US tariff pause: Trump tries to unite the world against China, calm stock markets

Was it about isolating China or calming the markets? Or both?

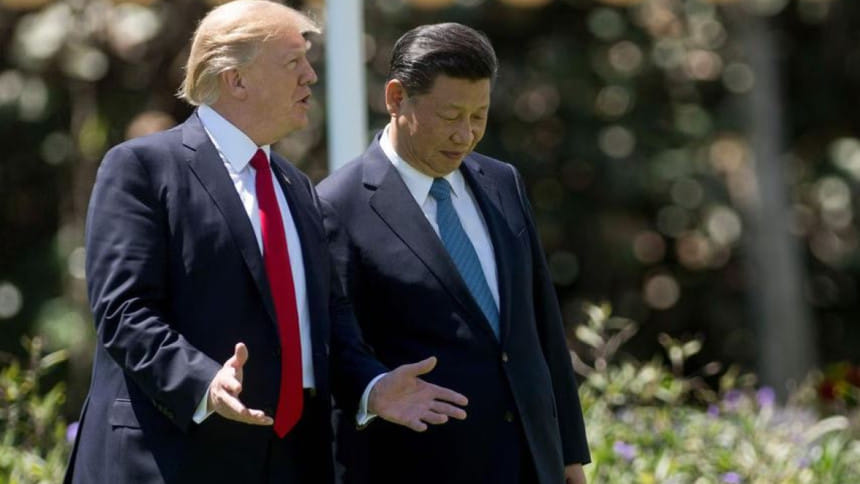

Whatever the case, President Donald Trump stunned the world with his abrupt decision to escalate the trade war against America's biggest rival and postpone the high tariffs imposed on allies.

And Chinese President Xi Jinping, he insisted, would come to the negotiating table.

In swift retribution against China's decision to match in kind the tariffs imposed by the US, Trump announced on April 9 that China's tariff rate had been increased to a total of 125 per cent.

At the same time, he issued a 90-day pause in the implementation of reciprocal tariffs that had been applied on trade partners with which the US has trade deficits, including important allies in Asia like Japan and South Korea.

"Based on the lack of respect that China has shown to the World's Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately," Trump said in a Truth Social post.

Until that point, China had been hit with tariffs of 104 per cent. It had retaliated with 84 per cent tariffs that matched Trump's announcement of 34 per cent "reciprocal" tariffs and an additional 50 per cent for retaliating.

Meanwhile, the baseline 10 per cent tariff that went into effect on April 5 remains in place for all trading partners, including Singapore. This applies also to the European Union whose planned retaliatory tariffs of up to 25 per cent on the US have not gone into effect yet.

While slapping another round of tariffs on China, Trump said his Chinese counterpart would want to talk to him.

"China wants to make a deal. They just don't know how to go about it. It's one of those things. They're proud people. And President Xi is a proud man, I know him very well. They don't know quite how to go about it but they'll figure it out. They're in the process of figuring it out. They want to make a deal."

Trump also denied that the stunning reversal had anything to do with the plummeting stock markets or the jitters in the bond markets stemming primarily from China's role as one of the largest foreign holders of US Treasury securities, and the potential actions it might take in response to escalating tensions.

Trump's market-moving decision was announced, unusually, during the trading hours in the US stock markets.

And ahead of it, Trump had suggested that it might be a good time to take a bet.

"BE COOL! Everything is going to work out well. The USA will be bigger and better than ever before!" Trump wrote on Truth Social at around 10am on April 9, as the stock market selloff continued in the aftermath of China's overnight decision to match the US tariffs at 84 per cent.

"THIS IS A GREAT TIME TO BUY!!!" he added.

Answering questions from reporters later, Trump said he had noticed that "people were getting a little queasy" but it was not the bond market nervousness that led to the move.

"The big move wasn't what I did today. The big move was what I did on Liberation Day," he said.

The S&P 500 closed up 9.5 per cent, in its best performance since 2008. The Nasdaq Composite rose over 12 per cent in its best day in nearly 25 years.

The decision, Trump said, came from the heart.

"We didn't have access to lawyers. We wrote it up from our hearts. It was written as something that I think was very positive for the world and for us, and we don't want to hurt countries that don't need to be hurt, and they all want to negotiate."

"No other president would have done what I did," he said, repeating his assertions that China was an "abuser" of the world trading system and had racked up large surpluses in its trade with the US.

"That's not right. And now I've reversed it for a short period of time," he said.

China's neighbours, including Japan, South Korea, India and Vietnam are in talks with Trump's administration for what the White House Press Secretary Karoline Leavitt has called "tailor-made deals."

Treasury Secretary Scott Bessent, who has emerged as the leading voice on the tariffs, waved off the suggestion that the move was all about China.

"It's about bad actors," Bessent told reporters as he went on to describe China as the "most imbalanced economy" and the "biggest source of the US trade problems and problems for the rest of the world".

It took Trump "great courage to stay the course until this moment" he said.

But if not about China, was it about calming the markets?

Like the President, Bessent also denied that case and called the 90-day reprieve a result of a "processing" problem.

"It's because of the large number of inbounds, we've had more than 75 countries contact us. And I imagine after today, there will be more," he said.

"It is just a processing problem. Each one of these solutions is going to be bespoke, it is going to take some time. And President Trump wants to be personally involved. So that's why we're getting the 90-day pause," he said.

Analysts agreed that the US had effectively isolated China.

"The pause leaves China alone in the crosshairs facing 125 per cent tariffs while others get a temporary reprieve," said Daniel Russel, the Vice President of International Security and Diplomacy at the Asia Society Policy Institute.

Trump's tariff barrage had been criticised even by allies for blurring the real priority, which was China, he added.

China was the target, said Philippe Gijsels, chief strategy officer at BNP Paribas Fortis, a Belgian investment bank headquartered in Brussels.

"Maybe a part of the cool down period was just to make sure that China and Europe did not start to unite against the US. Maybe this is also a way to isolate China," he said in an interview from Antwerp.

"It is clear that the main target of the Trump tariffs is China. And that was probably already the goal from Day 1.

"More and more it becomes China versus the US with global leadership at stake," he added.

But analysts remained unconvinced that Trump's strategy could make Beijing yield.

China is unlikely to change its strategy, Russel predicted, adding that it is likely to "stand firm, absorb pressure, and let Trump overplay his hand."

Beijing believed that Trump saw concessions as a "weakness", he said.

"So giving ground only invites more pressure," he said.

Ryan Hass, a Brookings Institution expert on China and a senior advisor at The Scowcroft Group, said in a post on X that Beijing would not blink.

"Chinese leaders understand holding firm will be economically costly. They're preparing the public to tolerate pain. Politics may drive decisions," he said.

Chinese leaders are skeptical that capitulating to Trump would resolve the underlying challenge from the US, which they judge is to undermine China's economic strength, he said.

And President Xi also has his own politics to manage, he added.

"He likely will go to great lengths to protect his political brand as a strong defender of national pride and honour. He doesn't want to allow a perception to emerge at home or abroad of being muscled around by Trump."

It all boils down to who is going to call whom, said Gijsels.

"It will become a battle between two contestants for world power. It's hard to predict how this will end. Still, some sort of negotiated solution is possible, probable but not certain."

From the European perspective, it was a relief even though the risks of the impact of a trade war between world's two largest economies remain elevated, he said.

Would the EU join forces with China to take on Trump? The idea has gained ascendance following April 8 talks between European Commission President Ursula von der Leyen and Chinese Prime Minister Li Qiang. They discussed a "negotiated resolution" to disruption caused by the US tariffs.

"It would not be a natural thing to do as the US has been an ally for the longest time," said Gijsels, the co-author, along with his colleague chief economist Koen De Leus, of a 2024 book The New World Economy in 5 Trends.

"That is not going to change overnight. Of course, when pushed enough, Europe could seek other alternatives," he said.

"I would put today down as an important win, a first step. Volatility will remain high and continue to move on the waves of the news flow," he added.

Russel said the administration's "blunt-force" tactics had rattled allies who saw the sudden reversal as damage control following the market meltdown, rather than a pivot to respectful, balanced negotiations.

"The whiplash from constant zig-zags creates more of the uncertainty that businesses and governments hate," he said.

Copyright: The Straits Times/Asia News Network

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments