Universal Pension Scheme: All you need to know

The government rolled out the much-anticipated universal pension scheme today with an aim to bring all citizens aged above 18 under the coverage. Here are some of the key issues regarding the pension scheme.

What is universal pension scheme?

The scheme mainly aims at bringing the growing elderly population of the country under a well-organised social safety net and provide them with a monthly stipend to support their daily expenses.

Who are eligible?

All citizens aged between 18 and 50 years on the basis of their national identity cards, including expatriate Bangladeshis, will qualify for the benefit. Currently, only employees of government, semi-government or autonomous organisations in Bangladesh receive pension benefits.

Under special consideration, citizens aged over 50 years will also be able to take part in the pension scheme.

Through the new law, the government aims to bring private sector employees under the pension scheme.

What are the schemes?

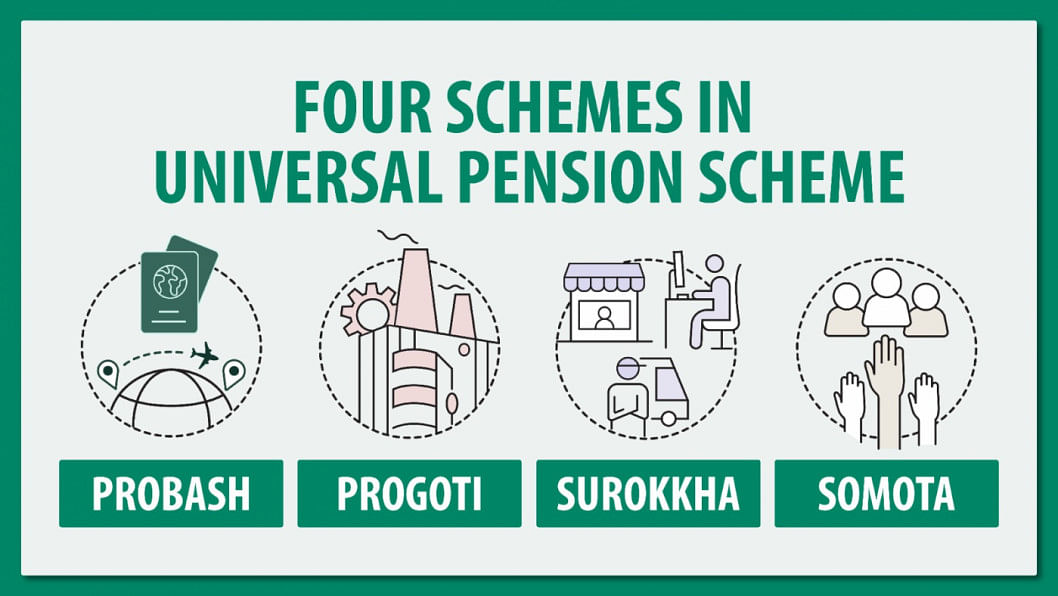

Four different schemes have been introduced— Progoti, Surokkha, Somota and Probash—to bring citizens from all walks of life under the pension facility.

Progoti

This scheme is for employees of private companies. Any employee working in a private organisation or the owner of that organisation can participate in it.

Surokkha

People working in the informal sector such as farmers, rickshaw pullers, labourers, blacksmiths, potters, fishers and weavers can participate in this scheme.

Somota

Low-income people living below the poverty line, who currently earn a maximum of Tk 60,000 a year, can participate in this scheme. Who will fall under the poverty line will be determined by the income limit published by the Bangladesh Bureau of Statistics.

Probash

Any Bangladeshi citizen working or living abroad can participate in this scheme by depositing the prescribed amount in foreign currency.

How to register or take part in the pension scheme?

To participate in the pension scheme, Bangladeshi citizens will have to register online from the country and abroad. A person has to register with the National Pension Authority's website: upension.gov.bd.

After that, a unique ID number will be given in favour of the applicant.

Expatriate Bangladeshi nationals who do not have national identity cards can apply for registration in the pension scheme with passport information.

A unique ID number, the rate of donation and the date of submission of the monthly donation will be informed through mobile number mentioned in the application and through email in case of expatriate applicants.

How much one has to pay as monthly instalment?

Any expatriate Bangladeshi can take part in the Probash scheme by paying Tk 5,000, Tk 7,500 and Tk 10,000 as monthly instalments for 10 years. In return, the person will get a monthly pension of Tk 7,651, Tk 11,477 and Tk 15,302 respectively after the completion of 10 years.

In the Progoti scheme, there will be three instalment amounts -- Tk 2,000 or Tk 3,000 or Tk 5,000 per month. Against a monthly payment of Tk 2,000 for 10 years, the beneficiary will get a pension of Tk 3,060 a month.

Under the Surokkha scheme, the monthly instalments will be Tk 1,000, Tk 2,000, Tk 3,000 and Tk 5,000. The depositors will get Tk 1,530 per month as pension against the payment of Tk 1,000 a month for 10 years.

In the Somota scheme, the monthly instalment size is Tk 1,000 where participant will pay Tk 500 and the government Tk 500. After 10 years, the beneficiary will receive Tk 1,530 a month as pension.

The amount of pension of these schemes will vary depending on the term and the amount of instalment.

How to deposit instalments?

The monthly instalments can be deposited to the designated bank accounts of the National Pension Authority through mobile financial services, online banking, credit or debit card. Expatriate Bangladeshis can deposit donations through credit and debit cards.

For all schemes, the instalments can be paid on a monthly, quarterly or annual basis according to the donor's background.

A text will be sent to the registered mobile number when the monthly instalment will be deposited to the designated bank account. In case of failure to pay the instalment, depositors will be informed along with the amount of fine.

On top of that, if an organisation participates in the pension scheme as an institution, the organisation and its employees will have to deposit the instalments together with the organisation.

How to get loan from the deposited money?

Under the scheme, the participants will be able to take 50 percent of the money deposited in the pension scheme as loan to spend on their own or family members' treatment, house construction, house repair and child's marriage.

The money taken as loan will have to be paid in 24 instalments, including the fees charged by the pension authority.

How long will the pensioners get benefit or what will happen after pensioner's death?

The pensioners will enjoy pension benefits until death. If the depositor dies before the age of 75 years while in pension, the nominee of the depositor will get monthly pension for the remaining time until the original depositor's age will hit 75 years.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments