An unlikely product brings $400m a year: cotton waste

The export of cotton waste from Bangladesh is rising rapidly on the back of higher demand for recycled garments globally amid growing consumer awareness and their lower prices in the domestic market.

Cotton waste refers to the waste of cotton and textile waste generated in spinning, weaving and textile mills coming in the forms of fibres, threads or fabric pieces depending on the manufacturing stage.

The consumption of recycled apparel items has grown in western markets, prompting local traders to ship the expensive raw materials directly to other countries, particularly India, China and Turkey.

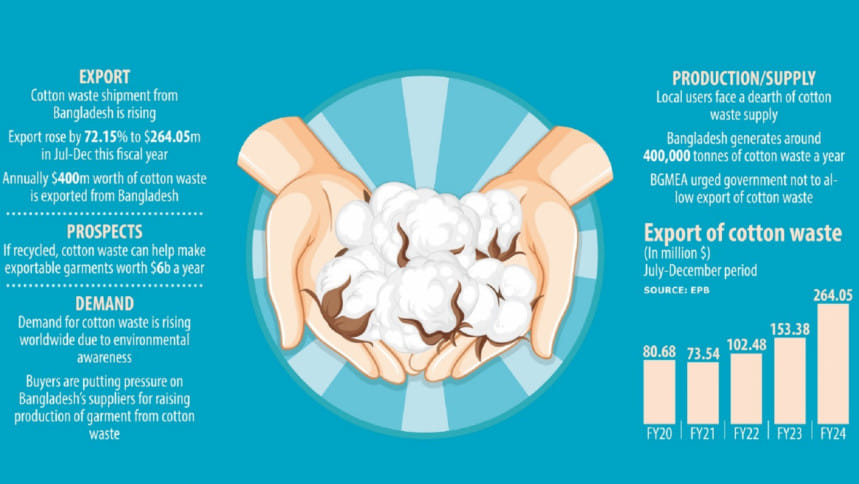

In July-December of the current financial year of 2023-24, cotton waste export rose 72.15 percent year-on-year to $264.05 million, data from the Export Promotion Bureau showed.

Cotton waste export stood at $411.12 million in the entire fiscal year of 2022-23.

Many international clothing retailers and brands are transforming the fashion industry on the basis of recycled items with a view to cutting their carbon footprint and avoiding widespread waste, sending the demand for waste materials high.

Recently, Swedish retail giant H&M asked garment suppliers to use more cotton waste than raw cotton in their manufacturing process. Clothing retailers and brands prefer the reuse and recycling of garments to avoid environmental damage.

A new proposed European Union law has already had an impact on the consumption of garments made from cotton waste. The 27-country bloc has decided not to buy garments from factories that don't use cotton waste from 2030, as part of their circular fashion move.

Circular fashion is a closed-loop system making new materials out of old materials, reducing the number of natural resources used to make clothing and diverting products from landfills.

Bangladesh generates around 4 lakh tonnes of cotton waste a year. If recycled, it could be used to manufacture exportable garments worth $6 billion. However, most of the items is being shipped abroad although local garment exporters are very much against.

"Because of higher demand abroad, traders don't even have to sort them properly before shipping," said Md Abdur Rouf, executive director of Bhaluka-based Simco Spinning & Textiles Ltd, which currently produces 20 tonnes of recycled yarn a day.

The gap between the export price and the local market rate is also a factor for the shipment of cotton wastes, said Rouf. As a result, many local mills are not finding enough wastes to make yarn and fabrics.

Khorshed Alam, chairman of Little Group, said since exporters receive higher prices, they prefer to sell the raw materials in the international markets.

"As a result, both value and volume of the export of cotton wastes are increasing."

Among the garment wastes, the cotton waste is more expensive and millers usually don't export them. Rather, they use them to make denim fabrics and denim garment items, Alam said.

On the other hand, knitwear waste is exported since the item is not recycled at a large scale, he added.

Monsoor Ahmed, chief executive officer of the Bangladesh Textile Mills Association, says nearly 30 local mills produce recycled yarns and they are demanding the removal of the VAT and other taxes on the sales of recycled yarn in the domestic market.

"Owing to the taxes, new investments are still slow and many traders prefer to exports."

Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), says the demand for recycled garment items is growing globally as consumers want to cut carbon emissions.

Each year, more than 10,000 crore items of clothing are produced globally, according to some estimates, with 65 percent of these ending up in landfill within 12 months. Landfill sites release equal parts carbon dioxide and methane – the latter greenhouse gas being 28 times more potent than the former over a 100-year period, said a BBC article in February last year.

The fashion industry is estimated to be responsible for 8-10 percent of global carbon emissions, according to the United Nations. Just 1 percent of recycled clothes are turned back into new garments.

The BGMEA has already requested the government discourage the export of cotton wastes since demand is rising at home.

According to Hassan, since significant investments in the recycled yarn processing have not taken place, some like to export the items.

The exports or local sales are much better options compared to the past scenario when most wastes from old clothing items either ended up in landfills or were burnt out.

"Now, it is being processed and made into yarns and fabrics," said the BGMEA chief.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments