WB offers first loan guarantee for LNG purchase

For the first time, the World Bank, which traditionally provides development project loans and budgetary support, has extended its assistance through a guarantee facility to support Bangladesh in purchasing liquefied natural gas (LNG), aiming to ease pressure on the country's foreign exchange reserves.

The World Bank approved a $350 million guarantee for state-owned oil and gas company Petrobangla yesterday. The initiative is intended to enhance gas supply security by enabling access to more cost-effective financing.

This project, titled "Energy Sector Security Enhancement," will utilise an International Development Association (IDA) guarantee to mobilise up to $2.1 billion in private capital over seven years for new LNG imports, according to a World Bank document.

The backing of an IDA guarantee will improve Petrobangla's creditworthiness to secure LNG supplies, said the World Bank in a statement.

According to the World Bank, imported LNG accounts for over one-fourth of total gas consumption in Bangladesh. LNG imports cost Bangladesh $4.5 billion annually (including import duties and regasification costs).

"The project will help Bangladesh enhance gas supply security in a cost-efficient manner, contributing to reliable and affordable electricity for industries and domestic users," said Olayinka Bisiriyu Edebiri, a World Bank senior energy specialist.

Zahid Hussain, former lead economist at the World Bank's Dhaka office, said, "It will reduce the financing cost by 1 percent due to the IDA guarantee."

"So, I think it's the right decision as Bangladesh can save $1 in every $100 spent on LNG purchases," he told The Daily Star.

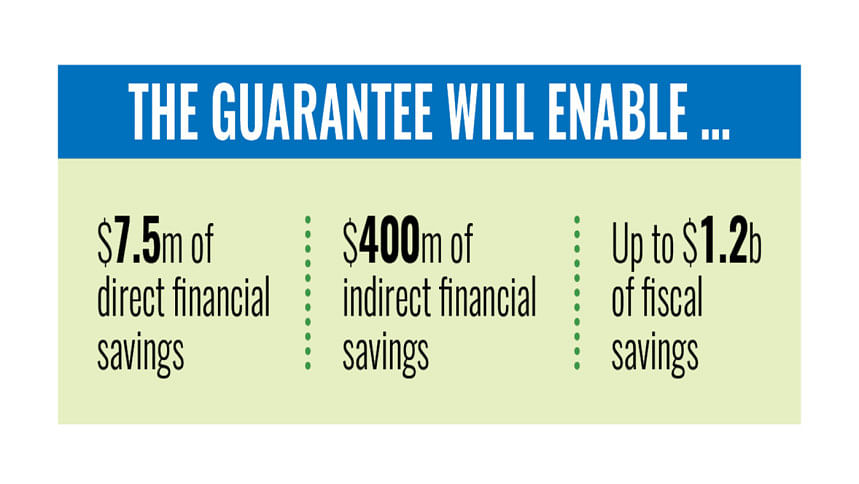

According to the World Bank document, Bangladesh can obtain a number of financial and economic benefits, such as an estimated $7.5 million in direct financial savings due to the lower financing cost.

The country can also avail around $400 million in indirect financial savings as a result of facilitating the shift from procurement of LNG cargoes under the spot market mechanism to a long-term arrangement.

Furthermore, it can secure up to $1.2 billion in fiscal savings through the displacement of expensive liquid fuels in the power sector, with associated emissions reductions and broader benefits to the economy.

It said the proposed operation involves a revolving working capital facility backed by an IDA payment guarantee to mobilise commercial financing and address payment security and immediate liquidity needs in the sector.

This is coupled with technical assistance to support the analytical work for short- and long-term gas sector planning, reforms, and institutional capacity building.

These reforms would aim to diversify gas suppliers, reduce losses, and improve Petrobangla's financial and operational efficiency.

As secure working capital financing for Petrobangla in US dollars, the facility is intended to enhance Petrobangla's ability to procure LNG by complementing the existing stand-by letters of credit and working capital lines provided by the International Islamic Trade Finance Corporation (ITFC).

The facility will enable a minimum of $350 million worth of annual gas imports on improved terms and, with the revolving feature, over a seven-year period unlock approximately $2.1 billion in gas supply.

The development partner also said the interim government is focused on sustaining the emerging signs of economic recovery, amid mounting energy import bills and associated pressure on the country's foreign exchange reserves.

The energy sector's reliance on imported primary fuels places stress on the economy, particularly as Bangladesh struggles with the availability of foreign exchange necessary to finance essential imports.

Imported LNG has supported about 30 percent of total gas needs since 2018 to backfill declining domestic gas reserves.

The absence of gas supply security in the power sector has significant fiscal costs for Bangladesh due to the high costs of generation from alternative sources.

Bangladesh Power Development Board (BPDB), as the single buyer for the power sector, is reliant on Petrobangla for gas supplies for its fleet of gas-fired power plants, it said.

According to the project document, to meet shortfalls due to the lack of availability of gas and other system constraints, Bangladesh imports electricity mostly from India.

However, this is insufficient to meet growing demand. This shortage of gas has forced the BPDB to rely on expensive oil-based power generation that is three to eight times the cost of gas-based power generation.

The reliance on expensive oil-based power generation inhibits cost recovery for the BPDB, given the cap on downstream consumer power prices, resulting in a reliance on government subsidies to close the revenue gap at the level of the BPDB.

Delays in receiving subsidies from the government constrain the BPDB's financial position, which in turn is unable to make timely payments to Petrobangla.

This creates a challenging cycle, as difficulties in payment collection from the power sector exacerbate Petrobangla's liquidity issues, leaving it saddled with high arrears—total receivables of Petrobangla as of June 2024 stood at $2.6 billion.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments