With Trump’s win, Bangladesh gets more investment queries from China

Chinese entrepreneurs are increasingly inquiring with Bangladeshi businesses over scope for factory relocations, joint ventures and fresh investments, apprehending that the new Trump administration might further hike tariffs on their exports to the US.

The Chinese also seek to take advantage of the fact that a European Union (EU) directive on corporate sustainability due diligence, which was already in effect, would be applicable for Bangladesh after two years in 2026.

The directive aims to foster sustainable and responsible corporate behaviour in companies' operations and across their global value chains.

Environmental, sustainability, and workplace safety certifications of companies in Bangladesh are also a big draw.

The inquiries have mainly been coming up with the leather and leather goods, manmade fibre, yarn, textile, and garment sectors over the last few months.

Local business leaders and officials say Trump's first term in the Oval Office caused a similar wave of investment enquiries from Beijing. However, that didn't materialise eventually as Trump's tariff plan saw a bumpy rollout plus the Covid pandemic, roiling the global business landscape and supply chain metrics.

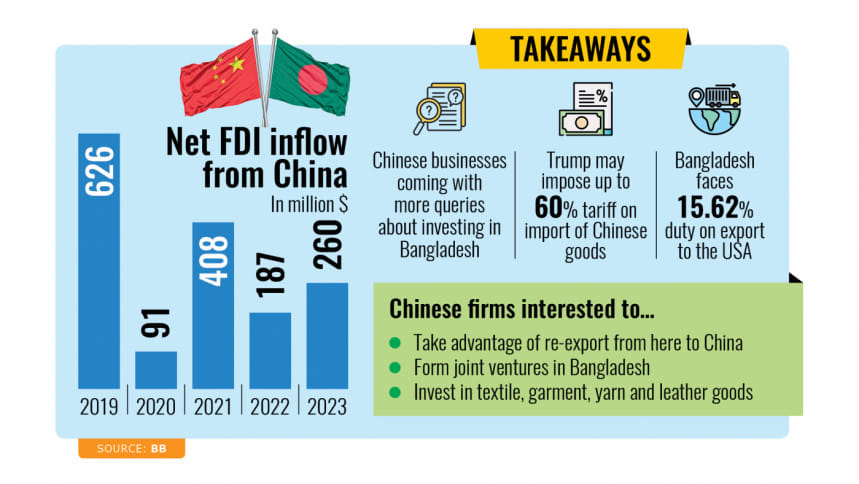

Around $1.03 billion was invested in Bangladesh from Chinese sources in FY18 and $626 million in FY19. But the inflow fell to just $91 million in FY20 during the height of the pandemic, according to Bangladesh Bank data.

There were signs of recovery afterwards as $408 million arrived from China in FY21, but that number declined to $187 million in FY22 and $260 million in FY23.

Currently, Bangladeshi exporters on average face a 15.62 percent duty on exports to the US, but it is still much lower than the 25 percent levied on Chinese goods.

Also, Bangladesh currently enjoys a duty-free facility on all its exports to China. This is advantageous as Chinese manufacturers in Bangladesh would be able to sell goods cheaply in China.

The tariffs on Chinese goods might be further hiked to up to 60 percent, making those uncompetitive in the US markets.

Prior to the US election on November 5, Donald Trump declared that if he were to get elected, he would increase the tariff on Chinese goods by up to 60 percent.

In his previous tenure, Trump increased the tariff on Chinese goods to 25 percent from nearly 3 percent with effect from January 2018.

Because of the higher tariff on Chinese goods, the shipment of garment items from other countries like Vietnam, Cambodia, and Bangladesh to the US started rising and the global share of China in garment trade also declined to a great extent.

For instance, the Chinese share in global garment trade is now at 31 percent while it was more than 36 percent five years ago.

On the other hand, Bangladesh's share in the global garment trade increased from 5 percent to nearly 8 percent over the last five years. Bangladesh has subsequently retained the second position in the global garment trade after China.

This is because Bangladesh currently has the highest number, or 230 to be exact, of garment factories having US Green Building Council's Leadership in Energy and Environmental Design certifications, signifying their compliance with environmental regulations.

These helped improve the reputation of the country and sector, said Khandoker Rafiqul Islam, the immediate past president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

Islam also said a lot of inquiries were coming from China and Taiwan over relocations and investment over many months as they were already feeling the pinch from the high tariff rate of 25 percent.

It is a good sign, but most of the investment that was coming in was on taking over ailing garment factories in Bangladesh, he said.

If Chinese investors take over ailing garment factories, it may not lead to a sudden increase in exports from the country as such changes take time, he added.

A local leather and leather goods exporter, requesting anonymity, said a few Chinese leather goods manufacturers have contacted him over the last few months, either seeking to undertake joint ventures or make fresh investments.

The Chinese exporters are facing high tariffs on products to the US markets, and they will face more difficulties in the near future once the Trump administration forms the US government in January next year, the exporter said.

However, the Chinese inflow of investment, either in the form of joint ventures or fresh investments, is subject to Bangladesh reaching political stability, he added.

Md Anwar Hossain, vice-chairman of the Export Promotion Bureau (EPB) and administrator of the BGMEA, also said a lot of inquiries were coming from Chinese investors, especially after Donald Trump won the US election.

Almost every day, Chinese investors are contacting him and inquiring about the relocation of factories, he also said.

Chinese investors are also interested in investing in Bangladesh as they will also have to face stringent conditions of the EU's due diligence directive, which will come into effect for Bangladesh at a later date, he said.

A senior officer of Bangladesh Investment Development Authority, requesting anonymity, said the official trend of Chinese inquiries centring investments was still the same as it was earlier.

But it is also true that the US foreign policy does not change a lot after a change of government, he said.

A clear picture of Chinese investment inflow to Bangladesh may only be available at least one month later as Trump is yet to take charge of the US government, he added.

Echoing similar views, Mohd Khorshed Alam, president of the Bangladesh China Chambers of Commerce and Industry (BCCCI), said it would take five to six months more to get the real picture of enquiries regarding Chinese factory relocation or investment due to Trump's win.

Currently, Chinese investments in Bangladesh are slow as they are closely monitoring the business and investment climate in the country, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments