating against any citizen on grounds of religion, race, caste, sex or place of birth.

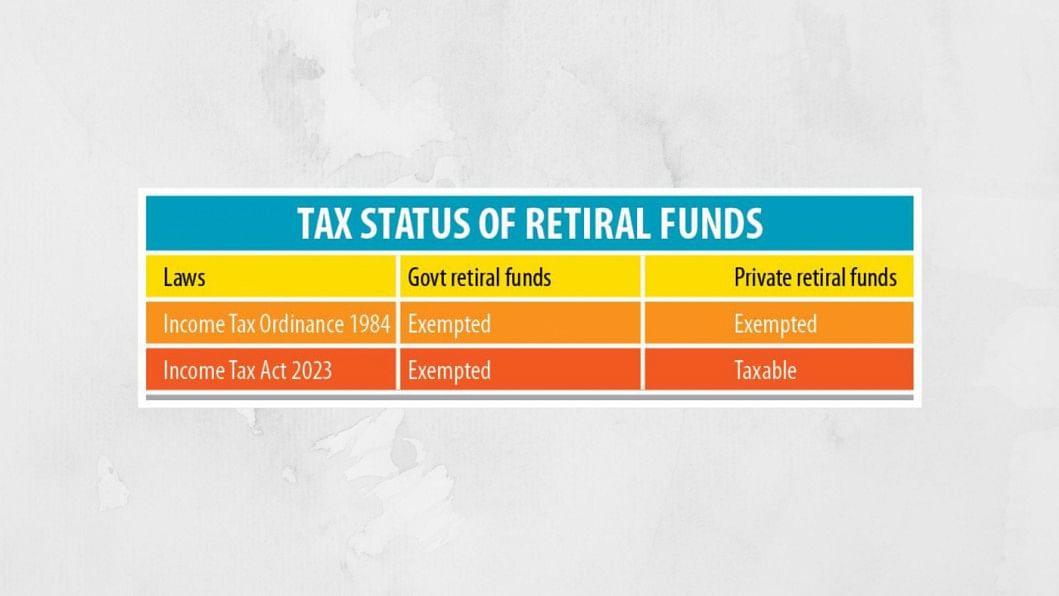

Tax analysts said, under the Income Tax Ordinance 1984, the National Board of Revenue (NBR) provided an exemption on income from provident funds and other retiral funds regardless of whether they were managed by the private or public sector.

Despite that exemption, the NBR introduced a withholding tax -- considered under minimum tax provision -- on all such retiral funds, including provident funds, gratuity, pension, and workers' profit participation funds, in the private sector through the Finance Act 2016. But it kept the public sector's retiral funds out of the purview of the tax.

"This was an anomaly and therefore we drew the attention of the NBR to correct this as there was no change in the exemption provision in the respective tax law," said Debabrata Roy Chowdhury, director legal and corporate affairs and company secretary at Nestle Bangladesh, a leading multinational company.

In the new Income Tax Act 2023, for the first time in the history of tax law, the exemption was formally withdrawn, but only from provident and gratuity funds managed by the private sector. The public sector's retiral funds remained out of the purview of such taxes, resulting in a disparity in tax treatment starting from this fiscal year, he added.

Muhammad Shahadat Hossain Siddiquee, a professor of economics at Dhaka University, said: "This is a completely discriminatory treatment of taxation between public and private employees and goes against the canon of the equity of tax."

Two eminent economists -- Ahsan H Mansur, executive director of Policy Research Institute of Bangladesh, and Zahid Hussian, former lead economist at the World Bank, Dhaka -- also offered opinions.

"What is the economic justification? There is no equity. It is discrimination," Hussain said.

But should the income earned from investing in provident funds be taxed?

Hussain said that access to the provident funds is very limited and the benefit is largely enjoyed by the middle and upper middle class. And as tax is applicable on long-term financial instruments, income from provident and other retiral funds can be taxable.

"The question is about taxing the income earned from investing in provident funds. There is no efficiency or equity for not taxing them," Hussain said.

However, Mansur begged to differ.

"There should be no tax on provident funds. Rather, tax can be imposed on the total income of the person, not on the stock. It is illogical and there should not be any division between the public and private sector," he said.

"Savings are discouraged by imposing tax on provident funds," Mansur added, suggesting the NBR provide tax credits for investment in pension funds.

Siddiquee added that 20 out of 35 OECD (Organisation for Economic Co-operation and Development) countries provide an extra tax allowance or tax credit for older people.

"Moreover, in countries such as Canada and the United Kingdom, such additional relief has been phased out for older people with higher incomes. In addition, a large number of countries across the globe provide tax relief for specific sources of retirement income," he said.

The economics professor pointed out a number of countries as examples regarding the taxation of retiral funds, saying full or partial tax relief for public pensions is available in 14 OECD countries.

In the case of the United States, between 15 percent and 50 percent of income from public pensions is not taxed depending on an individual's earning status, he added.

In Australia, benefits accrued from pension contributions and investment returns are not taxable for people over the age of 60 years.

"Based on the global context and social protection scenarios across the world, we can come to the conclusion that such a hefty tax imposed only on private provident funds, gratuity funds, and workers' profit participation funds has posed a big question mark on the issues of ethics, fairness, equity and social justice," Siddiquee said.

"Even the law takes a discriminatory approach as it exempts public sector employees. This will, in turn, create distortion in the system and pose a challenge to the principles of taxation," he said.

Siddiquee said in order for Bangladesh's economy to grow sustainably, retirement benefits must be sustainable because private pensions account for a substantial part of private sector capital to industry, implying that the tax treatment of pensions requires careful consideration for achieving potential growth and realising the government's Smart Bangladesh Vision 2041.

"Instead, generous tax treatment would help boost capital accumulation through pension savings but may be costly in terms of revenues forgone and encourage tax avoidance.

"The distributional consequences of 15 percent tax on earnings from retirement benefits is not desirable in the sense that taxing at the constant rate would help benefit individuals with higher incomes and create a distortion in the wellbeing of the society," he said.

"More importantly, similar consequences could also be evident if government employees earning the same income from the same type of funds remain outside the tax incidence."

On the issue, a senior official of the NBR said they were working to impose taxes on the salaries of government employees and on the income from the provident funds of public officials in order to ensure that both public and private sector employees are treated equally.

This may be placed in the parliament as part of the tax proposals for FY2024-25, the official added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments