Is there room to cut policy rate from 10%?

The central bank is set to unveil its latest monetary policy for the first half of the fiscal year (FY) 2025-26 tomorrow, as inflation slows but private sector credit growth hovers at multi-year lows, underscoring the fragility of the country's economic recovery.

Inflation declined to 8.48 percent in June, down from 9.05 percent in May, marking the lowest level since February 2023. The drop follows more than two years of aggressive monetary tightening, during which the central bank raised the policy rate, or repo rate, to 10 percent, its highest in a decade.

The foreign exchange market has also stabilised in recent months, supported by rising remittance inflows and a shift to a market-driven exchange rate. These improvements have prompted debate over whether there is now scope to ease the policy rate.

Governor Ahsan H Mansur, who will announce the new monetary policy at a press conference at the BB headquarters at 3pm on Thursday, has signalled that the policy rate will likely remain unchanged.

"There is no reason to reduce the interest rate," Mansur said in a recent interview with The Daily Star.

Still, the central bank is under pressure from sections of the business community, who argue that high borrowing costs are stifling investment.

This will be the second monetary policy announced by Mansur since he became governor of the Bangladesh Bank following the political changeover on August 5 last year.

The Monetary Policy Statement (MPS) has been drafted following a meeting of the central bank's Monetary Policy Committee, which held consultations with both internal and external stakeholders over the past month, according to officials familiar with the matter.

The policy will be finalised after presentation at the central bank's board meeting today.

BUSINESSES WANT LOWER RATES, ECONOMIST SAYS NO

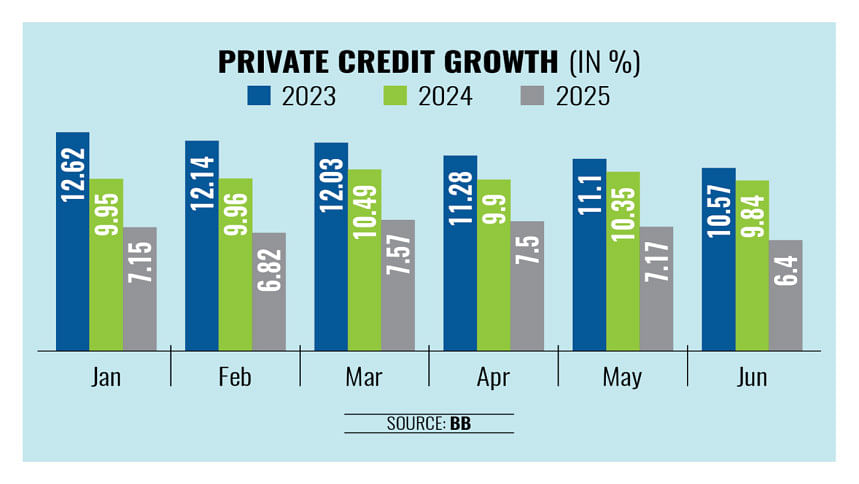

Despite the fall in inflation, private sector borrowing remains sluggish amid political uncertainty and the high borrowing rate.

Borrowing by the private sector dropped to 6.4 percent in June, according to the central bank, well below the target of 9.8 percent and the lowest recorded in recent years.

The International Monetary Fund (IMF), which approved a $4.7 billion loan package for Bangladesh, has recommended keeping the policy rate unchanged until at least mid-FY26 to prevent inflation from rebounding. It has also urged the central bank to move towards market-based monetary tools and interest rate flexibility.

However, some stakeholders, especially businesspeople, have criticised the central bank's tight monetary stance, arguing that the high interest rate is constraining investment.

The policy rate, or repo rate (repurchase rate), is the interest rate at which the central bank lends money to commercial banks when there is a shortage of funds.

In simpler terms, it is the rate at which banks borrow money from the central bank for short-term needs, usually against government securities.

"The interest rate should be lowered, considering the current economic situation," said Anwar-ul-Alam Chowdhury Parvez, president of the Bangladesh Chamber of Industries (BCI).

He cited concerns over the cost of borrowing, a deteriorating investment climate, and rising non-performing loans.

"Businesspeople are now facing trouble because of high bad loans in the banking sector and the overall investment environment," he pointed out.

These issues should be considered when formulating the monetary policy, he added.

However, Zahid Hussain, former lead economist of the World Bank Dhaka office, said there is currently no scope to increase the policy rate.

"The issue now is whether to cut it immediately or wait. If we consider cutting it now, we need to assess the potential benefits versus the risks," the prominent economist said.

He went on to explain, "Let's assume a reduction in the policy rate would lead to a decrease in retail interest rates. Even if not automatically, let's accept this argument for the sake of discussion.

"In that case, credit demand may rise, which could in turn stimulate investment."

"However, there's no guarantee that investment will actually increase, because the current investment stagnation is driven by uncertainty—something a policy rate cut cannot resolve," he said.

The expected benefits of a rate cut are unlikely to materialise as long as this uncertainty persists, he stated. "On the other hand, lowering the policy rate would increase credit demand, which could, in turn, create fresh inflationary pressure in the market."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments