US buyers delay apparel orders over pending tariff call

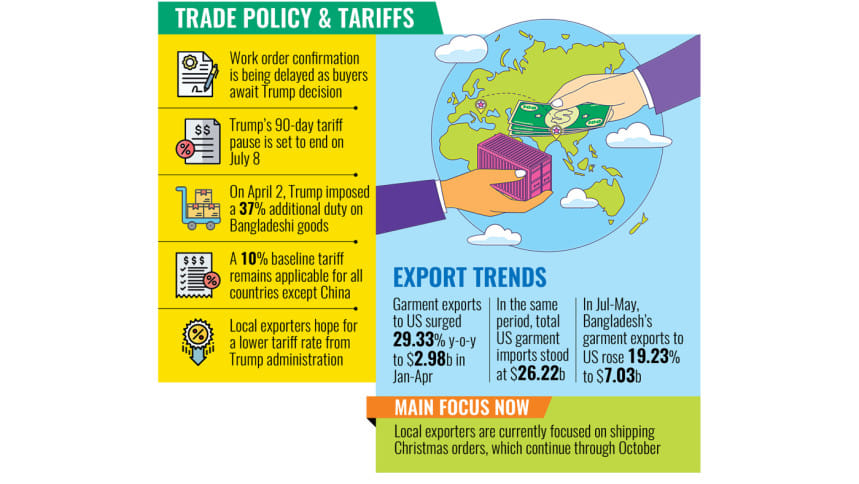

Local apparel makers are seeing delays in the confirmation of work orders for the next summer season, as US retailers and brands wait for the final decision on reciprocal tariffs by the US administration, expected in early July.

Western buyers usually place orders for upcoming seasons, such as summer and autumn, between June and September.

This year, US buyers are booking production slots as usual but are taking longer to confirm orders, according to manufacturers.

They say work orders from US-based retailers and brands are still slow, as buyers are in a wait-and-see mood now.

For now, exporters are busy shipping apparel for the upcoming Christmas season. These shipments are expected to continue until the first week of October.

Like other countries, these consignments from Bangladesh will face an additional 10 percent baseline tariff imposed by the Trump administration.

In early April, US President Donald Trump announced high reciprocal tariffs on imported goods, set to take effect from April 9. But just before the date, he announced a three-month pause, pushing the deadline to July 9.

Local exporters are hoping Washington will reconsider the proposed rates for key sourcing countries such as Bangladesh.

Faruque Hassan, managing director of Giant Group, said that under the new tariff plan, Bangladeshi products would face the highest rate after China, at 26 percent, including the additional 10 percent baseline tariff.

Hassan expressed hope that the US would not impose such a high rate, pointing out that it would be the steepest ever for Bangladeshi goods in the American market.

He said the US work orders for the next season are yet to pick up, as buyers are waiting for the final decision on the tariff.

Between January and April this year, garment exports from Bangladesh to the US, the country's largest single-nation market, rose by 29.33 percent year-on-year to $2.98 billion, according to data from the Office of Textiles and Apparel (OTEXA).

The US imported $26.22 billion worth of apparel during this period.

On a fiscal year basis, garment exports to the US increased by 19.23 percent to $7.03 billion during July to May, according to the Export Promotion Bureau (EPB).

Exports have grown as US retailers and brands sourced goods globally to avoid the impact of Trump's high reciprocal tariffs.

Since the Covid-19 pandemic, the garment sector in Bangladesh has faced repeated challenges, including the Russia-Ukraine war, global inflation, conflict in Gaza, tensions between India and Pakistan, re-routing of shipments from the Suez Canal, and, recently, the Iran-Israel conflict.

Domestically, the sector has struggled with shortages of gas and electricity, labour unrest, and uncertainty during the political changeover last year.

"Despite global and local challenges, export data shows that apparel shipments to the US are still growing," said Ramzul Seraj, managing director of Elite Garments Ltd, which exports mainly to the US.

He also said the inflow of work orders from the US is still unchanged, as it continues as it was earlier.

However, Sharif Zahir, managing director of Ananta Group, which also ships a large portion of its production to the US, said order inflow may remain slow for another three months due to buyer indecision over the Trump tariffs and wider economic and political uncertainty.

He noted that some US retailers and brands have shared part of the 10 percent additional tariff, covering up to five percent themselves, although the duty is supposed to be paid by importers.

Some exporters said buyers have sought to divide the extra cost among the main partners, with fabric suppliers, manufacturers, and importers each sharing around three percent.

"Work orders from US-based retailers and brands are still slow as they are in a wait-and-see mood now," said Mahmud Hasan Khan Babu, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

The BGMEA president said that there might be some uncertainty for the next season until the final decision comes about the Trump tariffs.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments