UAE emerges as top remittance source for Bangladesh

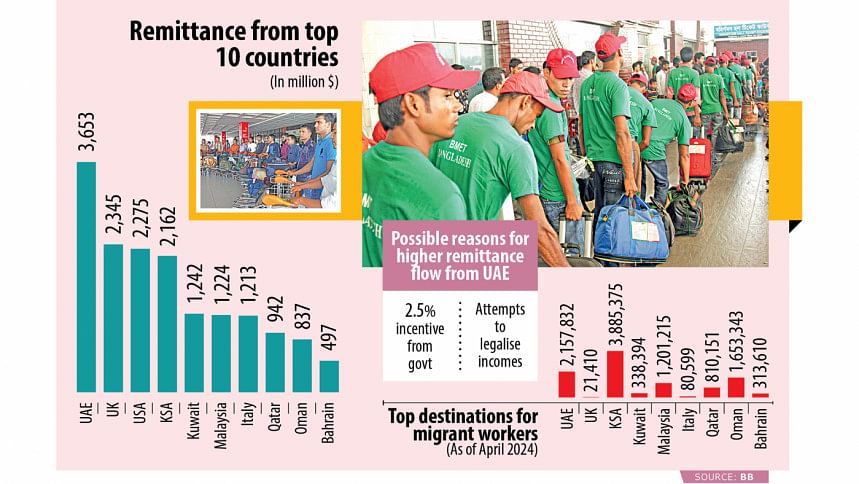

Bangladesh received the highest remittance from the United Arab Emirates in the first 10 months of the outgoing fiscal year, well ahead of traditional powerhouses such as Saudi Arabia and the United States, central bank figures showed.

The second-highest volume came from the United Kingdom, with the US was at third and Saudi Arabia at fourth.

The spike in the funds remitted from the UAE has been good news for Bangladesh since it gave a much-needed fillip to an economy reeling under the foreign currency reserves crisis for the past two years.

Experts, however, have raised questions about whether the smuggled money is returning in the form of remittance to enjoy incentives and legalise it.

UAE-based remitters sent $3.65 billion in July-April of 2023-24, which was 52 percent higher than the receipts of $2.41 billion in the same period of the previous fiscal year. It was third-placed in July-April of 2022-23.

The flow from the UAE constituted 19 percent of the $19.11 billion migrant workers transferred during the period, according to Bangladesh Bank data.

It comes as the Gulf nation has become a major hub for investments for Bangladeshis although how the financing to set up the ventures was mobilised could not be known immediately since only a handful of companies have received permission from the BB to invest abroad.

Many Bangladeshis have allegedly laundered money to the UAE illegally and invested there, according to media reports.

Dubai, the most populous city in the UAE, and the capital of the Emirate of Dubai, is currently one of the favourite destinations among the wealthy population in the world to siphon money, according to experts.

The fact that the UAE is not the largest destination for Bangladeshi expatriates has also deepened the suspicion.

Bureau of Manpower, Employment and Training (BMET) data showed 21.58 lakh people have gone to the country in search of jobs since 2004, which is 44.5 percent lower than the 38.85 lakh people who departed for Saudi Arabia, home to the largest number of migrant workers from the South Asian nation.

However, remittance receipts from the UAE were 40.8 percent higher than that of Saudi Arabia in the first 10 months of FY24. In July-April, $2.16 billion came from Saudi Arabia, down from $3.04 billion a year ago.

Prof Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, said there is no major differences between the workers who went to the UAE and those who went to Saudi Arabia in terms of skills and salaries.

"So, it is necessary to see who are sending the money from the UAE and why is this sudden spike?" Rahman asked.

Historically, Saudi Arabia had been the top remittance sender for Bangladesh. In the second half of 2022, it lost the spot to the US for a brief period, which came as a surprise. Still, Saudi Arabia retained the top spot at the end of FY23.

The UAE has been the top remitter since the beginning of FY24.

In order to attract remittances, the government introduced a 2 percent incentive in 2019, and it was later raised to 2.5 percent.

Rahman called for a thorough investigation to find out whether the money that was smuggled out of the country is being brought back to secure the incentives and legalise them.

He termed it as the "round trip" of the money.

"Although remittances are good for the foreign exchange reserves and the balance of payments, it is needed to probe whether there is any other purpose behind it."

Mohammed Nurul Amin, a former managing director of Meghna Bank and NCC Bank, said many rich people have settled in Dubai as it has now become a lucrative destination.

Now, the expatriates are getting incentives if they send funds to their beneficiaries back home through formal channels. This might be a reason behind the higher remittance flow from the UAE, he said.

Expats sent $2.35 billion from the UK in July-April, data from the BB showed. Remittances from the US dropped 25.33 percent to $2.28 billion during the period.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments