Telecom sector’s revenue to cross $5b by 2023

The telecommunication industry’s revenue will grow by 34 percent in the next five years to $5.08 billion from $3.8 billion at present, on the back of expanding user base and wide range of services, said the USAID in a new study.

“The sector is quite large in size and has a crucial contribution to achieving the goal of making Bangladesh a middle-income country,” said the report of the United States Agency for International Development (USAID) published recently.

The industry employs about 7.60 lakh people directly, of which 92.5 percent are unskilled and 7 percent are women, the Comprehensive Private Sector Assessment report said.

The job growth rate in the sector will be 9 percent from 2016 to 2020.

The USAID Bangladesh has listed 16 emerging sectors in the study which could contribute a lot to the country’s economic development, beyond that facilitated by the readymade garment sector. Telecommunication is one of them.

“The mobile telecom service in Bangladesh is very promising as the operators are providing standard services with extensive facilities to customers,” said M Farhad, secretary general of the Association of Mobile Telecom Operators of Bangladesh (AMTOB).

The report said the country is undergoing transformation on social and economic fronts. Rapid changes have been observed in the lifestyle of the population.

Connectivity has been an integral part of modern-day life, thus accelerating the growth in mobile communication and internet use.

The use of social media platforms such as Facebook, WhatsApp, Viber and video-streaming sites like YouTube have become part of everyday life for all classes of people, mostly young and middle-aged groups.

The use of social media is growing every day, resulting in more and more consumption of internet data. Steady population growth and increase in purchasing power will continue to drive the telecom sector growth, the report added.

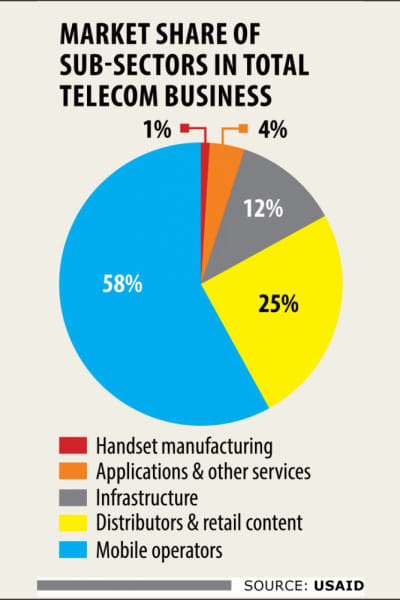

In 2016-17, the telecommunications sector accounted for 6.98 percent, or $29.6 billion, of the economy. The contribution of the sector is highly dominated by mobile operators with a direct impact of 58 percent, followed by distributors and retailers (25 percent), infrastructure providers (12 percent), and the handset industry, content applications and other services providers (5 percent).

Shahed Alam, chief corporate and regulatory officer of Robi, said the country has made tremendous progress towards implementing the Digital Bangladesh vision by 2021.

He said with Robi, mobile operators have created the platform for the digital economy to take off in the country.

“As part of that we are already in the process of transforming ourselves into a digital company by diversifying our product and service portfolio through digital innovation. This transformational journey is helping us get integrated with all elements of the country’s rich and varied socio-economic fabric.”

“Therefore, the telecom sector is becoming the key enabler for the country to achieve the targets set in the Sustainable Development Goals.”

The report found that the total number of smartphone users was 48 million in 2017 and it will go up by threefold to 138 million in 2025.

“As the number of smartphones will grow, the mobile broadband connection will grow accordingly.”

The report said the telecom sector has experienced sluggish growth in the face of rapid digital disruption and an unfavourable regulatory regime.

It listed the challenges facing the sector. They include rising use of communication applications which are gradually eating up the core revenue stream; higher corporate tax; higher customer acquisition price; the lowest return; and low investment for network upgradation and maintenance.

It recommended supporting internet-based startups that have cross-cutting impacts on industries such as telemedicine and ridesharing as well as introducing IT-enabled working space to support entrepreneurs, freelancers, and crowdsourcing in rural areas.

AMTOB’s Farhad said though the market is growing rapidly, the industry is suffering a lot due to over-regulation, regulatory unpredictability, and a weak telecom ecosystem.

“Super high taxation and the high price of spectrum are also impacting the industry. Given the scenario, it will be very challenging to roll out 5G service and implement Digital Bangladesh endeavour within the stipulated time.”

“We hope that the government and the regulator will understand the reality and take appropriate actions to overcome the challenges.”

Alam of Robi said the regulator’s traditional command and control mindset is failing to see beyond the immediate concerns of revenue collection.

“If this mindset persists, the country will only slow down its progress towards the creation of a full-fledged digital economy.”

The USAID report called for an initiative, in collaboration with small internet service providers, to provide last-mile services.

At the end of fiscal 2017, there were 85 million unique subscribers and it will be 107 million in 2025, making Bangladesh the fifth largest mobile market in the Asia Pacific and the ninth largest market in the world in terms of unique subscribers.

Active mobile connections will reach 190 million at the end of 2025 and the number of 4G users will be 41 percent, the USAID report said, referring to the GSMA, a trade body that represents the interests of mobile network operators worldwide.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments